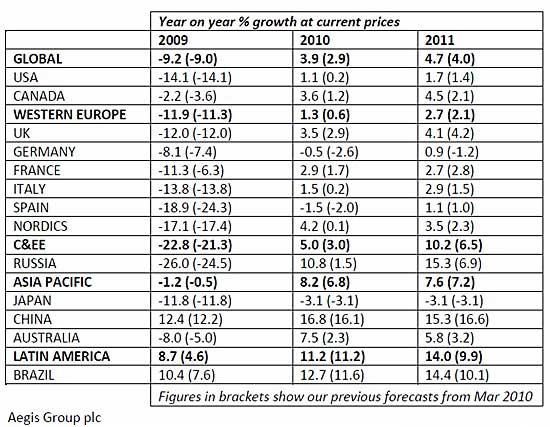

Driven by a faster than expected rebound in the US advertising market and continued robust growth in Asia-Pacific and Latin America, worldwide ad expenditure is forecast to grow 3.9% in 2010, an upward revision of 1.0 percentage point from the 2.9% forecast issued in March 2010, according to Carat.

As major markets continue to stabilize, further recovery is forecast for 2011 with ad growth expected to increase 4.7%, up 0.7 points from the 4.0% forecast six months earlier.

The revised forecasts, however, are against weak 2009 comparators, and consist of significant regional variances:

Ad growth in 2010 has been driven by a recovery in North America, supported by robust growth in Asia-Pacific and Latin America. In Western Europe, forecasts have been revised upward in the UK, France, Italy, and Germany. A rebound in Russia has significantly boosted growth in Central & Eastern Europe:

- In the US, ad expenditure is forecast to grow 1.1% in 2010, and 1.7% in 2011.

- The Canadian economy is now in full recovery and the ad market has returned to normal conditions, according to Carat. The effect of the Vancouver Winter Olympics Games helped to fuel the Canadian ad market, which is now expected to grow 3.6% in 2010 (up from the 1.2% forecast 6 months earlier), and 4.5% in 2011.

- Double-digit ad growth is expected in China (16.8%), Brazil (12.7%), and Russia (10.8%).

- Ad spending is forecast to fall in Japan (3.1%), Spain (1.5%), and Germany (0.5%).

Below, other projections from Carat.

US Ad Market Highlights

The US ad market is recovering faster than originally projected, registering improvements across most ad categories and media sectors in 2010:

- Online search is expected to capture a bigger share (10.3%) of total media spend in 2010, with 1.1% growth forecast in the year, and 1.7% growth in 2011.

- Digital and mobile spending are expected to increase at a faster pace, although traditional media will still have the largest share of ad revenues.

- The newspaper sector remains challenged, while TV and radio have rebounded.

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

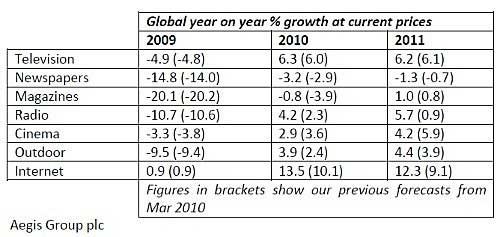

Global Forecasts by Category: Led by Internet and TV

All media are expected to return to growth in 2010 except for the newspaper sector, which, along with magazines, is expected to be the weakest performer:

- Magazine advertising—the worst-hit ad category in 2009—is expected to fall 0.8% in 2010, while newspapers will drop 3.2%.

- Internet spending is forecast to grow 13.5% in 2010, and 12.3% in 2011.

- TV spending is expected to climb 6.3% in 2010, and 6.2% in 2011, followed by radio, outdoor, and cinema.

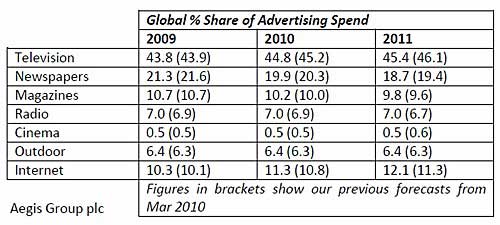

Online advertising continues to capture a growing share of the media spend and is forecast to reach 11.3% in 2010, and then 12.1% in 2011, overtaking magazines to become the third-most popular medium behind TV and newspapers.

Television, however, retains its position as the most popular medium, accounting for 44.8% of ad spend. That level is expected to increase to 45.4% in 2011.