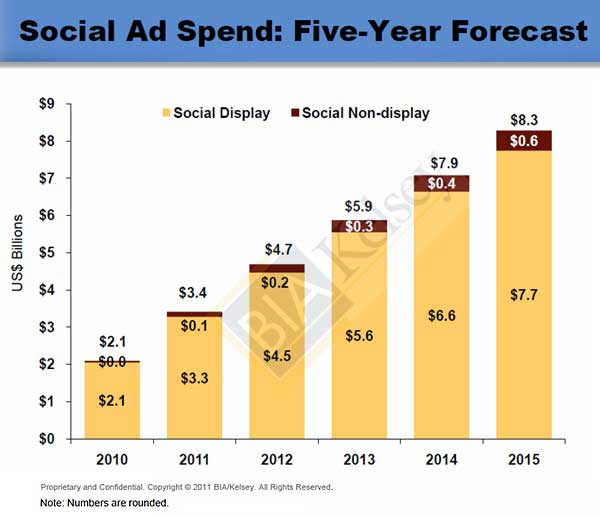

Social media advertising revenues are forecast to reach $8.3 billion in 2015, up from an estimated $2.1 billion in 2010—a compound annual growth rate (CAGR) of 31.6%, according to BIA/Kelsey's US Local Media Annual Forecast.

Display, which dominates social media advertising* is projected to climb from $2.1 billion in 2010 to $7.7 billion in 2015—a CAGR of 30.4%.

Though revenues for non-display ad formats, such as Twitter's "promoted products," are now minimal, the category is expected to expand, from zero in 2010, to $600 million in 2015, at a 65% CAGR.

Facebook is expected to dominate social advertising over the next five years.

"It's no surprise that Facebook commands a dominant share of all social ad impressions served and ad revenues generated," said Jed Williams, analyst and program director of BIA/Kelsey's Social Local Media practice. "As the social market leader, it already serves the most display ad impressions of any digital company, surpassing both Yahoo and Google.

"We fully expect Facebook to increase both impression share and ad revenue, as buyer awareness accelerates and creative formatting and targeting improve to optimize performance."

Meanwhile, Facebook is forecast to account for 21.6% of all US display ad dollars in 2011 and reach 23.8% by 2012, according to separate research from eMarketer.

Google is projected to account for 16.7% of display ad revenues in 2012, followed by Yahoo with 16.4% and AOL with 3.7%.

Below, other findings from BIA/Kelsey's five-year ad spending forecast.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

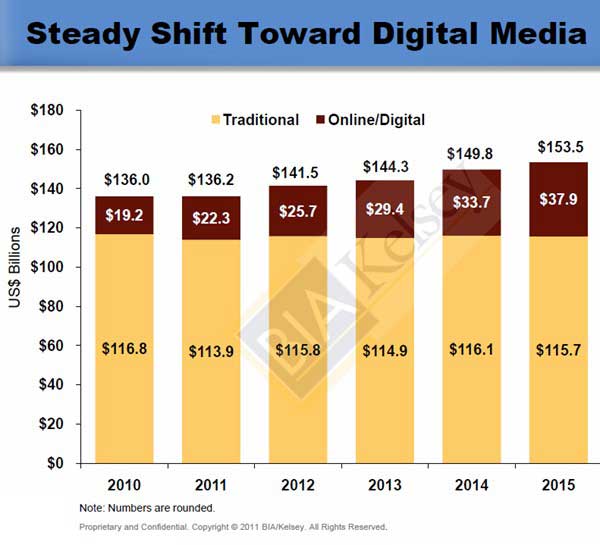

Local media advertising won't likely keep pace with the overall economy: Total local advertising is forecast to grow at a 2.4% CAGR over the next five years, from an estimated 136.0 billion in 2010, to $153.5 billion by 2015:

- Digital advertising revenues will remain strong, reaching $37.9 billion by 2015, growing at a 14.5% CAGR over the forecast period.

- Traditional ad revenues are forecast to total $115.7 billion by 2015, declining at 0.2% CAGR from 2010 to 2015.

*BIA/Kelsey defines social media advertising as money spent on ad formats across social networks, excluding virtual goods and rewards, social gaming, social commerce, and social marketing.