Despite widespread consumer adoption of social media, advertisers on average allocated just 4% of their media spend to the channel in 2009, relying instead on traditional, proven online media choices that were in place before the economic downturn, according to data from interactive agency Razorfish.

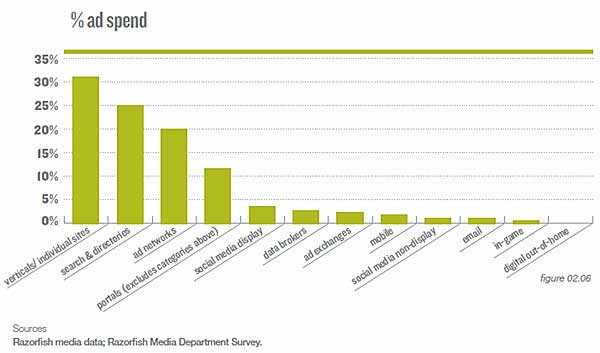

Because of the recession, a great percentage of Razorfish clients' spending was in highly efficient vehicles in 2009, such as vertical websites (31%), search (25%), ad networks (20%), and ad portals (12%).

Social media display advertising accounted for just 3% of digital ad spend in 2009 among Razorfish clients, while non-display social media advertising accounted for just 1%. Mobile advertising accounted for 2% of spend.

Below, other findings from the 2010 Razorfish Outlook Report.

The relatively small share of budget allocated to social media was a result of three factors, according to Razorfish:

- Social ads can be bought very inexpensively. Top sites such as Facebook and YouTube have more inventory than they can sell. In addition, without a clear homepage for Facebook and with most of YouTube's traffic bypassing the homepage and linking directly to content, there is little premium inventory to sell at high prices.

- Much of the spending on social media doesn't express itself in the form of buying media, but in the labor it takes to build a page, manage a community, or respond to Twitter comments, for example.

- Media dollars are spent toward social efforts to drive users to communities, content, and applications, but these are not captured under "social" ad spending because the buys don't occur on social sites.

Even as more spending is allocated to social media in the future, it will remain difficult to measure, as most of those dollars will not go toward ad impressions or clicks, Razorfish said.

Experimentation With Newer Channels

Despite advertisers' demands for efficiency in 2009, some still experimented with newer marketing channels. Among Razorfish clients who invested in digital out-of-home advertising in 2009, 100% did so for the first time this year–and among those who invested in ad exchanges, 80% did so for the first time.

Looking for real, hard data that can help you match social media tools and tactics to your marketing goals? The State of Social Media Marketing, a 240-page original research report from MarketingProfs, gives you the inside scoop on how 5,140 marketing pros are using social media to create winning campaigns, measure ROI, and reach audiences in new and exciting ways.

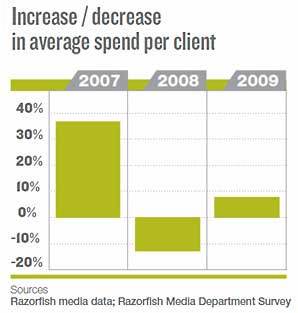

Overall, in 2009 there was a modest recovery in spending: The average media spend among Razorfish clients increased 4% over 2008 levels, compared with the 13% drop recorded in 2008 from 2007 levels.

Advertisers reacted to the recession by reducing overall budgets and shifting budgets to search and other measurable channels. In 2010, however, a more robust recovery is expected.

Contrary to popular belief, not every brand shifted its advertising focus to direct response as a result of reduced consumer spending: 60% of advertisers who did switch their ad approach actually moved to a more brand-focused message.

Looking ahead to 2010, greater investments are expected in social media, mobile, in-game, out-of-home, and local online advertising.

Other highlights:

-

CPM buying dominates: 48% of Razorfish media spending was channeled into CPM buys, while 10% went to time-based ads and sponsorships. Accordingly, approximately 58% of all spending went to impression-based media vehicles.

-

Search pricing: In 2009, average cost-per-click prices on major search engines were $0.56-$0.88. In 2010, with increased competition for keywords, search prices are expected to rise sharply.

-

The Search/portal category accounted for 45% of Razorfish media spending, of which Yahoo dominated impression buys, whereas AOL and MSN jointly dominated performance-based buys.

About the data: Findings are from the 2010 Razorfish Outlook Report, which examines client media-buying practices during 2009 and provides a forward view of media trends in 2010.