The smartphone market is still expanding: US adoption is expected to surge from 97 million devices in 2011, to 175 million by 2015, according to Yankee's forecast.

Nearly one-half (47%) of surveyed US consumers now own at least one smartphone, and 58% of consumers plan to buy a smartphone as their next mobile device.

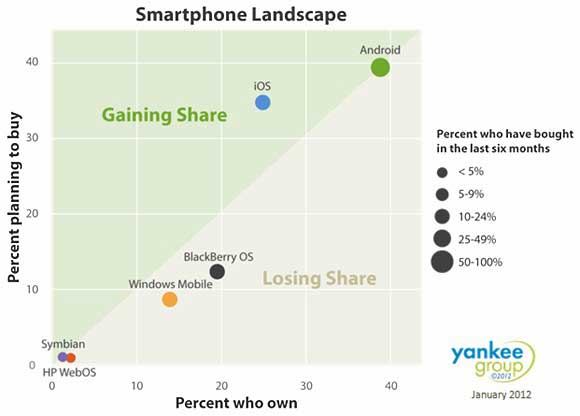

Apple's iOS, however, is the only platform set to gain share in the expanding market over the next six months.

- The green region contains OSs now forecast to gain share. Brands for which consumer intent to buy is high in proportion to their installed base are likely to gain market share over the next six months, as that buying intent translates into growth in their installed base.

- The tan region contains OSs that are losing share. Similarly, OSs for which consumer intent to buy is low relative to their installed base are likely to lose share.

- Android is today's most popular smartphone OS: 39% of smartphone owners use an Android-based device. Meanwhile, an equal proportion (39%) of consumers who intend to buy a smartphone in the next six months say they will buy an Android-based smartphone. Therefore, any OS intending to gain market share must grow at a rate higher than Android's 1:1 ratio.

- Apple iOS set to give Android a run for its money: 25% of surveyed smartphone owners own an iPhone (14 percentage points behind Android's installed base). However, 35% of consumers who plan to buy a smartphone in the next six months say they will buy an iPhone. As a result, iOS is set to win a greater stake in the expanding smartphone market over the period.

- RIM: 20% of smarphone owners now own a BlackBerry, but only 12% of those planning to buy a smartphone in the next six months plan to purchase a BlackBerry device. As such, BlackBerry will likely lose additional market share in the coming months.

- Windows Mobile: 14% of smartphone owners own a Windows Mobile-based device, but only 9% of those intending to buy a smartphone in the next six months say they will go with Windows Mobile.

- Symbian and HP WebOS: Fewer than 2% of those planning to buy a smartphone in the next six months want a Nokia or Palm.

Among key findings related to the four platforms: