Global ad expenditure is now forecast to grow 4.2% in 2011, down from the 4.6% forecast in December 2010, due to the effects of political instability in the Middle East and the earthquake in Japan, according to projections by ZenithOptimedia.

Even so, online advertising is expected to continue surging worldwide, with 16.4% average annual growth projected for display advertising through 2013, and double-digit growth in paid search and online classifieds expected over the same period.

Below, additional projections issued by ZenithOptimedia.

The cumulative ad spending losses attributable to the events in Japan and the Middle East are projected to total $2.4 billion in 2011. Still, ad recovery is forecast to continue over the long term due to quick rebounds of both shock-affected economies:

- Ad spend in Japan is forecast to shrink 4.1% in 2011, and then grow 4.6% in 2012.

- Ad spend in Egypt is expected to fall 20.0% in 2011, but rebound 12.1% in 2012.

Underlying Recovery Still Healthy

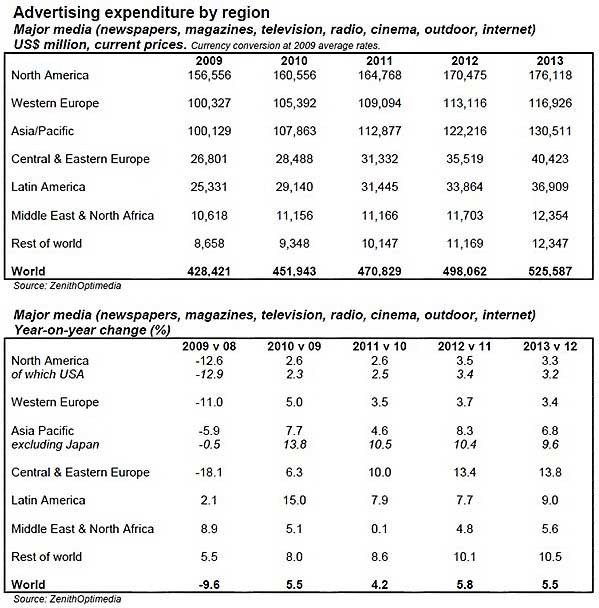

Global ad spending now forecast to grow 5.8% in 2012, up from the 5.2% projected in December, but the disparity in growth rates between developed and developing markets continues.

Over the next three years, North America is forecast to grow 3.1% on average (between 2010 and 2013), while Western Europe grows 3.5% over the same period.

The Japanese ad market is expected to grow just 0.7% annually between 2010 and 2013, while the Middle East is forecast to grow 0.1% over the same period, as advertisers tread carefully amid political instability.

Meanwhile Latin America is projected to grow 8.2% a year, Central and Eastern Europe 12.4%, Asia Pacific 6.6%, and Asia Pacific, excluding Japan, 10.2%.

Developing markets—defined as everywhere outside North America, Western Europe, and Japan—are projected to grow their share of the global ad market, from 30.9% in 2010, to 35.1% in 2013.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Russia to Reach Top 10 Ad Market Ranking in 2011

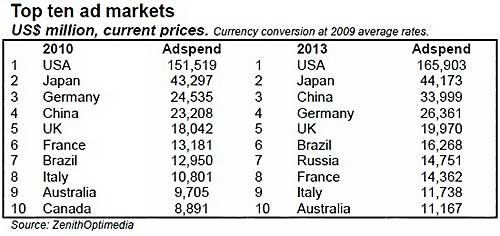

Three developing markets are expected to take their place among the world's top 10 ad markets by 2013, up from the two (Brazil and China) ranked in 2010.

Other key global ad market findings:

- China (forecast to grow 13.6% on average per year through 2013) will overtake Germany (forecast to grow 2.4% annually) to become the world's third-largest ad market in 2011, and stay at that position throughout the forecast period. China is currently just over one-half (54%) the size of Japan, the second-largest ad market, and is projected to be just over three-quarters (77%) of its size by 2013.

- Brazil (with 15.4% annual growth) will overtake France (2.9%) to take sixth place in 2011.

- Russia (23.3% growth) will rise from twelfth place in 2010, to tenth in 2011, eighth in 2012, and then seventh in 2013.

Top Ad-Spend Contributors

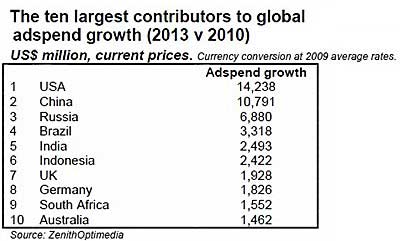

The US will contribute most new ad dollars to the global ad market over the next three years ($14.2 billion ) due to its sheer size—3.5 times the next-largest market.

Overall, developing markets are forecast to contribute 62% of new ad dollars over the next three years.

Internet to Become Second-Largest Ad Medium by 2013

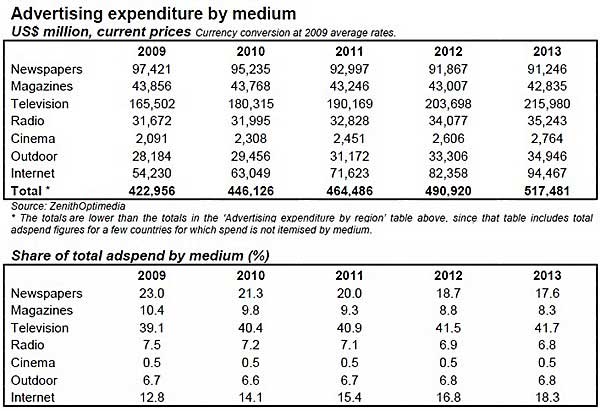

The Internet is expected to become the world's second-largest ad medium by 2013, overtaking newspapers. Although newspaper ad spending was still 51% larger than Internet ad expenditure in 2010, newspaper spending is shrinking 1.4% annually, as circulations fall in developed markets and readers migrate to the Web.

Meanwhile Internet advertising is forecast to grow at an average annual rate of 14.4% between 2010 and 2013.

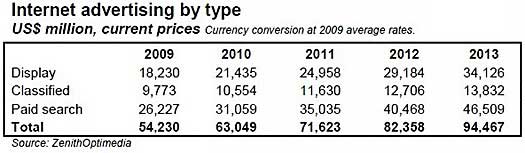

Newspaper ad expenditure is expected to fall, from $95.2 billion in 2010, to $91.2 billion in 2013, while Internet ad expenditure rises from $63.0 billion, to $94.5 billion over the same period.

Television is the largest medium and continues to increase market share. TV attracted 40.4% of global ad expenditure in 2010, up from 37.3% five years earlier, and is expected to attract 41.7% in 2013. People are watching more television than ever, due to bigger and higher-quality displays, more channels delivered via digital TV, and the convenience of PVRs, according to ZenithOptimedia. TV ad expenditure is forecast to rise from $180.3 billion in 2010, to $216.0 billion in 2013.

Internet Advertising

In the digital space, display advertising (including online video and social media) has overtaken search as the main driver of Internet ad growth.

Display is forecast to grow 16.4% on average from 2010 to 2013, while paid search and online classifieds grow at double-digits levels during the same period, 12.8% and 10.2%, respectively.

About the data: Ad-expenditure projections are issued on a quarterly basis by ZenithOptimedia. The above projections were issued in April 2011.