This week's 'Skim is all about fighting for the next user: Why you should consider Facebook's low-bandwidth app, Facebook Lite; why Snapchat's fastest-growing demographic will surprise you; what you need to know about how the Super Bowl played out on social, and the brands and social networks that claimed victory; what big play Pinterest is making in search; how to convert Instagram users to buyers; how B2Bs tap into social; and much more...

Skim to stay on top!

1. Facebook Lite hits 200 million users

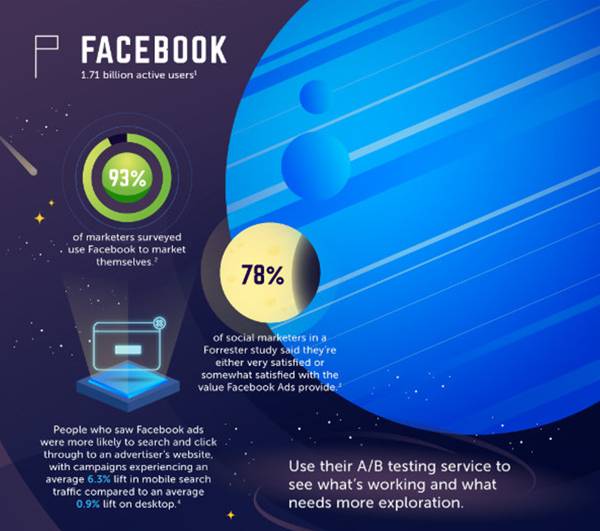

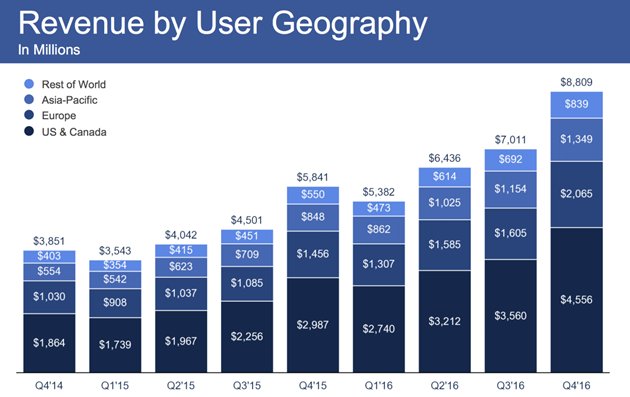

The social network's low-bandwidth world revenue skyrocketed 52% in 2016 thanks to the lite version of Facebook's app, which makes it easier and more enjoyable for users with poorer data connections to sign up and spend more time on the platform.

The social giant's revenue in "Rest of World" regions (those outside of US & Canada, Europe, and Asia-Pacific) ballooned to $839 million per quarter last year.

Facebook Lite launched in June 2015 and will now expand to Israel, Italy, United Arab Emirates, and South Korea. Oh, and there are some great ad options for your brand should one of these markets be in your purview.

2. Snapchat's fastest growing demographic is... those older than 35!

There's been a lot of chatter about Snapchat this past week after the company prepared its IPO, but the app bucking its stereotype of being elusive and cryptic for anyone older than Millennials wasn't in the headlines. In fact, research shows the app's fastest growing cohort of users is those age 35 and over.

The demographic grew 224% in 2016, with 33 million US users over 35 using the app in the last quarter, up from 10 million the previous year. Although reach encompassing this age group is still significantly less than that of competitors Facebook and Instagram, the app still has room to grow.

Now if it can just keep its cool, edgy social network demeanor as the adults join the party.

3. Everything you need to know about the 2017 Super Bowl on social media

You already know, but to put into perspective how important it is to be present on social media, you only need to look at the numbers: Super Bowl LI generated more than 27.6 million Tweets, 240 million Facebook interactions (90% of which were on mobile), and 150 million Instagram interactions.

Whereas Pepsi and T-Mobile walked away as the champs of Twitter in terms of mentions, Audi took the prize on Facebook with its politically charged equal-pay commercial. After the US, the four countries most engaged around the event on social include Mexico, Canada, Brazil, and Germany.

Click through to see how else the 64 million Facebook users and 44 million Instagram users interacted with brands and each other during the big night.

While #SB51 action played out in Houston, fans around the country buzzed on Twitterhttps://t.co/zW9IZcNNpK pic.twitter.com/6VznXvM1Ai

— Twitter Data (@TwitterData) February 6, 2017

4. Pinterest rolls out search ads, and here's how they work

Before search ads, advertising on the social pinboard platform meant buying Promoted Pins that would display your products only alongside relevant searches. The new search ads, on the other hand, appear right after users type something in the search bar.

The ads will be automatically created from product inventory, giving advertisers the ability to pay on a per-impression, pin-click, or engagement basis, and newly introduced ad groups make the platform familiar for any marketers used to pay-per-click campaigns on Google or Bing.

5. Snap's IPO filing paints a less rosy picture for the company's future

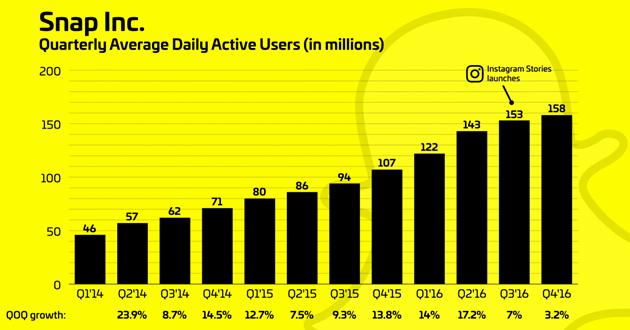

While Snap Inc.'s Snapchat grew leaps and bounds in 2016, growth almost came to a halt when Facebook's Instagram launched its own competing Stories feature that replicated one of Snapchat's most popular functions.

Although it's difficult to say for sure that Instagram's to blame, Instagram Stories attained the nearly same number of Snapchat's 150 million daily active users within five months of launch. Snapchat, in turn, walked away from Q4 of 2016 with growth at only 3.2%—the weakest figure since 2014, according to publicly available data.

Wall Street might still be convinced the app can build a healthy business based on its history, but expect investors to be obsessed with their growth numbers.