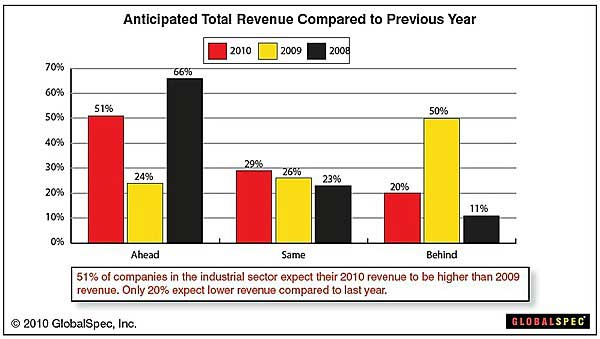

Despite dismal economic news overall, some business sectors are showing signs of improvement: Fully one-half of industrial-sector companies are expecting annual revenues in 2010 to be higher than they were in 2009, compared with the 24% of companies that reported the same a year earlier, according to a survey from GlobalSpec.

In addition, 66% of industrial-sector companies report their 2010 annual revenues are running on or above target.

Below, other findings from GlobalSpec's ninth annual industrial indicator survey, which polled 515 US companies in the engineering, manufacturing, and related scientific and technical market segments.

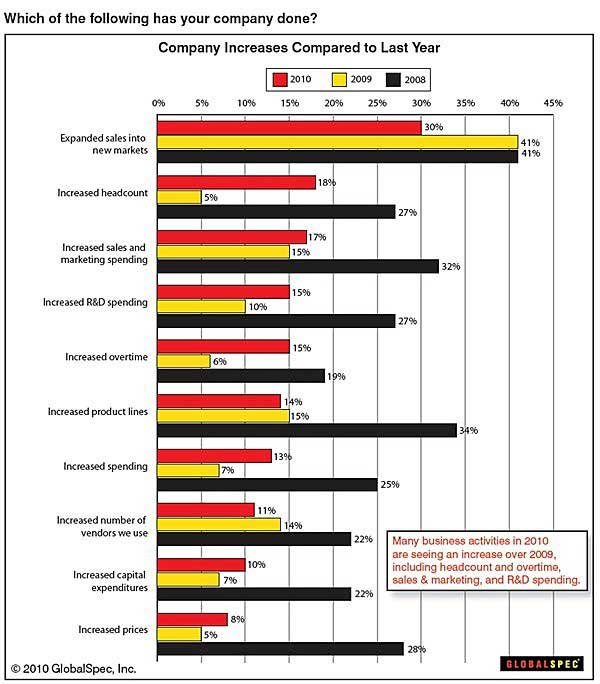

With projected annual revenues on target, some industrial companies have begun to increase spending modestly in 2010 on growth-oriented initiatives:

- 18% are increasing headcount, compared with 5% of companies that did so in 2009.

- 17% are increasing spending on sales and marketing (vs. 15% in 2009).

- 15% are allocating more spending to overtime help (vs. 6% in 2009).

- 13% are increasing general spending (vs. 7% in 2009).

Just 30% are expanding sales into new markets, compared with 41% of companies that did so in 2009.

The recession has forced many companies to work harder on workforce productivity and operational efficiency: 47% of industrial companies report a greater focus on improving production efficiencies in 2010, and 12% cite efficiency improvements as their single greatest area of concern this year.

Global Tech Marketing Budgets Up 3.7%

Fueled by a projected annual increase of 5.8% in global technology revenues in 2010, global-tech marketers are expected to increase their marketing budgets by an average annual 3.7% in 2010, according to separate research from IDC.

That's a significant improvement from 2009 levels, when tech marketing budgets were down 8.3% from the previous year, and global-tech revenue was down 4.5%, BtoB Magazine reported.

Those marketing categories that will make up the largest shares of spending in 2010 include:

- Events: 20.2%

- Digital marketing: 19.3%

- Marketing support: 19.0%

- Traditional advertising: 11.9%

Tech marketing priorities have clearly shifted: In 2009, traditional advertising made up 20.9% of marketing budgets and digital marketing made up 12.6% of total budgets, IDC said.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

High-Tech Jobs Up Slightly

News on the jobs front in the tech industry is also more upbeat. The high-tech industry added 30,200 jobs in the first half of 2010, showing glimmers of recovery after severe job losses in 2009, according to the trade group TechAmerica.

The number of total high-tech industry jobs reached 5.78 million jobs in June 2010, up 0.5% from six months earlier.

But total jobs were still down from 18 months earlier, when the nation's economic recession rippled through the high-tech sector. At that time, high-tech manufacturing, communications, and software services and engineering jobs were employing nearly 6 million people, according to TechAmerica.

About the data: Findings are from the ninth annual GlobalSpec Industrial Indicator survey of 515 US companies from engineering, manufacturing and related scientific and technical market segments, conducted online by GlobalSpec in June 2010.

Findings on projected 2010 tech-marketing budgets are based on the IDC 2010 Tech Marketing Benchmark study of 87 senior technology marketers, conducted from May to July, 2010. TechAmerica's report was based on US Department of Labor statistics data, compiled in the first half of 2010.