As advertisers continue to shift spending from traditional print media to the Internet, newspapers are failing to make up for the decline in print advertising revenues via gains in online ad revenues, according to a report by Pew Research.

Based on analysis of private financial data from 38 newspapers and in-depth interviews with senior executives from 13 companies, Pew found that on average, newspapers are losing seven dollars in print advertising for every dollar they gain in digital revenues.

Below, additional findings from The Search for a New Business Model, by the Pew Research Center's Project for Excellence in Journalism (PEJ).

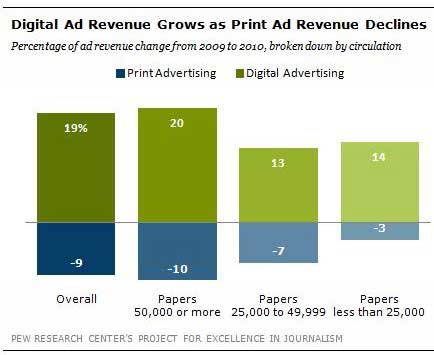

Overall, digital advertising is growing at a healthy pace: Among the papers studied, online ad sales grew 19% annually during the 2010 study period. However, print ad sales, which still account for 92% of overall ad revenues among the papers studied, fell by an average of 9% during the same period.

The highest rate of annual digital ad revenue growth occurred at those papers with circulations of 50,000 and above (20% on average).

Smaller papers (those with circulations smaller than 25,000 and those between 25,000 and 50,000) also recorded double-digit digital ad growth (14% and 13%, respectively), but they lost less print revenue during the period (3% and 7%, respectively).

The Digital Advertising Pie

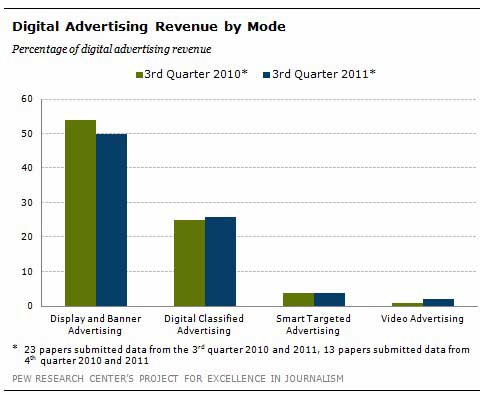

On average, conventional display and online classified ads accounted for three-quarters of total digital ad revenues in the third quarter of 2011. Among the newspapers that submitted data for that period, the key ad categories with share of revenues include:

- Non-targeted display and banner ads: 50%

- Online classifieds: 26%

- Behaviorally targeted ads: 4%

- Video ads: 2%

Daily-Deal, Mobile Revenues

Group-buying advertising plays a small but growing role: Daily-deal ad sales accounted for just 5% of total digital revenues in the third quarter of 2011, up 4 percentage points from 1% a year earlier. Among the 38 papers studied, 30 papers reported running daily-deal ads.

Mobile represents an even smaller part of the revenue mix. As of 3Q11, mobile accounted for less than one percent (0.9%) of revenues on average, up from a negligible 0.1% one year earlier.

A New Revenue Model?

Many newspaper analysts and insiders have advised the industry to find additional revenue streams, beyond advertising and paid subscriptions.

Among the newspapers studied, nearly one-half (44%) have experimented with such non-traditional revenue sources. Among those 44%, almost two-thirds reported earning less than $10,000 in 3Q11, and the median income generated was roughly $6,500.

The idea of new or non-traditional revenue streams continues to generate sharp divisions within the industry, Pew notes.

But executives at nearly all the newspaper companies studied agree on one point: To accelerate the transition to digital revenue, their approaches to ad sales need to change: 92% are placing a priority on hiring more people with digital ad training or experience, and 76% have changed the way they compensate ad sales staff.

About the data: The Search for a New Business Mode, by the Pew Research Center's Project for Excellence in Journalism, was authored by PEJ staff members Tom Rosenstiel, director; Mark Jurkowitz associate director; and Hong Ji; senior methodologist. The findings are based on responses from 38 US daily newspapers recruited by the PEJ. The survey was conducted online by Princeton Survey Research Associates International, October 26, 2011 to February 15, 2012.