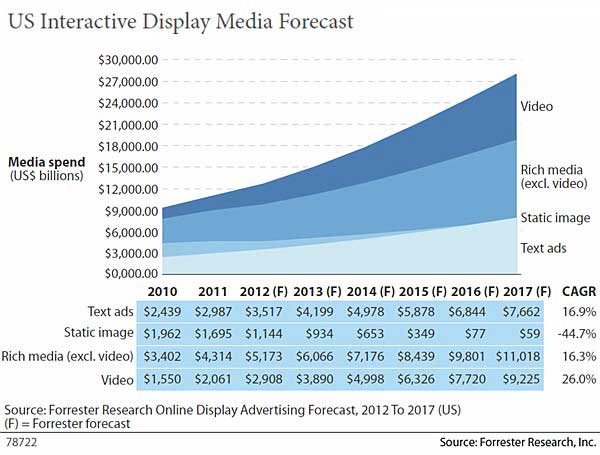

Online display ad spending in the US is forecast to grow at a compound annual growth rate (CAGR) of 17% over the next five years, from an estimated $12.8 billion in 2012 to $27.0 billion in 2017, according to an Oct. 9 report by Forrester Research.

Interactive display media spend is expected to outpace total ad spending rates: Offline media is poised to grow at a modest 1.1% CAGR over the same period.

Growth in video is projected to outpace other interactive channels.

Programmatic-exchange-based trading is forecast to account for 30% of total spend by 2017; concurrently, rich media and long-form video are expected to grow at 16% and 26% CAGRs, respectively, from 2012 to 2017.

The momentum in programmatic is attributed by Forrester to the shift to audience-centric buying, while the growth of rich media and video is attributed to the increased availability and quality of video placements.

Other key projections, issued by Forrester:

- CPM will increase as ad impressions increase in quality and quantity: As impression growth stalls due to viewable impression standards and stabilized social media use, increased spending will put upward pressure on CPMs, which will nearly double between 2012 and 2017.

- Mature digital media buyers are likely to become more reliant on technology, data, and analysis as the CPM rates of good-quality inventory rise.

- Marketers plan to increase investments in real-time media, third-party data targeting, and video across the US and Europe; interest in programmatic technologies will likely be stronger in the US in the near term.