Black Friday and Cyber Monday are two peak revenue days for e-commerce retailers during the holiday season, together accounting for 8.58% of all holiday shopping revenue. However, two periods in early and mid December are as lucrative, and less competitive for consumers' attention, according to a recent report by Custora.

The analysis found that the four days of December 1-4 brought in 9% of total holiday e-commerce revenue in 2012, and December 10-13 accounted for 8.49%, making both periods more rewarding than Black Friday or Cyber Monday.

Below, additional key findings from the E-Commerce Snapshot Holiday Edition, which was based on an analysis of data collected in 2012 from 30 million unique customers and $2 billion in revenue across US retailers in 14 verticals.

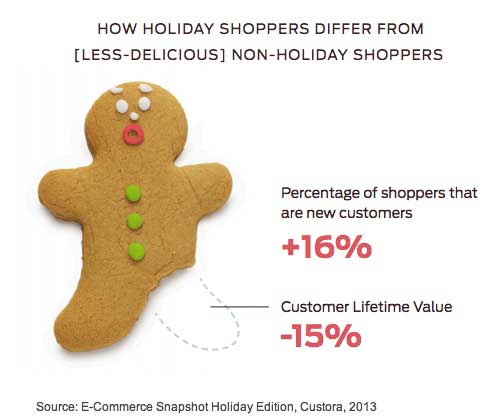

Holiday shoppers are less valuable

- During the holidays, on average 43% of customers to e-commerce sites are new customers (making their first purchase at the store), compared with 37% throughout the rest of the year.

- These holiday customers are more likely to be "one and done," driven by seasonal promotions and deals, with lower likelihood of making repeat purchases.

- This behavior drives a decline of 15% in customer lifetime value (CLV) for such newly acquired shoppers.

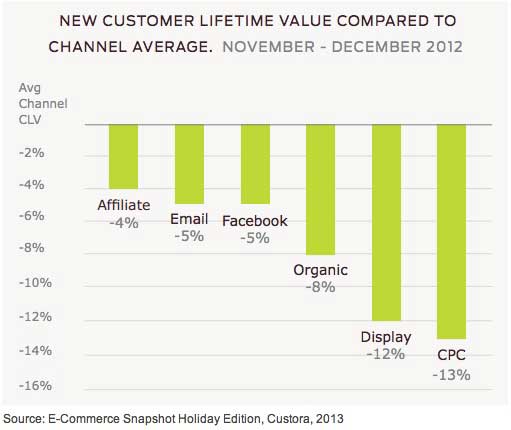

- The CLV of customers acquired through paid search (CPC) drops 13% during the holiday months compared with those acquired through the channel during non-holiday months.

- Display advertising follows a similar trend, with a 12% decline in CLV for customers acquired during the holidays compared with customers the rest of the year.

- Other channels, such as affiliate, email, and Facebook, display a much lower decline in CLV—around 5%.

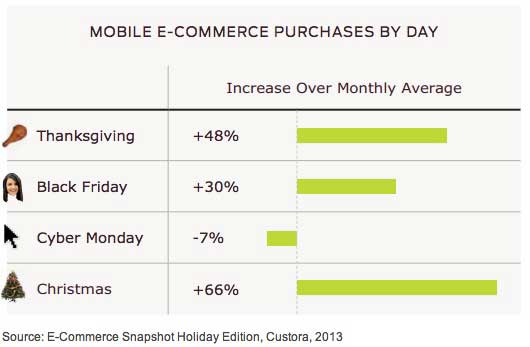

Black Friday is mobile Friday

The percentage of customers using mobile devices to make purchases online jumped by 48% on Thanksgiving 2012 and 30% on Black Friday 2012 compared with the average during November.

About the research: The report was based on 2012 data spanning 30 million unique customers and $2 billion of transaction revenue. The data includes US retailers from 14 E-commerce verticals, including fashion, beauty, lifestyle, and electronics.