Despite the renewed excitement in 3D entertainment over the past few years, would-be TV buyers appear to have little interest in purchasing a 3DTV set, according to a new survey from Retrevo.

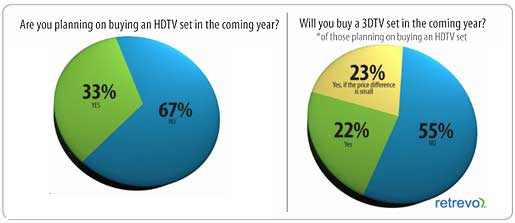

Interestingly, there are plenty of buyers for HDTVs: 67% of surveyed online consumers say they plan to buy a television set in the coming year. But among those buyers, only 22% plan to buy an HDTV set that supports 3D; 23% say they'll opt for 3DTV if the price differential is small.

Even so, 55% of TV buyers don't plan to purchase a 3DTV set, even if the price difference is small.

Below, additional findings from the most recent Retrevo Pulse Survey.

Key Obstacles: Lack of Content and Those Glasses!

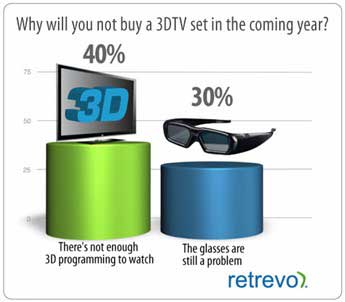

Even as price premiums begin to erode in 3DTVs, a lack of content and glasses are the biggest obstacles to adoption: Among TV buyers not planning to buy 3DTVs, 40% cite a lack of compelling programming to watch and 30% cite the need for 3D glasses.

Pop Quiz: What's the Difference Between Passive and Active 3DTV Sets?

If you answered "I have no idea," you're in good company: 75% of surveyed consumers say they don't know the difference between active and passive 3DTV sets.

So here's the scoop: Active sets, which use active shutter glasses require a battery and use a "sync" signal from the TV to create the 3D effect. Active glasses are typically a little heavier than the less expensive passive glasses.

Passive glasses are the type used in most movie theaters. Both types of glasses have their pros and cons, which likely adds to consumers' confusion about 3DTV.

Market Outlook for 3D Television

In 2010, 3DTVs were billed as the breakthrough technology of the year, particularly at the Consumer Electronics show (sponsored by the Consumer Electronics Association (CEA)) in Las Vegas. At the time, the CEA had forecast sales of 3D sets would reach 2.2 million in 2010 and that, by 2013 more than 25% of all televisions sold will be 3DTVs.

But consumers only purchased 1.1 million 3DTV units in 2010. Even so, the CEA now expects 3DTV shipments will top 3.6 million in 2011, and nearly double to 6.8 million in 2012.

About the data: Findings are from a survey of 1,000 online consumers, distributed across gender, age, income and location in the US, conducted in October 2011.