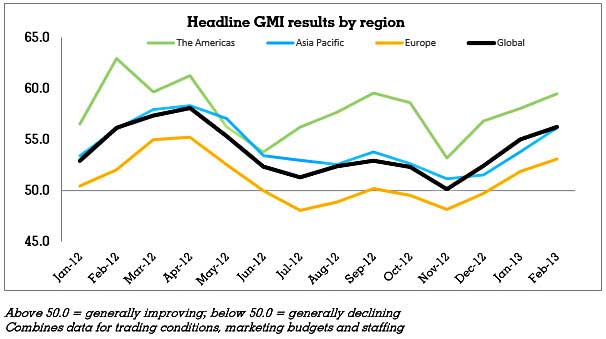

The outlook for marketers worldwide continues to strengthen, according to new data from Warc's Global Marketing Index. The headline GMI, a metric that combines trends observed in marketing budgets, trading conditions, and staffing levels, registered a reading of 56.2 in February 2013, up from 53.8 a month earlier.

Moreover, the headline GMI has now recorded month-on-month improvement for three consecutive months, with marketers in the Asia-Pacific region registering the strongest improvement in outlook.

The Americas remains the most positive region, with its headline GMI showing a strong reading of 59.5, up 1.5 points from January. The headline GMI for Europe also improved, reaching 53.1 in February, albeit remaining slightly less optimistic than the other measured regions.

The GMI is a monthly indicator of the state of the global marketing industry composed of three components: marketing budgets, global trading conditions, and staffing levels. A GMI reading of 50 indicates no change and a reading of over 60 indicates rapid growth.

Below, other findings issued by Warc in association with World Economics.

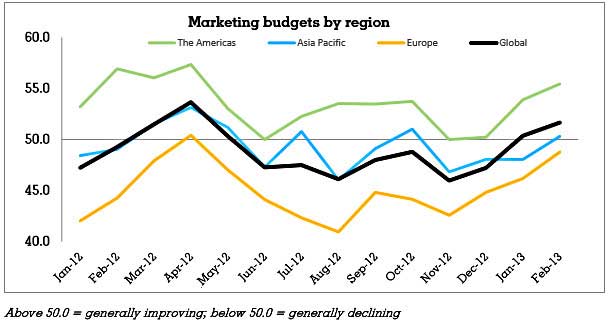

Global Marketing Budgets

The index of global marketing budgets registered further growth in February (51.7) with marketers in the Americas recording the greatest confidence (55.5).

Key budget-related findings for February 2013 include:

- Marketers in the Asia-Pacific region registered an increase for the first time in four months with the index rising 2.2 points in February, to 50.3.

- Marketing budgets are still being cut across Europe, but the European index recorded a value of 48.8 in February, up 2.6 points from the previous month.

- Digital channels excluding mobile (74.5) and mobile (68.6) continue to attract rapidly increasing investments, though both recorded slight month-over-month drops in index value, falling 0.5 and 1.3 points, respectively.

- TV gained marginally, up 1.1 points, to 48.8 in February, but continues to register a net budgeted spend decline.

- Radio also recorded a month-over-month improvement in index value, to 42.4 in February, but investment continues to shrink at a rapid rate.

Global Trading Conditions

The index for global trading conditions improved in February and now stands at 59.4 (up 1.5 points from January). That's the index's highest reading since April 2012.

The outlook for trading conditions remains most positive in the Americas at 60.9, followed by Asia Pacific at 59.7 and Europe at 57.4.

Global Staffing Levels

The global index of staffing levels, the third component of headline GMI, registered further improvement in February and now stands at 57.6.

Staffing levels continue to rise in all regions, with the Americas at 62.1, the Asia-Pacific region at 58.5, and Europe at 53.2.

About the data: Findings are based on a survey of 1,225 global marketers—experienced executives working for brand owners, media owners, creative and media agencies, and other organizations serving the marketing industry. The panel is selected to reflect trends in the three main global regions: Americas, Asia-Pacific, and Europe. GMI results are calculated by taking the percentage of respondents that report the activity has risen ("Increasing") and adding it to one-half of the percentage who report the activity has not changed ("Unchanged"). Using one-half of the "Unchanged" percentage effectively measures the bias toward a positive (above 50 points) or negative (below 50 points) index.