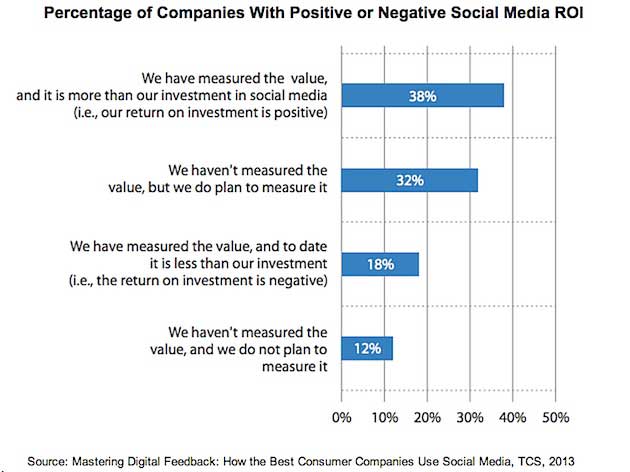

Some 38% of large consumer companies report a positive return on their social media investments, more than double the number of companies with a negative ROI (18%), according to a recent report by Tata Consultancy Services (TCS).

However, 44% of consumer companies haven't yet measured the return on investment of their social media efforts: 32% haven't measured ROI but plan to, and 12% have no plans to measure the return.

Below, additional key findings from the report, which was based on data from a survey of 655 large consumer companies located in North America, Europe, Asia-Pacific, and Latin America.

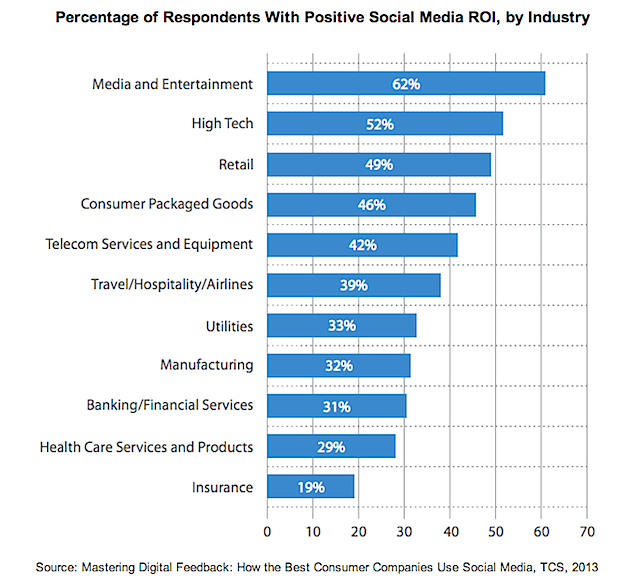

Return on Investment by Industry

Industries that benefit from social media tend to sell products and services consumers are passionate about. Those industries—media, retail, high tech, travel, and telecom—have products and services that are easier to create avid "tribes" of loyalists around, accofding to TCS.

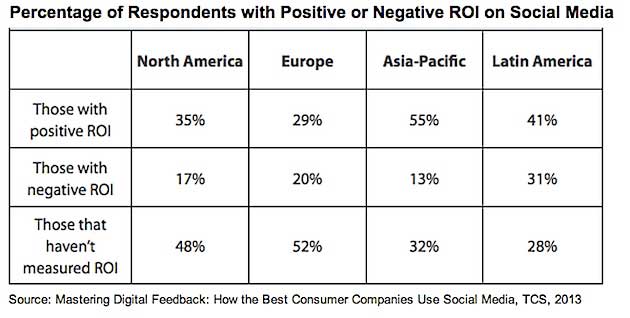

Regional Variations

The ROI of social media varies markedly by region of the world:

- Asia-Pacific respondents were the most likely to report a positive ROI: 55% claimed they had gained.

- By comparison, only 35% of North American and 29% of European respondents said their social media efforts had resulted in positive ROI.

- Asia-Pacific respondents were also less likely to have negative returns.

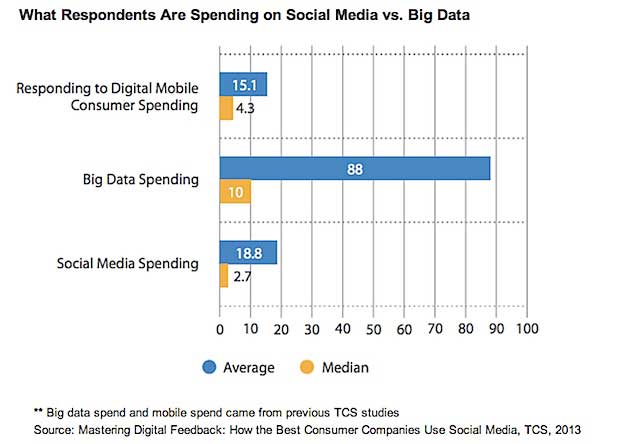

Social Media vs. Big Data

- Average spend in 2013 on social media was $10 million per respondent.

- This is significantly less than what they spent in 2012 on Big Data ($88 million).

About the research: The report was based on data from a survey conducted in in June and July 2013 of 655 large consumer companies located in North America, Europe, Asia-Pacific, and Latin America (average revenue of $15.6 billion; a median of $4.9 billion).