Nearly one-half (45%) of North American industrial businesses reported positive growth in the second half of 2010 and among them, more than three-quarters (76%) said their websites made a significant contribution to that growth, according to ThomasNet's Industry Market Barometer. Meanwhile, in a tough business environment, most industrial companies credit a strategic focus on customer service and retention for their success.

Below, additional findings from ThomasNet's Industry Market Barometer (IMB) report, based on a survey of manufacturers, custom manufacturers, and industrial distributors in North America.

Digital's Role

Websites played even a more important role among "Outperformers," top-performing companies that reported growth in the second half of 2010 and expected more growth through the first half of 2011. Such businesses—roughly 39% of surveyed companies in 2011—reported the following:

- 88% said their website contributed to growth, compared with 76% of all industrial companies.

- 42% said their site contributed to new revenue growth (vs. 18% of all companies).

- 53% said their site opened up new sources of business (vs. 48% of all companies).

- 54% said their site helped them serve customers better or more efficiently (vs. 46% of all companies).

Top Growth Strategies: Customer Service, Retention

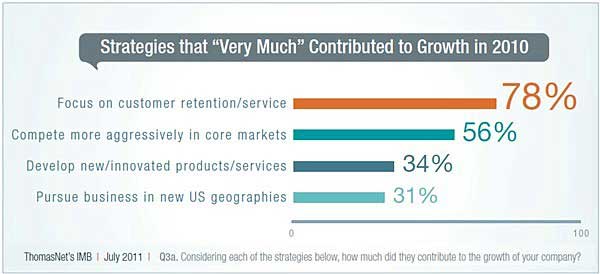

Among companies that reported positive growth in 2010, 78% said a focus on core customer service and retention strategies "very much" contributed to that growth, while 56% cited competing more aggressively in core markets and 34% credited new products/services offerings.

How Manufacturers Use Websites

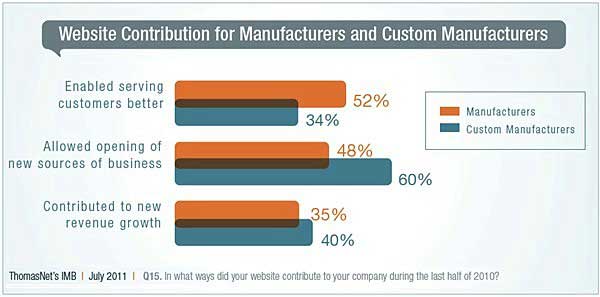

Custom manufacturers—those that deliver personalized or engineer-to-order products—credited websites most for opening up new sources of business (60%), whereas general manufacturers relied on websites to better serve customers (52%):

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Issues With Websites

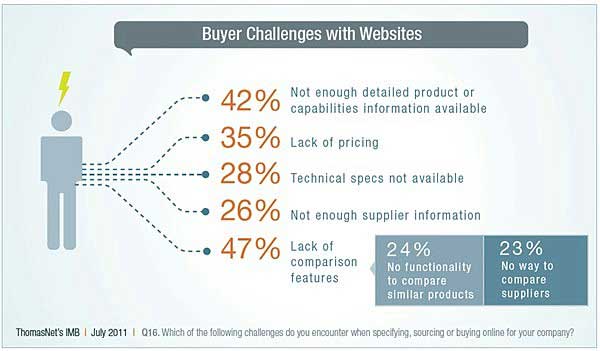

When industrial companies (or suppliers) put their buying hats on, many find problems with the sites they visit: 42% say websites don't have sufficient product information, while 47% say websites lack comparison features.

More than one-third (35%) of industrial companies cite the lack of pricing as a challenge.

Social Media Activity Still Low

Though a large number of companies say Facebook, LinkedIn, and Twitter are not important to their business, a growing minority say social channels are important, with industry forums (50%) and blogs (43%) cited as the most relevant.

Help Wanted: Skilled Trade and Sales/Marketing

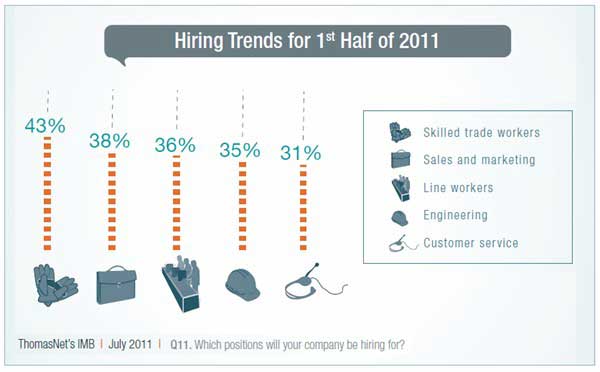

Some 37% of industrial companies planned to hire new employees in the first half of 2011; among them, 43% planned to will hire skilled trade workers and 38% planned to hire sales and marketing. Not surprisingly, 31% planned to hire customer-service staff.

About the data: The Industry Market Barometer's (IMB) survey polled 3,370 industry professionals (business owners and purchasing, engineering and sales and marketing professionals) from North America, primarily the US, from January 13 to March 31, 2011. Most respondents were from small and mid-sized businesses: 61% with fewer than 50 employees; 24% with 50-999 employees; and 7% with 10,000+ employees.