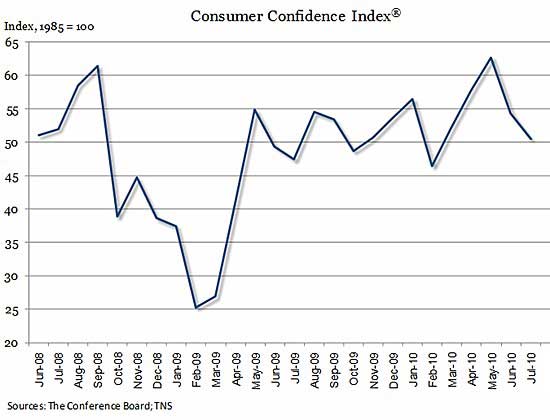

The Conference Board Consumer Confidence Index, which had declined sharply in June, retreated further in July and now stands at 50.4 (1985=100), down from 54.3 in June, the Conference Board reported.

The Present Situation Index decreased to 26.1 from 26.8 last month, while the Expectations Index declined to 66.6 from 72.7 in June.

"Concerns about business conditions and the labor market are casting a dark cloud over consumers that is not likely to lift until the job market improves," said Lynn Franco, director of The Conference Board Consumer Research Center.

"Given consumers' heightened level of anxiety, along with their pessimistic income outlook and lackluster job growth, retailers are very likely to face a challenging back-to-school season."

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Other findings:

- Consumers' assessment of current conditions was more downbeat in July. Those saying conditions are "bad" increased 43.6% from 41.0% in June; however, those saying business conditions are "good" increased to 9.0% from 8.4%.

- Consumers' assessment of the labor market was less favorable. Those claiming jobs are "hard to get" increased to 45.8% from 43.5% in June; those saying jobs are "plentiful" was unchanged at 4.3%.

- Consumers' short-term outlook deteriorated further in July. Those anticipating an improvement in business conditions over the next six months decreased to 14.3% from 16.2% in June; those expecting conditions to worsen grew to 15.7% from 13.

- Consumers were also more pessimistic about future job prospects. Those expecting more jobs in the months ahead decreased to 14.3% from 16.2% in June; those anticipating fewer jobs increased to 21.1% from 20.1%. The proportion of consumers anticipating an increase in their incomes declined to 10.0% from 10.6%.

About the data: The Consumer Confidence Survey is based on a representative sample of 5,000 US households. The monthly survey is conducted for The Conference Board by TNS. The cutoff date for July's preliminary results was July 21.