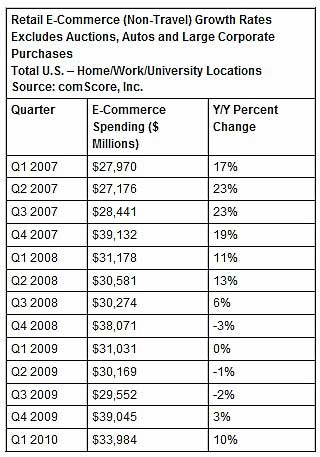

Bolstered by upper-income consumer spending, US retail e-commerce sales reached an estimated $34 billion in the first quarter of 2010, up 10% from a year earlier—the largest increase in spending since the second quarter of 2008, according to comScore.

Key first-quarter highlights:

- Sales growth in the first quarter was driven predominantly by upper-income consumers: Spending among households with annual incomes of $100,000+ grew 14% year over year.

- Pureplay (online-only) retailers continued to gain e-commerce spending market share from multichannel retailers.

- Larger online retailers continued to generate higher growth rates than smaller retailers, but smaller retailers are finally beginning to see positive growth again.

"The first quarter returned the US retail e-commerce market to healthy double-digit growth rates," said comScore Chairman Gian Fulgoni.

"While these spending gains provide reason for optimism, we should note that upper-income households are currently shouldering much of the growth. Should the economy falter in the second half of the year and upper-income consumers return to a savings mode, we could still see growth decelerate. But for the time being, this momentum is encouraging."

Looking for great digital marketing data? MarketingProfs reviewed hundreds of research sources to create our most recent Digital Marketing Factbook (May 2010), a 296-page compilation of data and 254 charts, covering email marketing, social media, search engine marketing, e-commerce, and mobile marketing. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Concerns Over Volatility of Upper-Income Spending

Since December 2009, sales at luxury chains have outpaced those at department stores and discounters, helping to boost overall consumer spending 3.6% in the first quarter of 2010, according to data from the International Council of Shopping Centers.

Although that increased spending has fueled hopes that the current economic recovery will continue to strengthen, some economists worry that much of the spending has come from increases in upper-income sector spending rather than from the broader middle class, the Los Angeles Times reported.

Upper-income spending can be volatile—since it involves luxury goods rather than every day necessities—and tends to fluctuate with financial markets.

"The economy can grow if lower-income households aren't able to spend, but it can't flourish," said Mark Zandi, chief economist at Moody's Economy.

Meanwhile, the economic recovery has now reached both US coasts and all regions of the country, according to Moody's.

Most significantly, the New York and California economies have turned the corner. Among the largest states, only Florida, Georgia, Michigan, Ohio, New Jersey, and Virginia remain in recession, according to Moody's.