Global digital out-of-home media (DOOH) revenues, generated by digital place-based networks (DPNs) and billboards and signage operators (DBBs), grew 15.3% to $6.97 billion in 2011, and are forecast to accelerate 19.2%, to $8.3 billion in 2012, according to data from PQ Media.

The continuing economic recovery and record political ad spending are key drivers of the strong 2012 forecast, according to PQ Media.

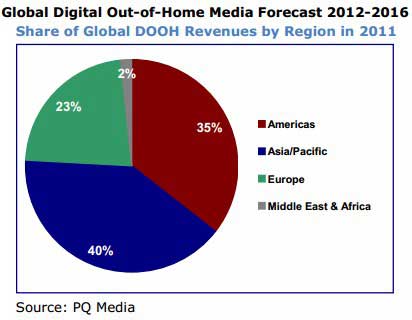

In regional terms, the Asia-Pacific (APAC) market is the primary growth engine. In 2011, APAC was the fastest-growing and largest DOOH region, accounting for 40% of all worldwide revenues.

The Americas accounted for 35% of total DOOH revenues in 2011.

Below, other findings from PQ Media's Global Digital Out-of-Home Media Forecast series, which tracked, analyzed and forecast revenue, growth, and trends in the leading 28 global digital out-of-home (DOOH) markets in four major regions: The Americas; APAC; Europe; and the Middle East and North Africa (MENA).

Country Highlights

Overall, the global DOOH industry expanded at a compound annual growth rate (CAGR) of 13.7% during the the 2006-2011 period. The US remains the largest global market; however, China, now second to the US, is growing at a faster rate.

Some key findings among the 28 leading countries tracked by PQ Media:

- The US, the largest overall DOOH market worldwide generated $2.05 billion in annual revenue 2011, up 11.2% from the previous year, driven primarily by double-digit growth among digital billboard operators, while digital place-based networks grew at a single-digit rate for the year.

- Ranking as the second largest DOOH market worldwide, China's revenues surged 39.2% in 2011, to $1.44 billion.

- The UK DOOH market, the largest in Europe, generated $549 million in 2011, up 11.3% due to the activation of new ad locations and digitization of older sites in preparation for the London Summer Olympics.

- Brazil's DOOH market grew 38%, to $155 million in 2011, the fifth consecutive year of double-digit growth for this market, PQ Media estimates.

Worldwide DBB and DPN Market

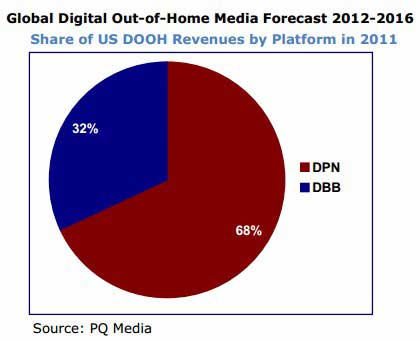

PQ Media defines the global DOOH industry in terms of two major platforms—digital place-based networks (DPNs) and digital billboards and signage (DBBs), across six venue categories: cinema, retail, office, entertainment, transit and roadside.

DPNs accounted for roughly two-thirds (68%) of the total DOOH spend in 2011, and DBBs accounted for the remaining one-third (32%):

Global DPN revenues grew 11.8% to $5.09 billion in 2011, driven by double-digit growth in the Asia-Pacific region, particularly China, which is the region's biggest and strongest growing market, PQ Media estimates.

Global DBB revenues increased 26% to $1.88 billion, fueled by positive measurement, regulation and agency perception trends in most of the leading markets in the four major regions.

US Market

In the US, DPNs remained one of the fastest-growing ad-based media in 2011:

- After a 15.3% expansion in 2010, revenue growth decelerated to 7.5% in 2011, due to a substantial slowdown in the cinema category. Total US DPN revenues increased at a CAGR of 10.7% from 2006 to 2011, reaching $1.41 billion, fueled by double-digit gains in the corporate, healthcare, entertainment, education, and transit venues.

- 2011 began strong for DPNs in the US; however, the sudden change in sentiment regarding an economic recovery triggered a decline in national scatter ad spend in the second half, as ad budgets tightened in the fourth quarter.

- Excluding cinema, however, the deceleration in overall DPN growth was much less severe in 2011, as combined operator revenue in the other four venue categories increased 13.2% to $736 million.

- US DBB revenues increased 20.3% to $638 million in 2011 and posted a 24.1% CAGR in the 2006-2011 period, fueled by accelerated rollouts of roadside DBBs, which produce higher and higher-margin revenue than static billboards.

2011-2016 Forecast

In 2012, global DOOH revenues are forecast strong (up 19.2% year over year, to $8.3 billion) as operators expand into new venues and markets, install DBBs in more locations, and incorporate enhanced and interactive features.

Global DOOH revenues are projected to expand at a 21.3% CAGR in the 2011-2016 period. US DOOH revenues are expected to grow 12.5% to $2.3 billion in 2012, and post a 12.5% CAGR in the forecast period.

US DPN revenues are projected to increase at an accelerated 10.5% in 2012 to $1.55 billion, driven by stronger audience metrics, more industry consolidation, greater network scale, and leading operators promoting the medium as a valuable component of multimedia ad solutions.

About the data: All data and analysis are from PQ Media's Global Digital Out-of-Home Media Forecast, 2012-2016.