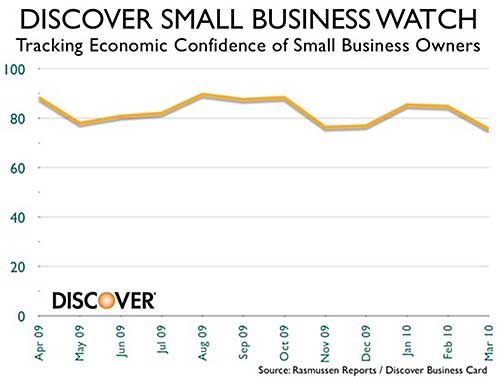

America's small business owners say business conditions are getting worse: After some upward trends for most of last summer and into the fall, the Discover Small Business Watch, a monthly index on the pulse of small business owners, measured 75.7 in March, down 9.2 points from February and back to the levels of a year ago, Discover reported.

Over one-half (53%) of small business owners said the economic climate would worsen in the next six months, compared with 37% who said so in February. Another 20% said things are getting better, 20% said things are the same, and 6% said they were unsure.

Regarding intentions to invest in their businesses, 52% said they planned to decrease spending, up from 43% who said so a month earlier; 27% said they would make no changes; and 18% said they planned to increase investment.

Below, other March indicators from the Discover Small Business Watch:

- Little faith was expressed for the direction of the larger economy: 58% said conditions are getting worse, up from 44% in February, while 22% said conditions are improving, down from 31% a month earlier. Some 16% said conditions are the same, down from 24%.

- Views on the current economy were relatively unchanged over February: 59% rated the economy poor, 31% called it fair, 6% said it was good, and 1% said it was excellent.

- Cash flow issues remained largely unchanged: 46% said their businesses had encountered temporary cash flow issues in the previous 90 days that caused them to hold off on paying some bills, while 47% did not have issues and 7% weren't sure.

Tax Filing

In the March survey, small business owners were asked questions pertaining to taxes: 72% said they were not able to take advantage of tax breaks for their businesses or themselves for 2009, while 19% said they had, and 9% were not sure.

Asked to identify which taxes caused the most frustration, owners cited the following top 6:

- Federal income taxes: 29%

- Self-employment taxes: 25%

- Real and personal property taxes: 7%

- Employer portion of Social Security taxes: 5%

- Sales taxes: 4%

- Unemployment taxes: 3%

Other tax-related findings:

- Finding and organizing tax preparation documents was very to somewhat difficult for 42% of small business owners, and not very or not at all difficult for 54% of them.

- Even though 70% of small business owners use a professional service to do their taxes, 73% said the preparation and documentation process is somewhat to very time-consuming.

- Of those small business owners not hiring a professional, 62% said they were using computer software, down from 71% last year.

- 24% of small business owners said they are expecting a refund this year, 28% said they expect to break even, 39% said they will owe taxes, and 9% were unsure.

- Among small business owners who expect to owe taxes, 43% said they would likely file for a tax extension, compared with 30% of people in the broader population who will likely seek more time. About one-half of those filing for extensions in both segments said they were doing so because of the economy.

About the data: The Discover Small Business Watch is a monthly index measuring the relative economic confidence of US small business owners who have fewer than five employees, a segment that consists of 22 million businesses producing more than a trillion dollars in annual receipts. Commissioned by Discover Business card, the survey was conducted by Rasmussen Reports, LLC among a national random sample of 750 small business owners.