Customer lifetime value (CLV or CLTV) is the most underappreciated B2C metric.

"Underappreciated, you say? We measure customer lifetime value, and it's really important to us!"

Sure it's a common metric, but why is it important to your business?

Most B2C marketers use customer lifetime value as an input to determine how much is reasonable to spend to acquire a new customer—customer acquisition cost (CAC). But for top-performing B2C companies in the world, CLV is the metric on which business decisions are made.

Here's why:

- It's a faster path to revenue.

- It's an easier path to revenue.

- For both reasons above, it's a more profitable path to revenue.

- And, of course, it justifies increased spend on customer acquisition.

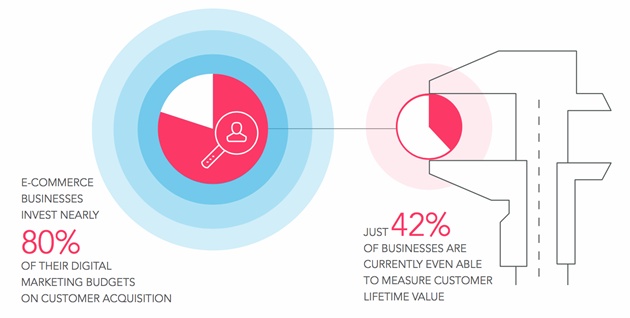

Unfortunately, even in a world where it costs five times more to acquire a new customer than it does to keep current customers, online retailers and other e-commerce businesses are continuing to invest nearly 80% of their digital marketing budgets on customer acquisition, and just 42% of businesses are currently even able to measure customer lifetime value, let alone accurately. Those two stats are more closely related than they seem at first glance.

By simply using some rough approximation of customer lifetime value to justify acquisition spend, companies are focusing on the wrong side of the equation. What they don't realize is that investing in maximizing CLV is indeed the most profitable—and, increasingly, the fastest—path to revenue growth.

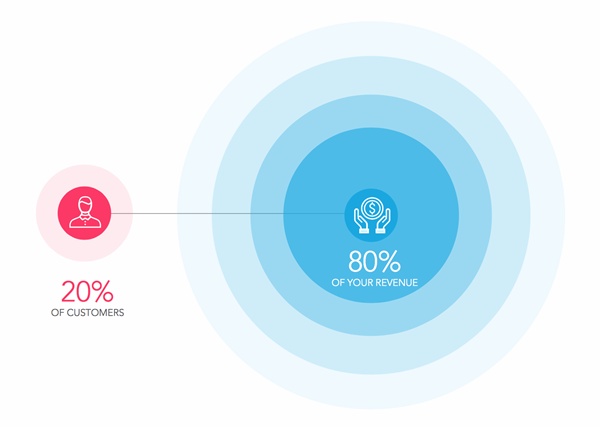

Consider, for example, that for each 1% of shoppers who return for a subsequent visit, overall revenue increases approximately 10%. That means if online retailers retained 10% more of their existing customers, they would double their revenue. Here's another way of looking at it: Reducing your customer defection rate 5% can increase your profitability 25% to 125%.

Growing revenue by driving up customer lifetime value can also be viewed as the easiest way to do it. Though customer marketing is complex, technology is making it incredibly more manageable and effective. For example, the probability of selling to a current customer is 60-70%, on average, whereas the probability of selling to a new shopper is 5-20%... not to mention returning customers spend on average 67% more than first-time customers!

So if growing customer lifetime value is so fast and easy, why isn't every B2C marketer talking about it?

The reality is that although increasing CLV is, for most businesses, generally a faster, easier, and more profitable path to revenue, it takes a significant shift away from the traditional marketing focus on volume and a re-focus on the quality of every customer interaction.

Here's the good news

Focusing in on, and maximizing, customer lifetime value isn't difficult if you're committed to it and have the right tools.

So what should you do next? We've laid out the four key steps to maximizing CLV:

- Unify all your customer interactions in one system of record. This is no longer a luxury; it is a prerequisite to finally achieving customer-centricity, which will in turn unlock your ability to maximize customer lifetime value.

- Model your customer lifecycle. Doing so is not as daunting as you think. However, to model your true customer lifecycle, you must tie cross-channel behavioral data together with purchase history details—and do it in real-time.

- Leverage customer understanding to engage customers when and where it will be most effective. When you understand where your customers are in their lifecycle and how they are interacting with your brand, you can harness that information to engage customers when and where doing so will be most effective.

- Identify the key drivers of lifetime value. Marketers still struggle to tie ROI to non-direct-response campaigns. But today it is not only possible but also critical to attribute revenue to investments like social media. Take it a step further by identifying the key attributes driving customer lifetime value, and double-down on those investments.

What to do next: Become customer-centric

If customer lifetime value is not your top marketing metric, or at least one of the top metrics, you're missing out on massive opportunity to grow revenue quickly and easily—and profitably.

Because it's your top customer metric, you need to be focused on not merely improving it but, rather, maximizing it. Channel-centric approaches to marketing and analytics limit the potential of customer lifetime value. The proliferation of marketing technology and point solutions has caused customer data to be more fragmented than ever, making it difficult to understand cross-channel behavior and engage customers when and where it will be most effective.

If you take no other step, take step 1

The most important step—because all others depend on its being done well—is step 1. The careful unification of customer data across channels and devices is a prerequisite to doing the other three steps well.

Every customer interaction must be resolved at the customer level (e.g., Jim opened email A, added product B to cart on Web browser, researched products C, D, and E using the mobile app, and ultimately bought product D in-store) to make advanced lifecycle segmentation, customer engagement, customer-centric analytics, and cross-channel attribution possible.

To learn more about growing your business and outperforming the competition by maximizing customer lifetime value, check out this whitepaper from Zaius.