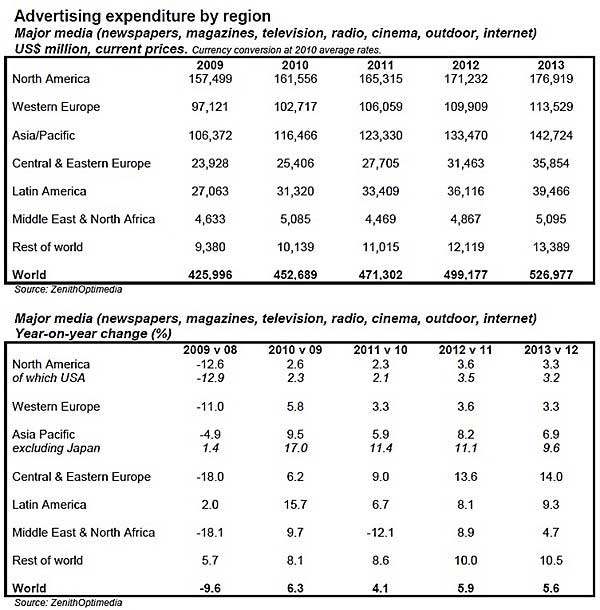

Global ad expenditure is now forecast to grow 4.1% in 2011, reaching $471 billion, the same as the peak level of spending in 2008, according to projections by ZenithOptimedia. The expected growth is just 0.1 percentage point (PP) below the 4.2% projected three months earlier.

Overall, the ad market continues to recover from the 2009 recession, but growth has dipped this year due to economic pressures, natural disaster in Japan, and political disruption in the Middle East, according to the report.

More robust growth is forecast to resume in 2012 and 2013, up 5.9% and 5.6%, respectively.

Below, additional projections issued by ZenithOptimedia.

Economic and political developments worldwide have affected ad spending forecasts for 2011:

- North-American ad spending is now forecast to grow 2.3% over 2010 levels, down 0.3 PPs from 2.6% projected three months earlier.

- Western Europe is expected to grow 3.3%, down 0.2 PPs from April's forecast.

- Moderate growth is forecast for Central & Eastern Europe and Latin America in 2011, 9.0% and 6.7%, respectively.

- Asia-Pacific is now expected to grow 5.9% in 2011, up from the 4.6% forecast in April, driven by better-than-expected performance in Japan as well as upgrades in the Chinese ad market.

- Middle East and North Africa spending forecasts have been adjusted downward—due to continued political unrest—and are now expected to fall 12.1% in 2011, down from the previous forecast of 0.1% positive growth.

Largest Global Ad Spend Contributors

The US will contribute most new ad dollars to the global ad market over the next three years ($13.8 billion ) due to its sheer size—3.3 times the next-largest market.

The next-five largest contributors, however, are all developing markets: China (which contributes almost as much as the US, some $13.0 billion), Russia ($6.1 billion), Brazil ($3.5 billion), Indonesia ($2.8 billion), and India ($2.6 billion).

Overall, developing markets are forecast to contribute 62% of new ad dollars over the next three years.

Internet Fastest Growing Medium

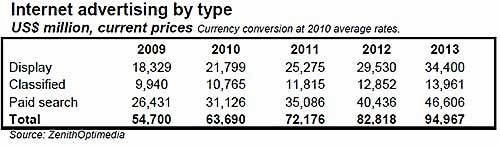

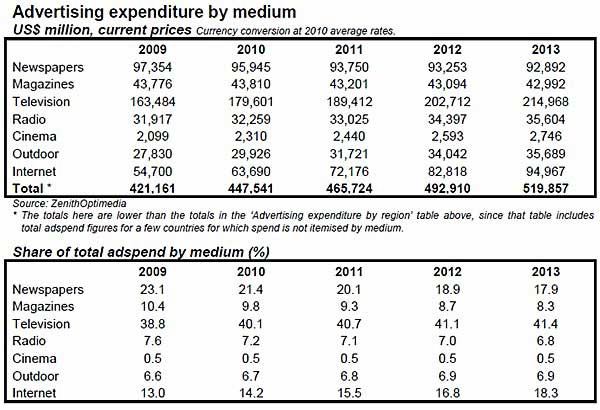

The Internet continues to grow at the fastest rate of any medium, at an average of 14.2% a year between 2010 and 2013. That growth amounts to roughly $31.3 billion over the next three years, from $63.7 in 2010, to $95.0 billion in 2013, at which point the Internet will be the world's second-largest medium, with an 18.3% share of spending.

Among key digital media categories:

- Display is the fastest-growing segment, growing by 16.4% a year, driven mainly by online video and social media.

- Streaming video ads are growing extremely quickly, thanks to the emergence of do-it-yourself tools that have allowed local advertisers to enter the market.

- Social media sites are near the top of the list of most-popular websites in most developed markets, and they are often way ahead of their rivals in time spent by users. In the US, social media use has jumped 25% over the last year, and now accounts for 16% of all time spent online, and 34% of display impressions.

- Paid search is growing by 14.4% a year, but its growth is being slightly restrained by the shift in search behavior from desktop to mobile devices, where costs are currently lower.

- Online classified is growing relatively slowly, by 9.1% a year, while employment and property markets remain weak in the biggest countries.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

TV to Contribute Most New Ad Dollars

Among other media markets:

- Television is the next fastest-growing medium (at 6.2% a year) and the largest contributor to global growth, accounting for 49% of new ad dollars between 2010 and 2013. TV's share of the global ad market has risen steadily over time, attracting 40.1% of spend in 2010, up from 37.3% in 2005, and now forecast to attract 41.4% in 2013.

- Newspapers and magazines have been declining since 2007, with a brief pause for magazines in 2010, when ad expenditure remained essentially static. That decline is expected to continue through the next three years. Magazines are suffering less than newspapers, however, because the experience of reading a magazine is less easy to replicate online, and because they do not rely so much on the timely delivery of information. Magazine ad expenditure is forecast to shrink 0.6% a year over our forecast period, while newspaper ad expenditure shrinks 1.1%. In 2013 newspapers will fall behind the Internet into third place, with a 17.9% share of spending.

About the data: Ad-expenditure projections are issued on a quarterly basis by ZenithOptimedia. The above projections were issued in July 2011.