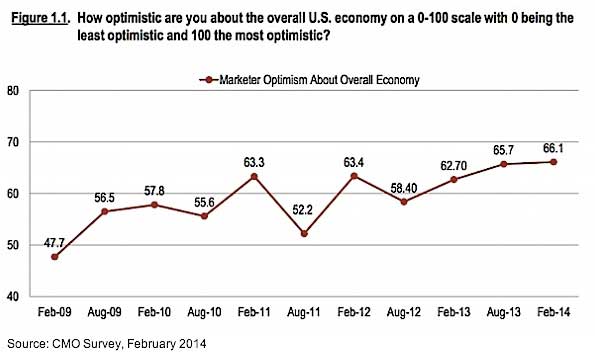

Marketing executives' confidence in the economy of the United States is at a five-year high, according to recent data from the CMO Survey.

Asked to rate their optimism about the overall US economy on a 0-100 scale, where 100 is most optimistic, marketers reported an average score of 66.1—nearly 20 points higher than the all-time low score of 47.7 in February 2009.

That bullishness extends across all B2B and B2C sectors, including manufacturing, biotech, and consumer packaged goods, the survey of CMOs and other marketing executives found.

Marketers' optimism is accompanied by expected improvements in key metrics, such as increased entry of new customers into the market, increased customer acquisition, increased purchase volume, and increased customer retention.

Moreover, marketers predict that customers' top priority over the next year will be a focus on product quality, not on low price.

Below, additional key findings from the report, which was based on data from a survey of 408 US marketers (88% VP-level or above).

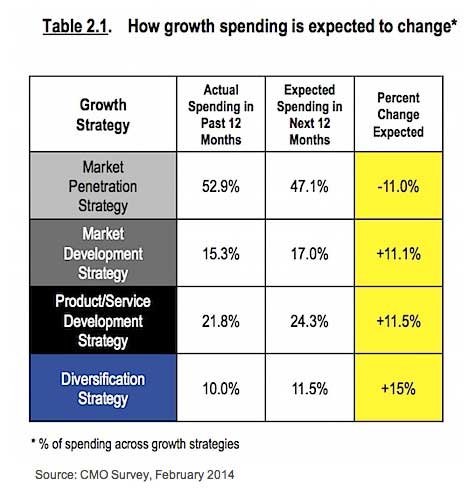

Growth Spending

- Over the next year, marketing executives report their companies will spend 11.1% more on market development strategies (sell existing products/services to new customers), 11.5% more on product/service development strategies (sell new products/services to existing customers), and 15% more on diversification strategies (sell new products/services to new customers).

- Those three strategies are riskier than a market penetration strategy (i.e., selling more existing products/services to existing customers), which is projected to decline 11%.

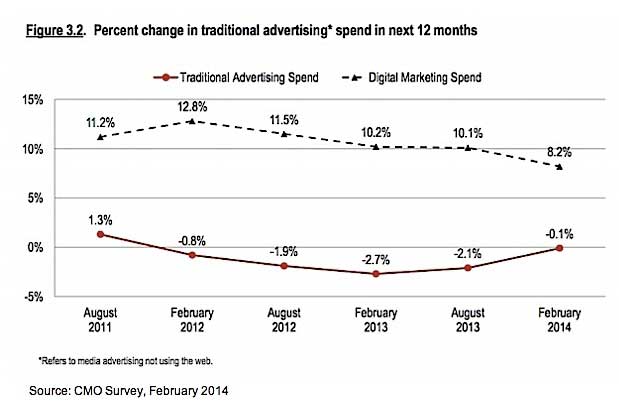

Digital vs. Traditional Advertising

- Marketing executives expect spend on digital advertising to increase 8.2% in the next year, whereas they expect a -0.1% decrease in spend on traditional channels.

- Survey respondents expect social media spend to grow from 7.4% of budgets to 10.1% in the next 12 months. In five years, they expect social to make up 18% of marketing spend.

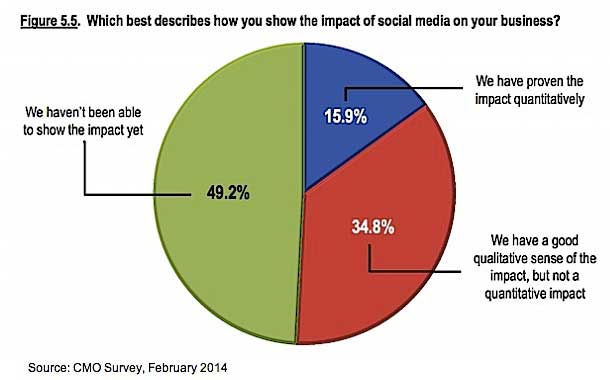

- Despite that expected increase in social media spend, 49.2% of marketing executives say they haven't been able to show the impact of social yet, and an additional 34.8% have only a qualitative sense of its effectiveness.

About the research: The February 2014 CMO Survey was based on data from an Internet survey of 408 top US marketers (88% VP-level or above).