Fueled by optimism about the economy and business prospects in emerging media and interactive services, mergers and acquisitions activity in media and marketing is expected to rebound in 2010, according to a survey from AdMedia Partners.

Seven out of ten (70%) senior business executives surveyed expect the economy to be stronger in 2010 than it was in 2009, and over two-thirds (68%) say the economy is now in recovery.

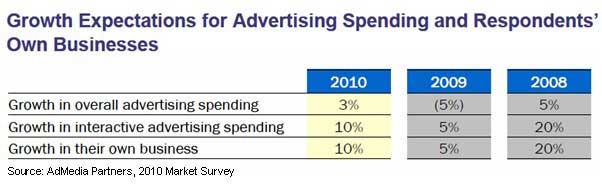

That optimism is reflected in executives' expectations for advertising spending this year: Overall ad spending is expected to grow an average 3% in 2010, while interactive ad spending is expected grow 10%.

Similarly, executives are forecasting an average 10% annual growth for their own businesses this the year.

Below, other findings from AdMedia Partner's 2010 Market Survey, which examines M&A prospects for media, marketing services, and digital marketing firms.

Strategic Vs. Financial Buyers

With larger numbers of cash-rich and relatively healthy companies eager to grow via acquisition this year, business execs expect a significant pick-up in deal-making: 83% of execs in marketing services and 80% in media say strategic buyers will drive increases in M&A activity in 2010, compared with 31% and 26%, respectively, who said so in 2009.

One-half of execs (50%) in marketing services and 48% in media services say financial buyers will drive M&A activity this year, compared with 14% and 6%, respectively, who said so in 2009.

Still, some execs are more cautious: 41% in marketing services and 37% in media say M&A activity by financial buyers will be flat in 2010.

Valuation of Marketing and Media Companies

The range of multiples that executives consider reasonable for digital marketing and digital marketing technology companies increased to 7-8x EBIT (earnings before tax and interest) in 2010, vs. 6-7x last year.

Meanwhile, the range for marketing services companies increased to 6–6.5x EBIT, from 5x last year, while traditional ad agency multiples stayed constant at 5x.

In contrast, multiples were down across all media sectors:

- Online media: 8-9x EBITDA (earnings before interest, taxes, depreciation and amortization)

- Information/database publishing: 7x EBITDA

- Consumer magazines: 4-5x EBITDA

- B2B publications: 4-5x EBITDA

- Exhibitions/tradeshows, conferences: 4x EBITDA

- Newspapers: 3x EBITDA

Media Sectors