Though overall global marketing budgets in the tech sector are increasing 3.5% in 2011, they are not keeping pace with annual revenues in the sector, which are expected to grow 6.5% over 2010 levels, according to a report by IDC.

Moreover, that 3.5% budget growth estimate is far less than the 8% projected in January 2011.

In recent years, marketing investment growth has generally tracked revenue growth, according to IDC CMO Advisory Service research, but that trend has not continued during the business downturn, the report notes.

Smaller tech companies, however, are surging ahead: Those with revenues less than $500 million, between $500 million and $999 million, and between $1.0 billion to $2.9 billion are expecting average marketing investment growth of 10%, 8.1%, and 7%, respectively, in 2011.

By contrast, larger companies—those with annual revenues between $3.0 billion and $9.9 billion—are reporting marketing investment growth of 2.1% on average, while companies with revenues greater than $10 billion are reporting investment growth of 1.7%.

Overall, services companies are recording the weakest marketing investment growth in 2011, down 1% from 2010 levels.

Below, other findings from IDC's 2011 Tech Marketing Benchmarking Study.

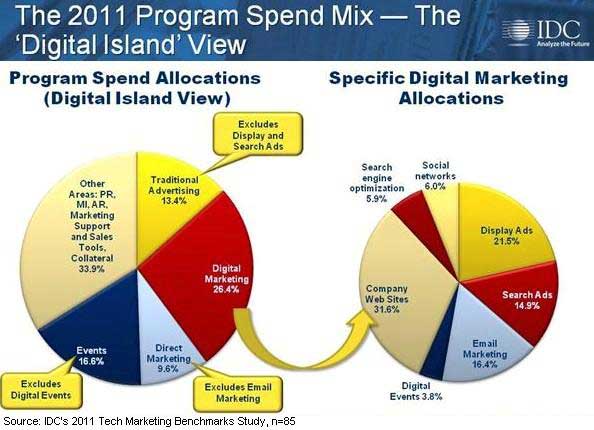

Digital marketing program spending, defined as display ads, search ads, email marketing, digital events, company websites, search engine optimization, and social networks, continues to increase rapidly.

Digital marketing accounted for 19.3% of total program spending in 2010, and that figure is rising to 26.4% in 2011.

Marketing organizations are also allocating more budget website content and development in 2011, which now accounts for 8.2% of the total program spending mix, or 31.6% of digital allocations.

Display, email, and search are expected to account for 21.5%, 16.4%, and 14.9% of digital allocations, respectively, while social media accounts for 6.0% of the digital mix (less than 2% of total marketing investments).

Among other allocations-related findings, issued by IDC:

- Marketing departments have increased staff allocations for website content and development to 5.6% in 2011.

- Marketing operations has recorded growth for a number of years, but the trend appears to be leveling off. Marketing operations currently accounts for 5.3% of total marketing staff, a decrease from the previous year's allocation. That finding may not signal that companies are reducing marketing operations staff, according to IDC; instead, the cause of the year-over-year decrease is likely a combination of other staffing categories increasing more rapidly and an IDC taxonomy change to include a new category:marketing IT.

- Sales enablement budgets are growing: In 2010, the category accounted for 3.1% of the total staff mix; in 2011 allocations have risen to 3.7%.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

IDC's CMO Advisory Service tracks a series of top-line key performance indicators; below, key observations for 2011:

- Marketing Budget Ratios, calculated by dividing total marketing spend by revenue, are decreasing in 2011 because revenue growth is outpacing investment growth.

- Marketing's focus in 2011 has shifted from demand to awareness: IDC's Awareness-Demand Ratio, which calculates the total amount of marketing spend dedicated to awareness building activities versus demand generating activities, is at 52%.

- Program-to-People Ratios, which track the percentage of total marketing spend directed toward programs, have increased year over year to 60%. The main contributor to the increase in this ratio in 2011 is the increase in awareness-generating activities such as advertising, which are more programs-spending heavy.

About the data: Findings are from IDC's ninth annual Tech Marketing Benchmarks Study, conducted from May 15 to July 31, 2011 among more than 100 tech companies representing roughly $850B in revenues. Hardware, software, and services companies with both direct and indirect channel strategies are represented in survey.