Ad clicks via tablet devices are projected to account for 20% of Google's paid-search revenues in the US by December 2013, up from 10.7% a year earlier, according to a new report from Marin Software.

That would amount to roughly $5 billion in revenues from tablet ads alone for the year. Overall, Google is expected to earn $9.9 billion in total mobile revenues in 2013, up from an estimated $5.8 billion in 2012.

The strong performance of tablet ads, coupled with a surge in user adoption, is driving the rise in ad investment, according to the report.

Below, additional findings the report titled "Mobile Search Advertising Around the Globe: How Smartphones and Tablets Are Changing Paid Search," by Marin Software.

Effectiveness of Ads

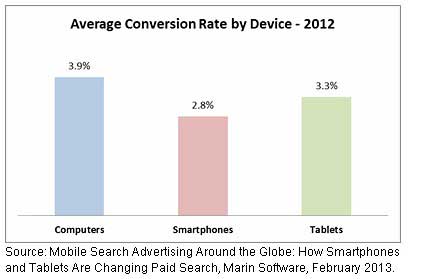

On average, the conversion rate for search ads served via tablet was 3.3% at the end of 2012, compared with 3.9% for desktop and 2.8% for smartphone:

Meanwhile, the effectiveness of Google's tablet search ads are rising. Conversion rates on search clicks via tablet devices increased 31% from January to December 2012 , compared with a 9% rise for smartphones and 7% for computers.

Given such trends, conversion rates for ads via tablets are expected to eclipse those via desktop by the end of 2013, according to the report.

Cost of Ads

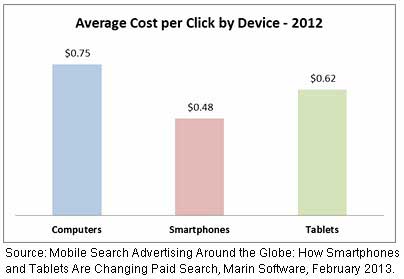

Another positive for advertisers is price: The cost-per-click (CPC) on smartphones and tablets is much lower than it is on desktop computers.

Smartphones clicks were roughly 36% cheaper than desktop clicks in 2012. Similarly, tablet clicks were about 17% cheaper than their desktop counterparts:

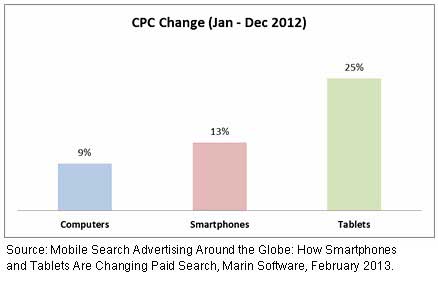

CPCs via tablets and smartphones increased 25% and 13%, respectively during 2012. By contrast, CPCs via computers grew roughly 9%:

So although smartphones and tablets have lower CPCs, they're increasing at a faster pace, suggesting that tablet CPCs will likely equal desktop CPCs during 2013.

Other key findings:

- Among the brands studied, click-through rates (CTR) for search ads on tablets were 37% higher than ads placed on desktop searches.

- Advertisers increased their investment in paid search on tablets in 2012. Spend share grew from 4.8% in 1Q12, to 10% in 4Q12 with spend on tablets eclipsing smartphones for the first time in the fourth quarter.

About the report: Findings are based on the analysis of Marin's clients—leading brands and advertisers that manage more than $4 Billion in annualized paid-search spend, representing major industry sectors in Australia, Brazil, Canada, China, the Eurozone, India, Japan, Mexico, New Zealand, Russia, Singapore, the UK and the US. Importantly, Marin's clients are mainly large advertisers spending upwards of $100,000 per month on paid-search. As such, the information presented is biased towards larger advertisers, and may not reflect mobile search trends for small or medium-sized businesses.