Major Takeaways:

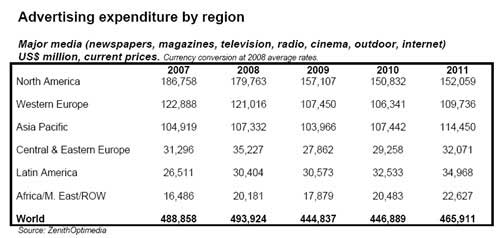

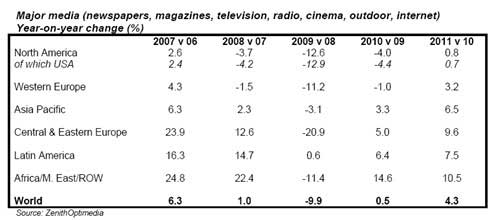

- New information about weak first half causes ZenithOptimedia to downgrade its global ad growth forecast for 2009 to -9.9%.

- But the second half is developing in line with predictions, demonstrating clear improvement in the rate of decline.

- Developing markets to grow a healthy 7.8% in 2010 and 9.8% in 2011.

- But structural economic problems will drag developed markets down 2.9% in 2010, before modest 1.5% recovery in 2011.

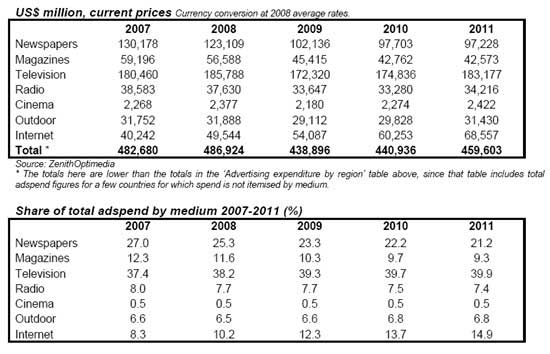

- Internet advertising to grow 9% this year, and reach 14.9% share of global ad expenditure by 2011.

- Newspaper and magazine ad expenditure will shrink every year over our forecast period, falling to 25% and 28% below their respective 2007 peaks by 2011.

The first half of 2009 was more painful for the media industry than anticipated; as a result, ZenithOptimedia has revised downward its forecasts for global ad expenditure growth this year to -9.9%, from the -8.5% the company published in July:

The downgraded ad spend figure for 2009 almost entirely relates to first-half activity. Since then, improvements in economic confidence have been accompanied by positive signals from media owners that the downturn is bottoming out. ZenithOptimedia is still confident that the second half of the year will be much less painful for the ad market than the first half, and expects the market to hit bottom before the end of 2009.

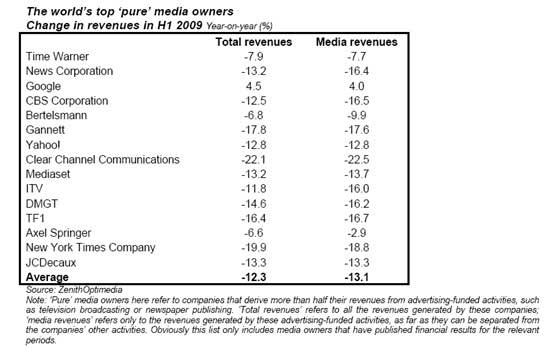

2009 Was a Bad Year for Media Owners

The world’s largest media owners suffered an average 13.1% drop in their media revenues in the first six months of the year, according to ZenithOptimedia. Apart from Google, every one of the top media owners shrank in the first half of 2009:

A note about the 13.1% drop in 1H09: As bad as this figure is, it probably understates the decline suffered by the industry as a whole, says ZenithOptimedia, as it does not include the results of the US publisher and broadcaster Tribune Company, which entered Chapter 11 bankruptcy in December 2008.

Outlook for 2010 and 2011

ZenithOptimedia now forecasts a meager 0.5% recovery for 2010, down from the estimated 1.6% recovery it forecast in July.

In 2010 a sharp disparity between developed markets and developing markets will appear. Developed markets (North America, Western Europe, Japan) will shrink another 2.9%, while developing markets will grow by a very healthy 7.8%.

The credit crisis has exposed deep structural problems in developed economies that will take years to resolve, and there remains plenty of uncertainty over the timing and scale of recovery as governments struggle to maintain spending in the face of ballooning debt. In contrast, many developing markets have continued to grow throughout the crisis, and others look well positioned for a strong recovery in 2010. Ad expenditure has continued to grow in 27 developing markets this year, and is expected to nearly double to 52 in 2010. All developed markets are shrinking this year, but ZenithOptimedia expects nine to return to growth in 2010.

Looking to the longer term, ZenithOptimedia predicts 4.3% growth in global ad expenditure in 2011, with all regions experiencing at least some expansion. This number is somewhat below the 5%-6% average growth rate for the global ad market, but would represent a welcome step towards normality. Developing ad markets are expected to accelerate to 9.8% growth in 2011, while developed markets will experience a mild 1.5% recovery. Developing markets’ share of global ad expenditure is rising rapidly and is forecast to reach 35% in 2011, up from 29% in 2008.

Global Ad Spend by Medium

The internet is the only medium expected to grow in 2009, by 9.2%. This is slightly lower than the 10.1% growth forecast in July, but ZenithOptimedia has downgraded internet advertising by less than the market as a whole. Most of this growth is coming from paid search and innovative formats:

Key findings:

- In the US—where ZenithOptimedia has the most detailed breakdown of internet advertising by type—the company forecasts that paid search will grow by 20% in 2009, while internet video will grow 19%, social media will grow 45% and mobile will grow 69%.

- Traditional display and classified are practically static in comparison; they are forecast to grow by 3% and 2% respectively this year.

- Globally, ZenithOptimedia predicts internet advertising to account for 14.9% of all ad expenditure by 2011, up from 10.2% in 2008.

- All other media are shrinking. Most are shrinking at around the market average rate, but newspapers and magazines are in steep decline: newspaper ad expenditure is forecast to fall 17% this year, and magazine ad expenditure to shrink 20%. Both these media have been in decline since 2007, and are expected to remain in decline for the rest of the forecast period.

- By 2011 newspaper ad expenditure is forecasted to be 25% below its 2007 peak, while magazine ad expenditure will be 28% below its own peak.

- Prospects for other media are more encouraging: Television, cinema, and outdoor advertising are expected to return to growth in 2010, followed by radio in 2011.

About the data: ZenithOptimedia is the source for all data cited here.