When measuring the success of online display advertising, media buyers and planners at agencies involved in online display advertising tend to place great importance on performance metrics such as conversion, even for branding awareness campaigns, according to a survey from Maxifier.

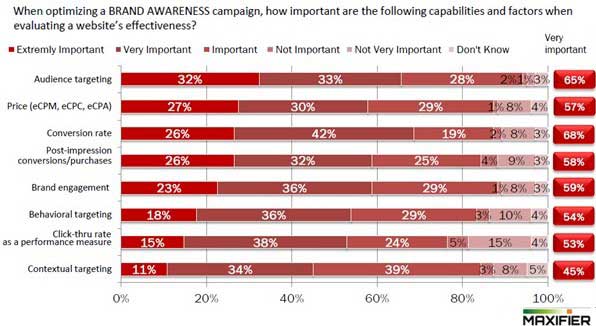

Among buyers and planners at digital marketing agencies in the US, 68% rate conversion rates as extremely (26%) or very important (42%) when optimizing brand-awareness ad campaigns, compared with 59% who view brand engagement as extremely (23%) or very important (36%).

Audience targeting is key for brand awareness campaigns with 65% of respondents rating the metric extremely or very important, as is the price of ads (57%).

Apparently, brand advertisers are focused on reducing lost impressions—and making sure ad dollars are not wasted.

Below, additional findings from Maxifier's Ad Optimization report.

Direct-Response Campaigns

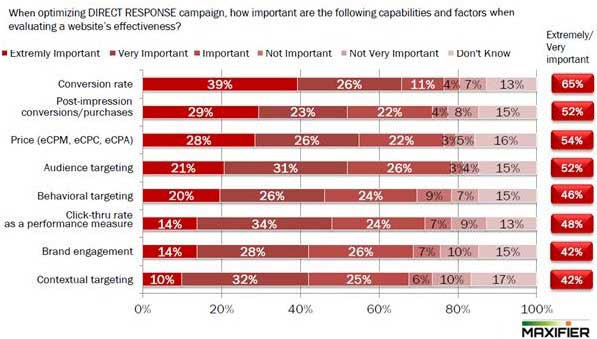

Direct-response marketers are primarily concerned with conversion: 65% of respondents rate conversion rates as either extremely (39%) or very important (26%) when optimizing direct-response campaigns. Price is ranked second with 54% ranking ad cost as extremely (28%) or very important (26%) when optimizing direct-response campaigns.

Ad Budgets

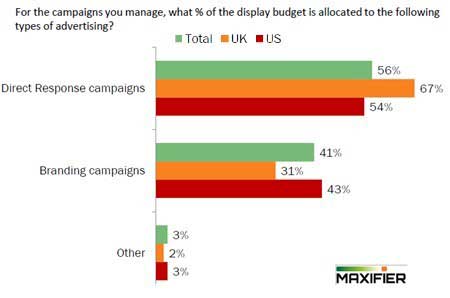

In the US, direct-response campaigns account for 54% of total ad budgets, and brand campaigns account for 41%. By contrast, in the UK, marketers invest more heavily in direct-response campaigns (67%) over branding campaigns (31%).

US campaigns typically run longer as well: 47% of campaigns last three months or more, whereas in the UK, only 16% of campaigns last that long.

Impact of Optimization

The report also highlights the growing importance of optimization, for both brand and direct-response campaigns, to ensure campaigns deliver on advertisers' objectives.

On average, brand campaigns in the US are optimized 10 times (vs. 7 times in the UK). For direct-response campaigns, the level is slightly higher at 11 times (11 times in the UK as well).

What's the result of optimization? Across brand-awareness and direct-response campaigns in the US, an average of 10% of websites are dropped from campaigns, equating to 7 sites for brand campaigns and 8 for direct response.

In the UK, 8% of websites, on average, are dropped from campaigns, equating to 3 sites for brand campaigns and 9 sites for direct response.

The study also revealed a more mature ad landscape in the US compared with UK in terms of technologies for the buying and selling of online advertising: Demand-side platforms are used more widely in the US than in the UK (22% and 14%, respectively), as are exchanges (32% and 24%, respectively).

About the data: Results are based on a telephone survey of 227 UK and US media planners and buyers in agencies involved in online display advertising. The research was overseen by London-based Loudhouse in the fourth quarter of 2011.