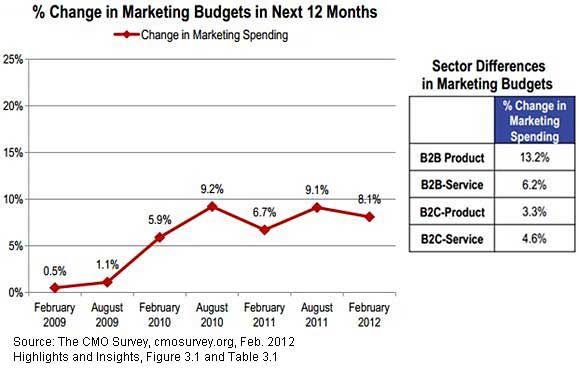

Buoyed by renewed confidence in the US economy and higher expectations for new business, CMOs say they plan to boost marketing spending over the next 12 months, with B2B products and B2B services marketers leading the way, according to the CMO Survey.

Moreover, the renewed confidence among surveyed CMOs is reflected in their higher financial performance goals:

- Sales are expected to climb 6.8% on average over the next 12 months, up 42% from the 4.8% bump in sales recorded in the previous 12-month period.

- Profits are expected to rise 6.2%, up 59% from the 3.9% profit growth recorded over the past year.

- New customer acquisition is expected to rise 5.7%, up 45% from the 6.2% growth achieved in the past year.

Below, additional findings from the February 2012 CMO Survey, a nationwide poll of senior marketing executives conducted biannually by The American Marketing Association and Duke University's Fuqua School of Business.

Confidence in New Business Growing

One-half of surveyed CMOs expect to win new customers over the next 12 months, and nearly two-thirds expect to benefit from higher purchase volume and cross-selling opportunities:

- 50% expect increased entry of new customers into the market, up from the 42% who did so in August 2011.

- 64% expect increased customer purchase volume, up from 56% six months earlier.

- 62% expect customers to buy more related products and services, up from 33% six months earlier.

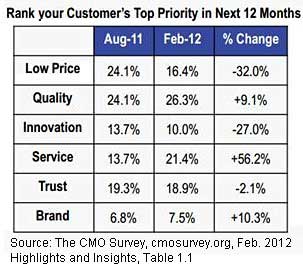

However, CMOs are cognizant of customers' shifting priorities:

- Price is becoming less important: 16.4% of CMOs cite low price as their customers' biggest priority, compared with 24.1% who said so six months earlier.

- Service is far more important: 21.4% of CMOs cite customer service as their customers' biggest priority, compared with 13.7% six months earlier.

Budget Growth

Among CMOs surveyed, marketing budgets are expected to climb 8.1% on average over the next 12 months, down from the 9.1% increase reported in August 2011:

However, growth is stronger among B2B products and B2B services companies (13.2% and 6.2%, respectively) than for B2C products and B2C services companies (3.3% and 4.6%, respectively).

Marketing Mix

Spending on traditional advertising is expected to fall dramatically over the next 12 months, while several marketing categories grow robustly:

- Spending on non-Web-based advertising is expected to fall 161.5% over the next 12 months from levels forecast in August.

- Spending on brand building is expected to grow 26.3% over the next 12 months, while online marketing rises 14.3%.

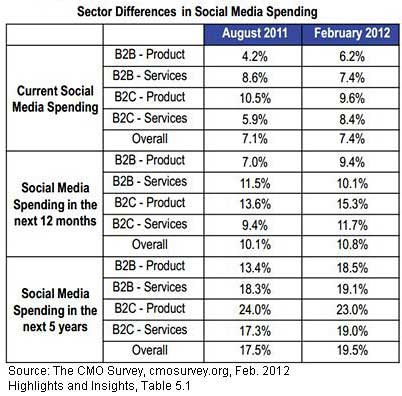

Social Media Spending

Social media marketing spend is expected to reach 10.8% of total marketing budgets over the next 12 months, up from the 10.1% forecast six months earlier.

Moreover, in the next five years, social spending is projected to account for 19.5% of total marketing budgets, almost three times more than the current level of 7.4%.

B2C brands that sell products and services are expected to invest the biggest share of their budgets in social media in 2012, 15.3% and 11.7%, respectively.

Though B2B services companies are reducing social investments to 10.1% (vs. 11.5% in August), B2B products companies are upping social investments, to 9.4%, from 7.0% in August.

Other social media-related findings:

- Marketers still struggle to ingrate social media into their overall approach. On a scale of 1-7, with one being "not integrated at all" and seven being "very integrated," nearly one-quarter of CMOs (18.4%) selected "1" to describe how well their company integrates social media with the firm's overall strategy, whereas 7.0% rated their efforts a "7", or very integrated. The average was 3.8.

- Social media staffing levels are up: the number of people employed in-house to conduct social media for the company increased to 9 in 2012, from 5.3 one year earlier. The number of individuals from outside vendors providing social media support for the company increased to 4.0, from 1.8 in February 2011.

Marketing Spend as a Percentage of Total Budgets, Revenues

On average, marketing spending is projected to account for 10.4% of overall firm budgets in 2012, up from 10.0% in August 2011. That proportion is lower among B2B products and services companies (8.7% and 8.2%, respectively) than B2C products and services companies (16.1% and 16.8%, respectively).

Relative to revenues, marketing budgets will account for 7.3% of revenues for B2B products companies, 4.8% for B2B services companies, 13.8% for B2C products companies, and 16.6% for B2C services firms.

Optimism Abounds

CMOs are optimistic about the US economy: Asked if they are more or less optimistic about the overall economy compared with the previous quarter, the optimists outweighed the pessimists, 8 to 1.

On a scale of 0-100, with 0 being the least optimistic, CMOs rated their optimism at a 63.4, an 11-point increase from the August-2011 survey, and a 16-point increase from the all-time low (47.7) reported in February 2009.

Rounding out the bullish sentiment, CMOs' optimism for their own companies exceeded that of the overall economy (72.8 vs. 63.4).

About the data: The February 2012 CMO Survey is a nationwide poll of chief marketing officers conducted twice each year by Duke University's Fuqua School of Business in conjunction with the American Marketing Association. The survey collected responses from 269 senior marketing executives, January 31 to February 16, 2012.