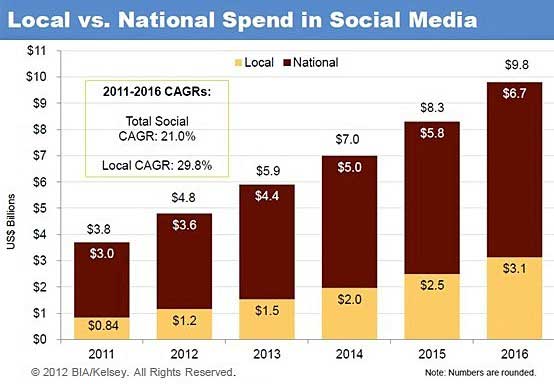

Social media advertising revenue—now dominated by Facebook and Twitter—is forecast to reach $9.8 billion in 2016, up from an estimated $3.8 billion in 2011, a compound annual growth rate (CAGR) of 21.0%, according to BIA/Kelsey's US Local Media Annual Forecast.

Growth in local markets is projected to be particularly robust over the five-year period, driven by crucial changes to Facebook's and Twitter's ad platforms that are offering better opportunities for smaller brands to reach consumers online, according to the report.

Below, additional findings from BIA/Kelsey's five-year social ad spending forecast.

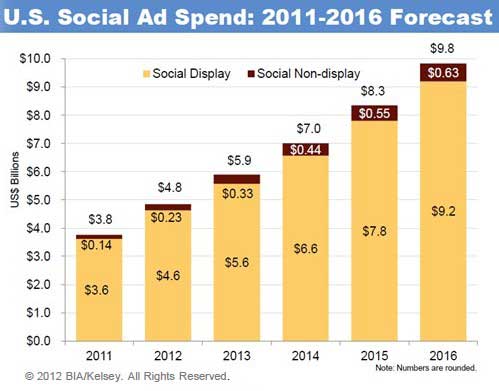

Social display, which dominates social media advertising* is projected to climb from $3.6 billion in 2011 to $9.2 billion in 2016—a CAGR of 20.6%.

The segment of non-display ad formats, such as Twitter's promoted products, is expected to grow robustly, from $140 million in 2011, to $630 million in 2016, a 35.2% CAGR.

The local segment of US social media ad revenue is forecast to grow at a 29.8% CAGR over the next five years, from $840 million in 2011, to $3.1 billion in 2016.

The national segment of social ad spend is expected to reach $6.7 billion in 2016, up from $3.0 billion in 2011.

"Better performance, coupled with richer formats and creative elements, like video, will be the principal social ad market growth drivers," said Jed Williams, analyst and program director for Social Local Media at BIA/Kelsey.

"Social advertising's local business penetration will steadily increase as SMBs' understanding of social media deepens, and as the networks continually improve the ease of onboarding and campaign management."

"Facebook opening its Ads API to more partners, including those that work with SMBs, and Twitter's self-serve platform will help to 'democratize' social ads, which will ultimately lead to more local growth."

* BIA/Kelsey defines social media advertising as money spent on ad formats across social networks, excluding virtual goods and rewards, social gaming, social commerce, and social marketing.