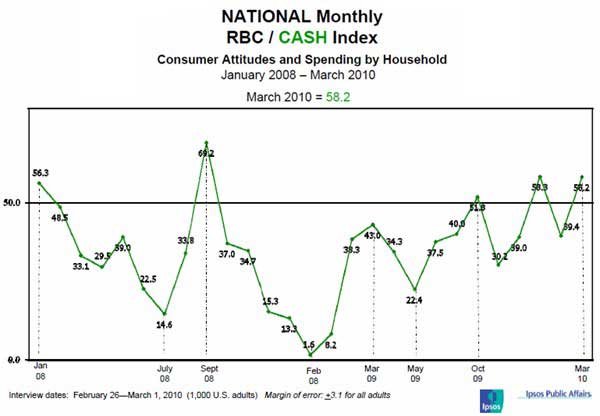

US consumer confidence improved sharply this month after taking a tumble in February, according to the recent results of the RBC Consumer Attitudes and Spending by Household (CASH) Index.

Buoyed by consumers' upbeat evaluations of their current economic condition and their positive outlook for the job market, the RBC Index for March 2010 now stands at 58.2, up 18.8 points from its February reading of 39.4.

Highlights of the survey results:

- Consumers' attitudes about current conditions soared in March, increasing 26.2 points and bringing the RBC Current Conditions Index to 56.7—the highest level since May 2008. Consumers reported renewed optimism in their personal financial situation and their purchasing power: 25% said their personal financial situation is strong, compared with 21% in February.

- The RBC Investment Index increased sharply this month, climbing 24.3 points to 65.1—the highest mark for the Index since January 2008. The increase in investment confidence stems from consumers' diminished fears about their ability to save, as well as improved personal financial considerations. Consumers who report they feel less confident in their ability to make investments for the future dropped to 52%, down from 57% in February.

- The RBC Jobs Index also rallied in March, increasing 13.3 points to 68.2—the strongest reading for the Index since November 2008. Americans reporting personal job losses declined significantly in March: 61% reported job losses in their immediate circle as the result of economic conditions, compared with 67% in February. Perceptions of job security also improved this month: 32% of consumers reported more confidence in their job security compared with six months ago (28% said so last month).

- Although significantly brighter than a year ago when the RBC Expectations Index was in negative territory, consumers' near-term economic outlook continues to be volatile, showing a small upswing in March following considerable changes in January and February: The Index now stands at 57.3, up 9.3 points from February's 48.0. Some 10% of consumers said their personal finances will be weaker in six months (vs. 13% who said so last month), and 33% said their finances will strengthen in the near future. The share of consumers who said the economy will be weaker six months from now held steady at 16%.

About the data: The RBC Index is a monthly national survey of consumer attitudes on the current and future state of local economies, personal finance situations, savings, and confidence to make large investments. This month's findings are based on a representative nationwide sample of 1,000 US adults polled from Feb. 26 to March 1, 2010, by survey-based research company Ipsos Public Affairs.