Customer experience (CX) is top-of-mind for B2B marketers and insights professionals heading into 2020, according to new research by B2B International.

The survey, fielded in 4Q19 among large organizations serving B2B markets throughout North America and Europe, found 52% cite "delivering excellent customer experiences" as a top overall business challenge they currently face.

CX also tops the lists related to both current and future strategies:

- 54% say "customer experience and loyalty" is the current marketing strategy their organization is focusing on—a share that skews significantly higher among US respondents (60%) versus those in Europe (47%).

- 55% cite "customer experience research" as the research approach they expect to be most useful in the next two years—a significant increase in interest around CX research over the past year, when 45% indicated this view in the prior wave of the survey, fielded in 1Q19.

Taken together, those results reflect a growing consensus that elevating CX is a primary imperative on the minds of most B2B marketers and researchers.

And rightly so, given additional survey results that lay bare a stark lack of progress by leading B2B brands in embedding CX best-practices into solutions and services in recent years.

Improvement in embedding B2B customer experience best-practices has stagnated

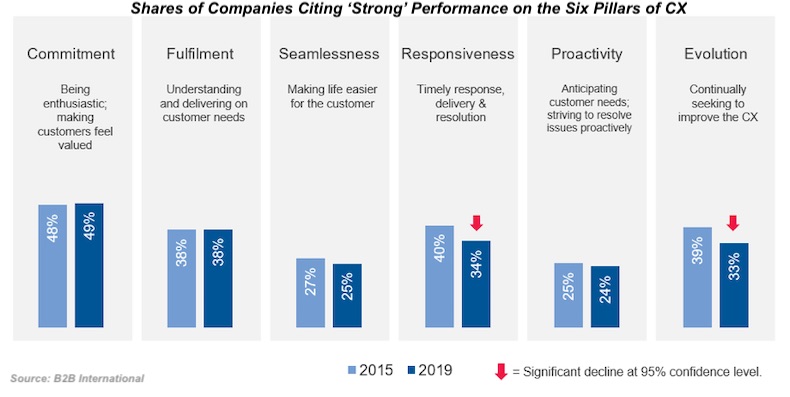

The following figure illustrates this trend by showing the share of respondent companies evaluating their own performance as "strong" on each of the six pillars of customer experience in both the 2015 and latest (2019) waves of this survey.

The share of strong performers remained remarkably flat on each CX pillar over that four-year period; moreover, self-reported performance on two of the pillars actually declined significantly: in the critical competencies of responsiveness (from 40% in 2015 to 34% in 2019) and evolution (from 39% in 2015 to 33% in 2019).

CX "laggards" outnumber "leaders" two to one, and vary significantly by industry and geography

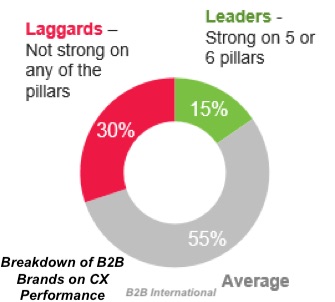

Further analysis of the 2019 results sheds more light on the share of B2B brands that qualify as "CX leaders"—those who report strong performance on at least five of the six best-practice pillars—versus those that may be viewed as "CX laggards," those lacking strong performance on any of the six pillars cited in the survey.

Based on those definitions, there were twice as many firms who qualified as CX laggards compared with leaders:

- The former make up 30% of those surveyed.

- The latter comprise only 15%.

- The remaining majority, roughly 55%, fell between those two extremes (see figure below).

Clearly, when twice as many organizations sit near the bottom versus the top of the CX performance spectrum, an industrywide imperative exists to significantly improve in this area in the years to come.

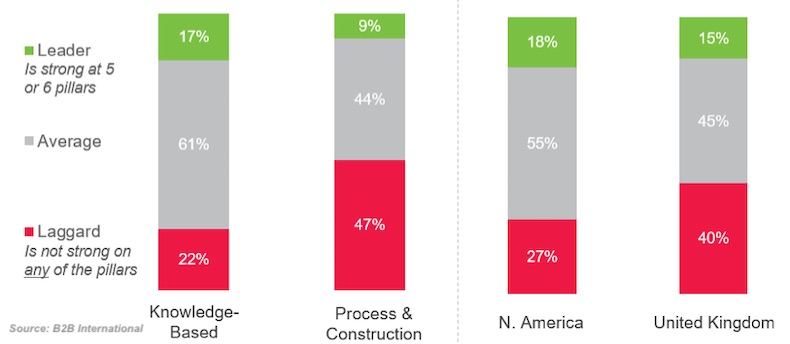

Today’s CX leaders and laggards are not evenly distributed across industries or geographies.

For instance, only 22% of responding organizations in knowledge-based disciplines (such as IT/technology, healthcare, and financial services) evaluated themselves as laggards in terms of CX performance—a stark contrast to the nearly half (47%) of companies in process & construction verticals that view themselves in this group. In fact, fewer than 1 in 10 process & construction firms currently consider themselves to be leaders in CX.

A similar divergence appears in the results for companies in the US & Canada versus those in the UK (see figure below):

- Just 27% of North American firms judge themselves to be laggards.

- Fully 40% of British companies see themselves as laggards.

Deep insights, seamless consistency, and superior personalization distinguish CX leaders

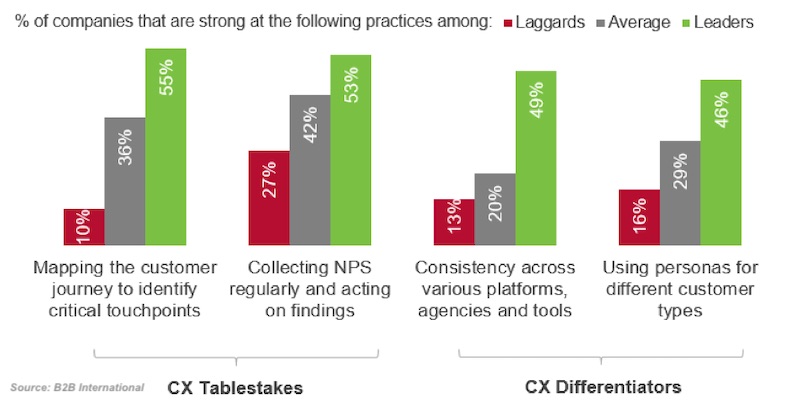

The survey results revealed what distinguishes the leading B2B brands on customer experience, thus indicating what B2B marketers need to do to help their brands get ahead in the years to come.

The stronger brands naturally perform well on the more common practices of mapping customer journeys and regularly collecting Net Promoter Scores (NPS), but those "tablestakes" practices reflect a more average performance.

What goes further in distinguishing CX leaders from laggards is that the former are much more likely to exhibit "consistency across various platforms, agencies, and tools," and they "use buyer and user personas to better target and communicate to different individual customer types."

Those results highlight that CX Leaders have a more cohesive marketing ecosystem along with a detailed understanding of customers at the individual level, which ultimately lay the foundation for customer experience excellence.

In this regard, 88% of B2B marketers and insights professionals say gaining "deep insights into our customers/stakeholders" is the top trend they expect will have the greatest influence on their marketing and insights strategies over the next three years. To enhance the customer experience, it is critical to start with an in-depth understanding of customers and all of their interactions with the brand.

"Driving improvement in seamlessness and personalization, while ensuring steady progress on each of the six pillars of CX excellence, provides a strategic road map that B2B brands can follow to achieve the goal of elevating experiences for customers in 2020 and beyond," B2B International Research Manager Taylor Wray concludes.

About the research: B2B International’s Marketing & Insight Survey is based on online surveys completed by 302 B2B marketing and insights professionals at businesses across North America and Europe in 4Q19. The participants work across a wide variety of sectors, including knowledge-based, process and construction, IT and technology, trade and services, among others. The average annual revenue of organizations responding to this survey is approximately $1 billion.