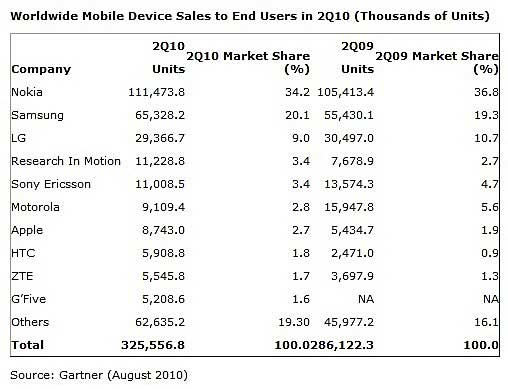

Driven by increasing smartphone adoption, worldwide sales of mobile devices to end-users reached 325.6 million units in the second quarter of 2010, up 13.8% from the same period a year earlier, according to Gartner.

But competition drove prices down: "Although the mobile communication devices market showed double-digit growth this quarter, average selling prices (ASPs) were lower than expected and margins fell," said Carolina Milanesi, research vice-president at Gartner. "We attribute the decline in ASPs to a stronger dollar, a depreciating euro, and intense competition that drove price adjustments and changes to the product mix."

Smartphones: Android Operating System (OS) Overtakes Apple's

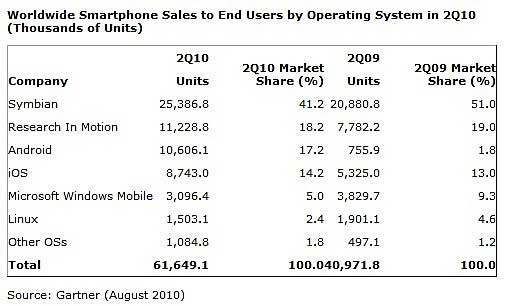

Smartphone sales to end-users reached 61.6 million units in second quarter, accounting for 19% of worldwide mobile device sales, up 50.5% from 41.0 million a year earlier.

The top 4 smartphone OS vendors all expanded unit sales during the period, accounting for 91% of the worldwide smartphone OS market, up from 75% the previous year.

Android expanded rapidly in the second quarter, overtaking Apple's iPhone OS to become the third-most popular OS in the world: Android sales reached 10.6 million in the quarter, or 17.2% of the overall smartphone OS market—up 15.4 percentage points (PPs) from 1.8% a year earlier. In the US, Android overtook RIM to become the No. 1 smartphone OS.

Meanwhile, Symbian lost 9.8 PPs in market share, falling to 41.2% in the second quarter from 51.0% a year earlier.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Top 10 Device Manufacturers

In the second quarter of 2010, HTC made its debut among the top 10 mobile device manufacturers, holding the No. 8 spot with 1.8% market share, having grown 139.1% year-on-year. That growth reflects the popularity of its Android portfolio but also a more aggressive branding strategy, according to Gartner.

Other second-quarter 2010 device-related findings:

- Nokia's mobile device sales to end-users reached 111.5 million units and a 34.2% share of the overall mobile device market. Nokia's economies of scale and excellent distribution enabled it to hold on to the top spot in the mobile device market. Even so, Nokia lost 2.6 PPs in market share year-on-year.

- Samsung's sale of 65.3 million devices in the second quarter enabled the manufacturer to hold on to 20.1% of the device market. Although Samsung's sales were strong in developing markets, its shift in product mix caused an overall decline in ASPs. Samsung will be among the first manufacturers to bring Windows Phone 7 devices to market in time for 4Q10, signaling the company's willingness to keep its platform options open, even as it works on its own OS, bada.

- Research In Motion (RIM)'s mobile device sales to end-users reached 11.2 million units in the second quarter, confirming RIM's position as the fourth-largest brand (3.4% share). New devices running BlackBerry OS 6.0—such as RIM's first touchscreen/QWERTY slider combo, the Torch—will be available in 3Q10. The Torch's form factor will still appeal more to business users than to consumers and will stop many loyal BlackBerry users from defecting to other platforms but won't attract many new users to the brand, according to Gartner.

- Apple's mobile device sales reached 8.7 million units—2.7% of the device market and 14.2% of the smartphone market. Apple maintained its No. 7 spot in the worldwide mobile device market and held the No. 3 spot in the worldwide smartphone market. A wider global rollout of iPhone 4 will sustain Apple's sales momentum throughout the second half of 2010, according to Gartner.