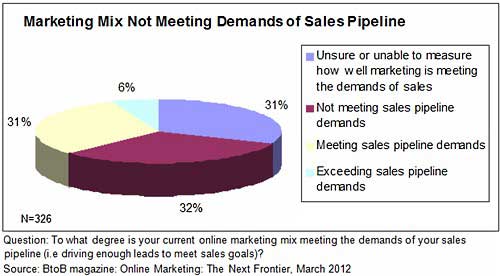

Some 61% of B2B marketers say generating more leads is their biggest marketing challenge in 2012; however, nearly two-thirds say their marketing mix does not meet sales pipeline demands (32%) or they are unsure of whether their marketing mix is effective (31%), according to a new report by BtoB Online and Bizo.

Nearly three in ten B2B marketers (31%) say they have an adequate supply of leads, and 6% say their lead efforts exceed sales pipeline demands.

Below, additional findings from Online Marketing: The Next Frontier, a report based on a survey of 326 B2B marketing professionals, by BtoB Magazine and Bizo.

Email Most Widely Adopted, Most Effective Tactic

Asked to rank various marketing tactics in terms of the amount of time and resources spent on each activity, B2B marketers rank email first (49%) (i.e., 49% say they spend more time and resources on email than other channels).

Similarly, paid search (36%) is ranked second among B2B marketers, followed by display ads (35%), and social media (29%).

Email is also cited as the most effective channel among B2B marketers:

- 59% say email is the most effective channel for generating leads.

- 88% say they are using email marketing as a branding channel.

In addition, 30% of B2B marketers say email is now a mature and well-optimized part of their mix.

By contrast, fewer marketers cite paid search (19%), display ads (12%), and social media (5%) as a mature and well-optimized part of their mix.

Planned Improvements

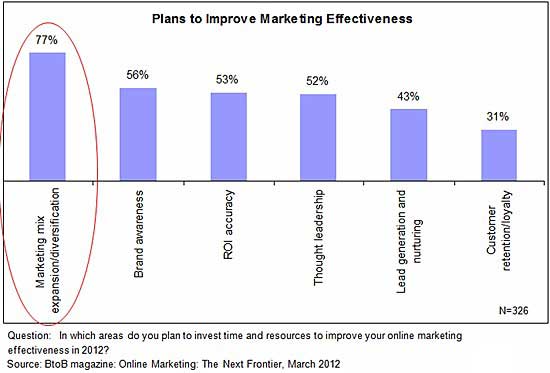

Most marketers plan to diversify tactics in the coming year.

Asked how they plan to improve online marketing effectiveness, more than three-quarters (77%) say they plan to expand or diversify their marketing mix in 2012, while 56% plan to focus on developing and promoting their brand.

More than one-half of B2B marketers plan to improve ROI measurement practices (53%) and thought leadership (52%) in 2012.

Measuring Impact

Among surveyed B2B marketers, nearly 40% cite accurate measurement and attribution of online conversions as a top online marketing challenge.

B2B marketers were asked specifically how they track leads back to programs:

- 20% say they nearly always attribute leads to multiple marketing programs.

- 36% say they "sometimes" attribute leads to more than one program.

- 26% say they attribute leads to one program only, or do not track leads to any marketing program.

Opportunities in Data-Driven Segmentation and Targeting

B2B marketers are most comfortable using segment targeting for email: 84% say use segment targeting in email campaigns.

However, only one-third (33%) of B2B marketers use segment targeting in display, paid search, or social media programs. Among that third, most segment by industry (65%), geography (56%), job function (55%), and title (49%).

B2B marketers cite various roadblocks to effectively using segment targeting, including:

- Lack of data: 37%

- Uncertainty in how best to use targeting and segmentation in campaigns: 33%

Greatest Challenges

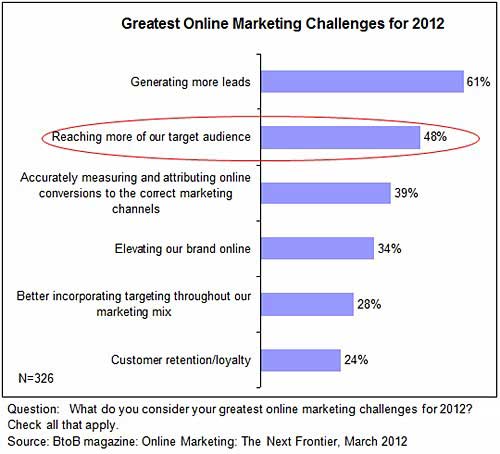

In addition to generating more leads in 2012, 48% of B2B marketers cite reaching more of target audiences as a key challenge in 2012, while 34% are concerned with elevating their brand online.

Nearly one-quarter of B2B marketers (24%) say customer retention is a key challenge in 2012.

Other key findings:

- 80% of B2B marketers use social media; that tactic is now rated as B2B marketers' second most important form of digital media outreach.

- Marketers are focused on branding as a competitive differentiator: 91% say they are making an effort to increase the value of their brand online.

About the data: The survey was fielded online among 326 B2B marketing professionals in the US from January 18 to February 3, 2012. Among the companies represented, ad agencies and tech companies predominated, accounting for 26% and 25% of respondents, respectively. Manufacturing (11%), financial services (8%), and consultancies (7%) also were represented. The sample skewed toward small-to-midsize companies: 45% of the companies surveyed have fewer than 50 employees. Some 63% of companies have annual revenues of less than $25 million and 13% have annual revenues greater than $1 billion.