A series of weekly videos shared on Facebook generated 15 new customers for you over the course of a month. Pop quiz: is that result worth the effort you put into it?

There's no way of knowing, yet. You need content marketing metrics: customer acquisition costs, marketing spend, lifetime value, and more; you need to compare stat A with stat B. In short, you need to put the data into context.

Content marketing in 2016 was an undisputed champion. A full 60% of marketers create at least one piece of content each day. Content marketing leaders experience traffic growth that is 7.8x higher than that of content marketing followers. Inbound (i.e., content) marketing costs 62% less than outbound methods, but generates 3x as many leads.

But (there's always a "but") some may question the point of it all. Sure, content marketing spreads brand recognition, assists with SEO efforts, and builds your reputation and authority, but is that enough?

If you're on the content bandwagon but don't know your customer acquisition cost (CAC) and customer lifetime value (CLV), you're playing a dangerous game: You might be spending thousands on blog posts or infographics and assuming it's worth those seven new clients you picked up, but is it really worth it?

To some, it always comes down to dollars and cents. They want to see facts and figures that demonstrate the monetary value of the strategy. In the past, that kind of talk had content marketers gasping, clutching their chests, and muttering about "engagement this" and "awareness that" under their breath.

But you can show the financial side of content. It can even be simple. And you need to do it to understand the big picture.

Ready? Even if math scares you a little, I promise this won't hurt.

Content Marketing Metrics: The Building Blocks

Customer acquisition is a critical metric regardless of your field or industry. If you make $100 from each sale, but your CAC is $175, you're not going to last long.

The raw number of new customers is worthless without knowing the cost to get them. A "good" CAC hinges on those customers' lifetime value, among other things.

Some sources suggest spending about 20-30% of CLV on CAC. So, for example, if your CLV is $100, you should keep your CAC to no more than $20-30.

Calculating CAC

Your CAC is the total cost of convincing a prospect to purchase your product or service. It includes all relevant expenditures, such as research, marketing, and support services and tools.

The simplest way to calculate CAC for a set period of time (weekly, monthly, annually) is this:

CAC = Total Marketing Costs (TMC) / Total New Customers (TNC)

When measuring for content marketing, your TMC should include...

- The cost of the content itself (what you paid the writer and/or graphic designer and/or video producer)

- Your salary costs (how much did you pay your staff to publish, distribute, promote, and monitor)

- The tech costs (the fees for the services, tools, and platforms used)

You may have a very long list, and you may take a few weeks to identify them all, so start today. Jot down every expense related to your content marketing. The more precise your cost amount, the more precise your CAC.

Let's compute a quick-and-dirty CAC of content marketing for a fictional business:

- Content Costs: 12 articles per month x $150 per article = $1,800

- Salary Costs: 1 marketing officer paid $36,000 per annum, or $3,000 per month

- Tech Costs: Outbrain $200 + Hootsuite Pro $100 + Unbounce $100 + SumoMe Pro $60 + Ahrefs $180 = $640

- Total Marketing Costs (TMC) = $5,440

If our company picked up 100 new customers via its content marketing that month, the CAC would be 5,440 (TMC) / 100 (TNC) = $54.40 (CAC).

So, this business has a CAC of $54.40... So what, right? CAC on its own doesn't tell us much. It needs to be compared with customer lifetime value (CLV) so you can see where you stand.

Calculating CLV

When considering CLV, you can work in either historic (after the fact) or predictive figures.

To calculate the historic CLV, you add up every transaction from the first (T1) to the most recent (Tn), and then multiply by the average gross margin (AGM is sales revenue minus the cost of goods sold, divided by total sales revenue; it's expressed as a percentage).

CLV [Historic] = (T1 + T2 + T3…+ Tn) * AGM

To find your (simple) predictive CLV—arguably the more valuable figure—try this formula:

CLV [Predictive] = ((T x AOV) * AGM) * ALM

...where T is the average number of monthly transactions, AOV is the average order value, ALM is the average customer lifespan in months, and AGM is the average gross margin.

The resulting dollar figure gives you a best-guess estimate on how much you can expect from each acquired customer over the length of that customer's relationship with you.

A Cautionary Note

Those formulas result in a ballpark figure. They're basic introductions. You can (and should) get incrementally more sophisticated over time as you collect data and include more variables.

You might try a subscription model CLV calculator (that one uses your customer lifetime value to determine your target CAC, as well as providing suggested pay-per-signup, click, and impression values), a physical-product calculator, or a CLV formula with a lot more moving parts, depending on your business.

Aim for a CLV about 3x your CAC. Less than that, and you're spending too much on acquisition; more than that, and you could safely spend more on your content marketing to help your business grow faster.

Putting the Metrics to Good Use: ROI

Once you know your CAC and CLV, you can examine the return on investment, and break it all down by specific marketing channels.

To find your basic ROI:

ROI = (CLV - CAC) / CAC

So, a lifetime value of $200 with an acquisition cost of $50 yields an ROI of 300% [(200-50) / 50 = 3, or 300%].

Examine the CAC and ROI for each channel you use (company blog, Facebook, Instagram, Twitter, LinkedIn, and so on) to see what drives the biggest bang for your buck so you can optimize marketing budgets, allocation, and overall goals.

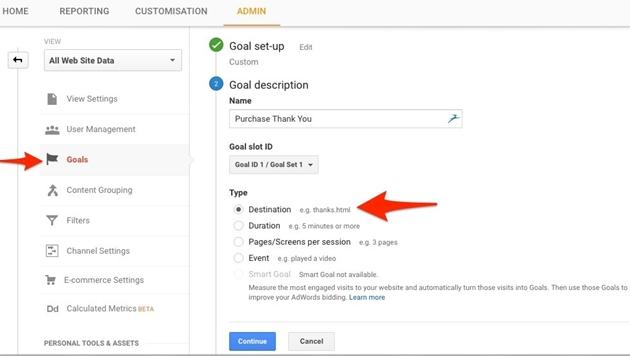

In Google Analytics you can set up destination goals (with the "thank you" page after a purchase as the destination), with traffic segmented by source, to analyze your CAC by individual channel. You might discover that infographics shared on Facebook generate more customers at a lower CAC (so then you would do more infographics).

To lower your CAC, work toward increasing end conversions by A/B-testing your landing pages and email campaigns, and enhancing perceived user value (creating the best product or service for a competitive price).

Summing It Up

That's the Cliff Notes version (just enough to get started). If you remember nothing else, remember this:

- Your CAC (Total Marketing Cost / Total New Customers) is worthless without knowing your CLV ((T x AOV) * AGM) * ALM.

- Aim for a CLV:CAC ratio of roughly 3:1.

- Those two figures allow you to calculate your ROI ((CLV - CAC) / CAC) for each content marketing channel you use.

There's more you could do, but let's start small. Knowing content marketing metrics such as CAC, CLV, and ROI—even in a general sense—will help you make the right marketing decisions for your business, your customers, and your growth.

So get calculating!

More Resources on Content Marketing Metrics

Is Your Content Working? How to Measure Content Marketing Results

Content Marketing Has Become Risky Business: How to Win in a Data-Driven World