Tech companies are increasing their marketing budgets a paltry 1.7% in 2012, roughly one-half the 3.5% bump they reported in 2011, according to the "2012 CMO Tech Marketing Benchmark Study" from IDC.

"The main culprit is the economy," wrote Rich Vancil, VP of IDC Executive Advisory Strategies, in a recent blog post. "Management teams are not willing to spend until better signs of demand pick up. The second factor is media shift: Going-to-market with digital vs. traditional media."

Tech marketing budgets hit a low point in 2009, falling 8.3% in the wake of the financial crisis. In 2010, tech marketing budgets increased 3.7% over the previous year, and then rose 3.5% in 2011.

Below, additional findings from IDC's 2012 CMO Tech Marketing Benchmark Study, based on a survey of 91 tech companies conducted from May to August, 2012.

Software companies and smaller tech brands are the most confident

Software vendors are increasing budgets some 5.2% in 2012, whereas hardware vendor budgets are falling 0.5% and services vendor budgets are falling 3.7%.

Also, companies with revenues of less than $500 million are expecting average marketing investment growth of 15.8%, compared with 5.2% growth for those with revenues between $1.0 billion to $2.9 billion, and 0.5% for those with revenues over $10 billion.

Digital allocations, as a percentage of total budget, continue to rise

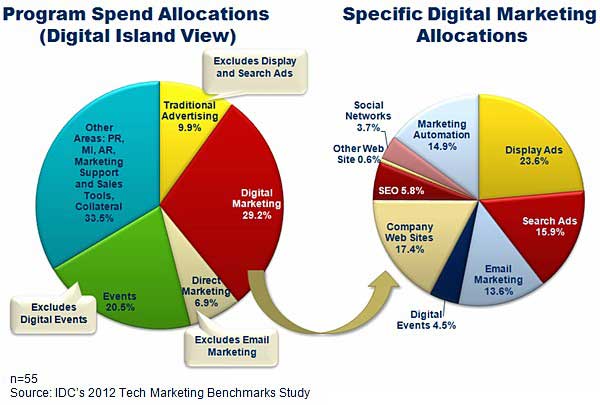

Digital marketing spending, defined as display ads, search ads, email marketing, digital events, company websites, marketing automation, SEO, and social networks, continues to rise.

In 2011 digital marketing accounted for 26.4% of total program spend; that figure has reached 29.2% in 2012.

Among other spending-related findings:

- For the first time, IDC is tracking marketing automation spending, which is projected to account for 14.9% of digital budgets in 2012.

- Display ads are expected to account for 23.6% of digital spend, up from 21.5% in 2011.

- Email is projected to account for 13.6% of digital spend, down from 16.4% a year earlier.

- SEO budgets remain essentially flat, from 5.9% in 2011, to 5.8% in 2012.

- Spending on social marketing is expected to account for 3.7% of digital allocations during the year.

About the data: Findings are from IDC's tenth annual Tech Marketing Benchmarks Study, conducted from May 14 to August 15, 2012 among 91 technology companies representing roughly $750 billion in annual revenues. Hardware, software, and services brands with both direct and indirect channel strategies are represented in survey.