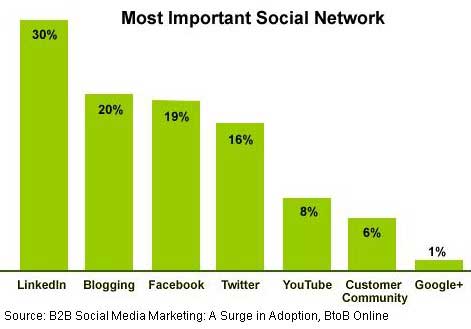

Though B2B marketers use a variety of platforms for social media marketing, a plurality (30%) cite LinkedIn as their most important channel for social outreach, according to a report by BtoB Online, which also found that increasing numbers of B2B marketers are fully engaged with social marketing.

Among surveyed B2B marketers, Facebook (20%) is ranked as the second most important social channel, followed by blogs (19%), Twitter (16%), and YouTube (8%).

Newer on the social scene, Google+ (1%) is ranked as the least important social channel by B2B marketing professionals.

Below, other findings from the report titled "B2B Social Media Marketing: A Surge in Adoption" issued by BtoB Online.

Asked which channels they use most often, B2B marketers cite the "big three" social sites first: LinkedIn (83%), Twitter (80%), and Facebook (79%); YouTube and blogging round out the top 5 channels, at 60% and 50%, respectively.

B2B social media use has grown over the past two years

Among B2B marketers surveyed:

- 32% are "very" or "fully" engaged in marketing via social channels, up from 21% in 2011. That number is expected to increase to 53% by 2013, according to BtoB.

- 35% began marketing via social media in the previous two years alone.

- Only 13% report using social media marketing for more than 4 years.

Social marketing boosts branding

Social marketing is primarily viewed as having softer marketing attributes among B2B marketers: 69% cite branding is their top goal for social marketing, followed by driving website traffic (58%), product promotion (56%), SEO (45%), competitive intelligence (45%), and new product development (25%).

Marketers are upping ROI measurement practices

Two in five B2B marketers (40%) now measure the ROI of social media, up 15 points (or 60%) from the 25% who did so one year earlier.

About the data: Findings are based on a survey of 622 B2B marketers conducted online March 5-16, 2012. Companies of various sizes were represented, from small businesses (64% reported annual revenue of $25 million or less), to midsize companies (19% reported annual revenue of $25 million to $499 million) and large enterprises (17% reported annual revenue of $500 million or more). Ad companies comprised 26% of respondents, followed by tech companies (17%), publishing/media (12%), consulting (11%) manufacturing (7%), and financial services (5%).