Although 91% of senior corporate marketers agree that successful brands are using customer data to drive marketing decisions, 39% say their own company's data is collected too infrequently, or not effectively enough, according to a report by the Columbia Business School's Center on Global Brand Leadership and the New York American Marketing Association (NYAMA).

Overall, the study found that the use of big data—working with large customer datasets to mine key trends—is still a "work in progress" for most companies.

Below, additional findings from the first BRITE-NYAMA Marketing Measurement in Transition Study.

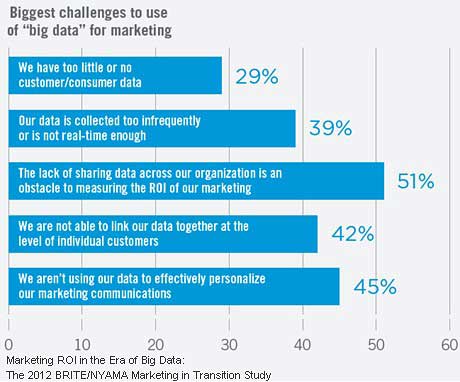

Challenges to Using Big Data

Among surveyed senior marketers, 51% say a lack of sharing customer data across the organization is a problem, and 45% say they're not using data to effectively personalize communications.

Some 29% of senior marketers say their marketing departments have too little or no customer data at all.

Traditional Data Still Reigns

The promise of big data is also based on integrating new types of information generated via online activity, such as mobile computing and social media.

However, few marketers are collecting such information: Only 19% collect customer data from mobile channels and 35% collect customer data from social channels.

Instead, marketers continue to focus on traditional customer survey data, including customer demographics (74%), transactions (64%), and usage (60%).

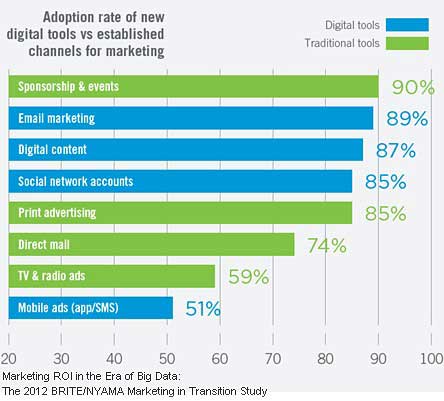

Adoption of Digital Channels

Despite widespread adoption, marketers are also struggling to measure the impact of the newest digital tools, according to the study.

For example, 85% of senior marketers use social networking (brand accounts on Facebook, Twitter, Google+, and Foursquare), and 51% use mobile ads (in-app, or SMS).

Moreover, social media adoption is relatively consistent across business sectors: 78% of B2B companies are using social networks for marketing.

Retail and travel/leisure are among the highest adopting industries. Industrial manufacturing is among the lowest adopting industries, as is the healthcare/pharmaceutical industry, which has been slow to adopt social networks due to its regulatory environment.

However, no industry reports less than 70% adoption of social marketing.

Even so, social and mobile channels are among the least likely to be measured for ROI:

- 14% of marketers who use social networks are collecting financial metrics.

- 17% of those using mobile ads are tying them to financial metrics.

By contrast, 41% of email marketers measure their results using financial metrics.

Moreover, as the number of marketing tools expands, the challenge of measuring and comparing them grows: 60% of senior marketers say comparing the effectiveness of marketing across their different digital media is "a major challenge."

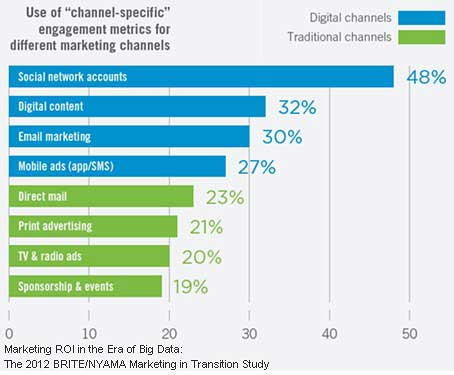

Channel-Specific Metrics

Digital marketing channels are far more likely than traditional channels to be measured via metrics that cannot easily be compared with other channels (e.g., "retweets" measure customer engagement on Twitter, whereas "likes" and "shares" measure it on Facebook).

Nearly one-half (48%) of those who use social networking measure the tool via channel-specific metrics, as do 30% of those using email marketing.

Traditional channels such as direct mail and advertising are typically measured via standard metrics which are more comparable to other key performance indicators (KPIs), the study found.

The study also revealed confusion about the meaning and significance of ROI. Among senior marketers:

- 31% say simply measuring the audience you have reached is "marketing ROI."

- 57% do not base their marketing budgets on any ROI analysis.

- 28% base marketing budgets on "gut instincts."

- 21% are using financial metrics for "little" or "none" of their marketing budget.

Even so, marketers are under pressure: 70% say that their marketing efforts are under greater scrutiny than in the past.

About the data: Findings are based on a survey of 253 corporate marketing decision-makers, director-level and above, surveyed online from January 27 to February 8, 2012. Respondents are employed at large companies (90% have a global annual revenue of over $50 million; 45% are over $1 billion). Respondents were from B2B and B2C companies in diverse industries. The study was piloted by Columbia Business School Marketing Professor Don Sexton, board member of the NYAMA, with David Rogers, Executive Director, BRITE, Center on Global Brand Leadership. The study was made possible with support from Research Now and GreenBook.