A "new frugality" born of the Great Recession and evidenced by two consecutive years of declining per-capita consumption is now becoming entrenched among US consumers and is reshaping their consumption patterns in ways that will persist even as the economy starts to recover, according to a study from Booz & Company.

Cuts in per-capita consumption spending have been recorded across all demographic groups, but they have been most pronounced among lower-income women, the study found. Consumer outlook, meanwhile, is modestly conservative: Only 32% households expect to be better off this year.

Below, other findings from New Marketing Imperatives: US Consumer Spending and Shopping Behavior Emerging from the Recession.

Recessionary Behaviors Are Hardening

The new frugality—characterized by a strong value-consciousness that dictates tradeoffs in price, brand, and convenience—has become the dominant mindset among consumers:

- 65% say they consider saving more important than spending.

- 65% say they sacrifice convenience for price.

- 65% say they frequently use coupons.

- 55% say they prefer the best price to the best brand.

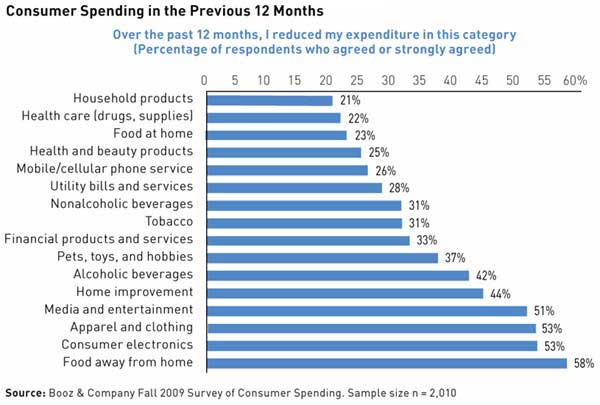

Moreover, in the previous 12 months, consumers have continued to cut back on spending in 16 major categories, especially in discretionary spending: 58% of consumers say they have cut back on eating out, while over one-half say they have cut back on consumer electronics (53%), apparel and clothing (53%), and media and entertainment (51%).

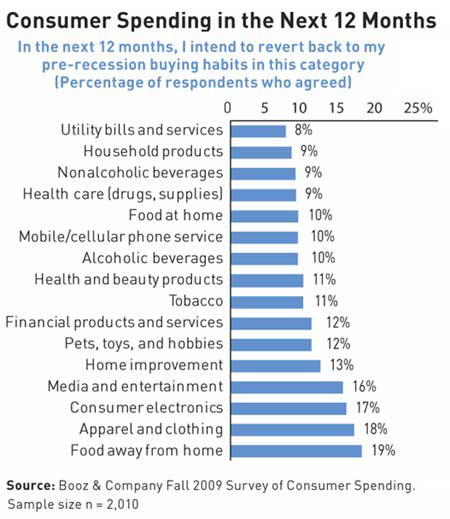

More significantly, a year after the meltdown in the financial markets, just 9% of consumers intend to revert back to pre-recession spending levels on household products in the next 12 months, while 10% plan to do so on mobile phone services, 11% on health and beauty products, and 18% on apparel, clothing, and shoes.

Price Sensitivity Has Increased

In the previous 12 months, many consumers switched to less-expensive brands across a variety of categories:

- Food at home: 44% of consumers

- Household products: 40%

- Apparel and clothing: 36%

- Health and beauty products: 34%

- Consumer electronics: 28%

- Healthcare: 26%

- Tobacco: 26%

- Alcoholic beverages: 24%

The shift to private labels, which started before the recession, also accelerated during the downturn:

The trend toward private labels is expected to continue: Many consumers report having good experiences with private labels—and so need strong reasons to switch back to pre-recession brands, Booz & Company finds. Meanwhile, retailers make greater profits on private labels and generally give them more display space.

New-Frugality Consumer Segments

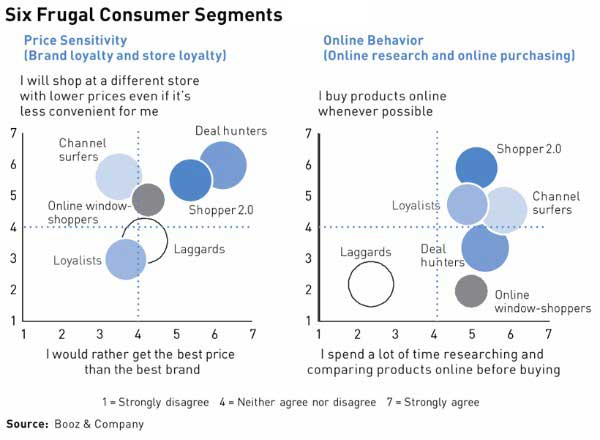

In view of the new frugality, six distinct consumer segments have emerged, reflecting consumers' approaches to spending, price sensitivity, brand loyalty, methods for researching products, and shopping preferences:

- Shoppers 2.0: 16% of consumers surveyed. The most technologically advanced consumer segment, these shoppers tend to buy online across categories, exhibit price sensitivity, frequently use coupons, and show little brand or format loyalty.

- Deal Hunters: 21%. The most price-sensitive consumer segment, these shoppers are heavy coupon users with low levels of brand or format loyalty. Unlike those in the Shopper 2.0 segment, they are not inclined to buy products online; they direct their price-focused online research to getting the best deal in the store.

- Online Window-shoppers: 11%. This segment conducts a high level of research online but, like the Deal Hunters segment, is less likely to purchase online. Its members exhibit a more modest degree of price sensitivity and brand switching than those in the Shopper 2.0 and Deal Hunters segments.

- Channel Surfers: 20%. This consumer segment is the most willing to hunt for particular brands and the most likely to switch retail destinations to seek out those brands at favorable prices. Its members are the most likely to trade off convenience to get good deals on the brands they want.

- Loyalists: 15%. The least likely to change brands and retail formats for reasons of price, these shoppers conduct research and buy online, often seeking to preserve their established brand preferences.

- Laggards: 17%. The least interested in changing behavior, these shoppers conduct very little online research or purchasing, and they exhibit the lowest level of coupon use. They are not motivated to switch brands or retail format.

As those descriptions indicate, behavioral traits, especially price sensitivity and online behavior, vary among the six segments:

About the data: Findings are from a survey of 2,000 US consumers conducted in October 2009 by Booz & Company.