Only one-third of chief marketing officers report that they are able to demonstrate quantitatively the impact of their marketing spending, according to a recent report by The CMO Survey.

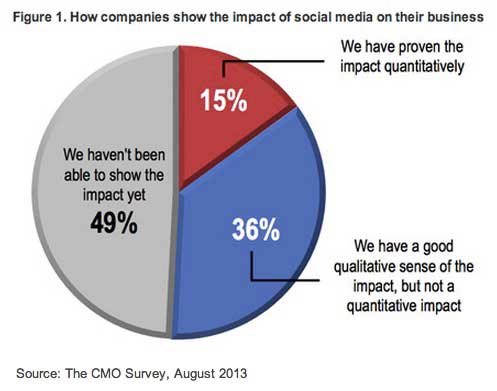

Proving the value of social media spending is a particular challenge for top marketers. Only 15% of CMOs surveyed report proven quantitative impacts from their social media marketing. Another 36% say they have a good sense of the qualitative impact, but not the quantitative impact.

Moreover, almost half of the CMOs surveyed (49%) have not been able to show that their company's social media activities have an impact on their business.

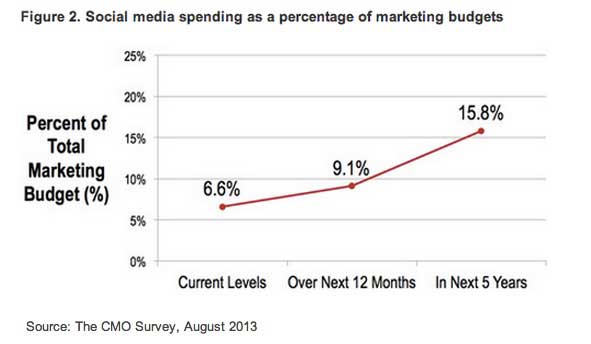

However, despite their struggles to prove value, top marketers expect to increase expenditures on social media from 6.6% of their overall budget to 15.8% over the next five years

Below additional key findings from the report, which was based on a survey of 410 US marketers working primarily for Fortune 1000 firms.

Marketing Analytics and Big Data

- 60% of CMOs surveyed collect online customer behavior data for targeting purposes and 88.5% expect to increasingly do this over time.

- Marketing analytics is currently 5.5% of marketing budgets and is expected to increase to 8.7% over the next three years.

- However, the use of Big Data remains a challenge for CMOs. The percentage of projects using available or requested marketing analytics decreased from 35% in 2012 to 29%.

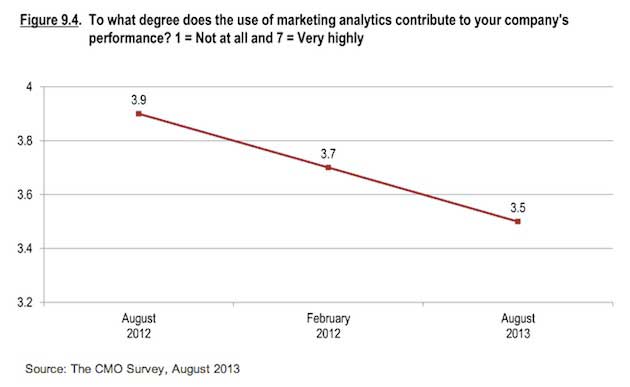

- CMOs report only "average" contribution of marketing analytics to company performance (3.5 on a 7-point scale where 1 is "not at all" and 7 is "very highly").

Optimistic About the Economy

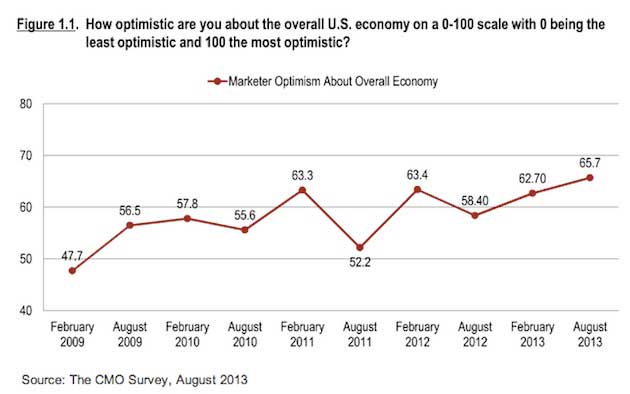

- CMOs report their highest levels of optimism for the overall US economy in four years.

- On a scale of 0-100, with 0 being the least optimistic, CMOs rated their optimism for the US economy at 65.7. This is nearly a 20-point increase over the same measure taken in August 2009.

- Almost 50% of top marketers say they are "more optimistic" about the overall US economy compared with last quarter.

About the research: The report was based on data from a survey of 410 US marketers polled in July and August 2013. Most survey respondents work for Fortune 1000 companies, and 93% are VP-level employees and above.