Chief marketing officers at US companies are planning significant hiring and budget increases over the next two years as they remain optimistic about prospects for their companies and the economy, according to a survey conducted by Duke University and the American Marketing Association. Overall, CMOs expect marketing budgets to increase, on average, 5.9% in the next year, with social media emerging as a central component of Internet marketing strategies.

Below, other findings from the February 2010 CMO Survey, a nationwide poll of senior marketing executives conducted biannually.

Economic and Business Outlook

Economic optimism continues to grow: 62.1% of CMOs say their optimism about the US economy has increased since the previous quarter, compared with 59.1% who had said so six months earlier (Aug. 2009).

Nearly two-thirds (63.9%) of CMOs say they are more optimistic about their own companies than they were in the previous quarter, compared with 48.2% who had said so six months earlier.

That optimism is reflected in marketers' expectations for customer behavior over the next year:

- 66% anticipate increased volume in customer purchases.

- 47% expect an increase in the number of new customers in their markets.

- 45% say they have improved their abilities to retain current customers.

- 26% are forecasting higher prices.

Business Growth Strategies

Marketers' growth-strategy priorities over the next year will be as follows; percentages refer to the share of total spending to be allocated to business growth:

- Market penetration (taking current products/services to current markets): 44%

- Product/service development (new products/services to current markets): 26%

- Market development (current products/services to new markets): 18%

- Diversification (new products/services to new markets): 13%

B2B product firms expect the biggest spending reduction to be in market penetration (from 44% in Aug. 2009 to 39% in Feb. 2010) and the biggest spending increase to be in diversification (from 10.8% in Aug. 2009 to 15% in Feb. 2010).

Investments in organic growth continue to dominate most business agendas: CMOs' plans regarding company growth are as follows; percentage refer to the share of total spending to be allocated to growth opportunities:

- Internally generated growth: 69.5%

- Growth through partnerships: 14.7%

- Growth from acquisitions: 10.4%

- Growth from licensing: 5.4%

Digital Marketing Will Lead Budget Growth

Of the average 5.9% increase in marketing budgets expected this year, the following marketing areas are expected to account for the largest share of the increase in spending:

- Internet marketing: 12.2%

- CRM: 9.9%

- New product introduction: 6.9%

Investments in traditional advertising are expected to fall 2.5%—a smaller decline than the 7.9% anticipated in Aug. 2009.

Marketing Budgets: B2B Firms

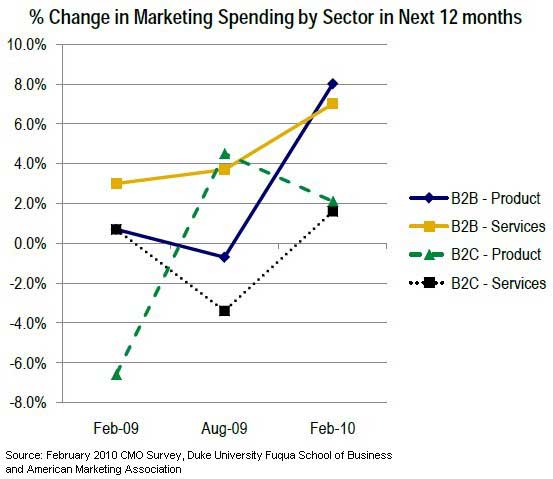

Spending priorities vary across sectors: B2B products companies and B2B services companies are planning the largest increases in marketing spend over the next 12 months: 8.0% and 7.7%, respectively.

Meanwhile, B2C products and B2C services companies trail significantly, at 2.1% and 1.6%, respectively.

B2B services companies plan more substantial spending increases than other sectors in the next year, most notably in the following areas:

- Brand building: B2B services firms will increase spending 11.8%, compared with 4.3% across all sectors.

- CRM: B2B services firms will increase spending 16.6%, compared with 7.5% across all other sectors.

- New service introductions: B2B services firms will increase spending 10.4% compared with 5.3% across all other sectors.

Meanwhile, B2B companies (products and services) plan to increase spending on new product introductions 11.3% in the next year, compared with B2C firms' 4.7% planned increase.

Social Media Spend

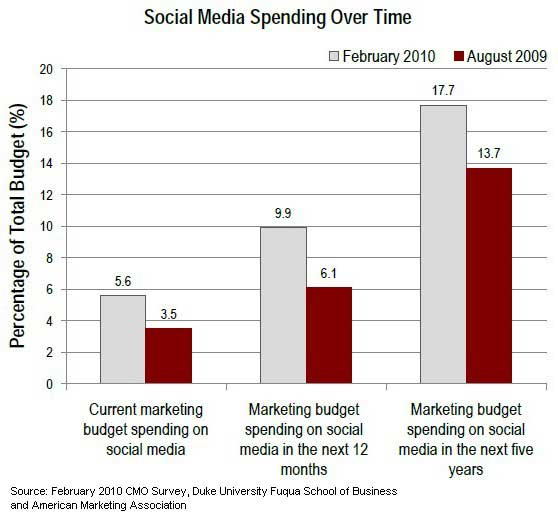

On average, companies now allocate 5.6% of their current marketing budgets to social media, an allotment they expect to increase to 9.9% during the next 12 months.

Meanwhile, investments in social media are expected to reach, on average, 17.7% of total marketing spend in the next five years.

Looking for real, hard data that can help you match social media tools and tactics to your marketing goals? The State of Social Media Marketing, a 240-page original research report from MarketingProfs, gives you the inside scoop on how 5,140 marketing pros are using social media to create winning campaigns, measure ROI, and reach audiences in new and exciting ways.

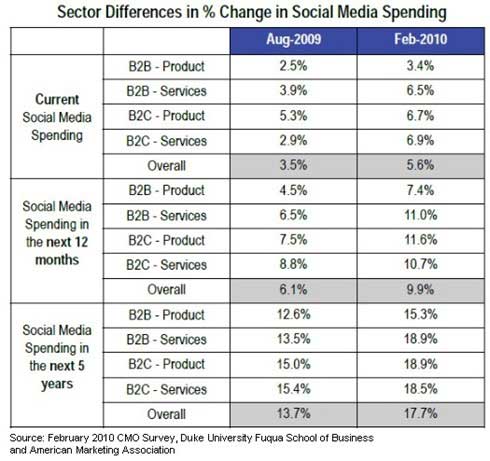

Sector Differences in Social Media Spend

B2B services companies are planning the largest planned increases in social media spending in the next year, to 11%, from the Aug. 2009 level of 6.5%.

Meanwhile, B2C services companies registered the largest increases in social media spending over the past six months, from 2.9% in Aug. 2009, to 6.9% in February.

Hiring Plans

Nearly one-half (46.7%) of companies say they expect to hire new marketers during the next six months, while 61.4% plan to hire in the next year and 77.5% plan to hire over the next two years.

On average, companies plan to increase hiring levels 8.2% in the next six months, 12.9% in the next year, and 24.1% over the next two years.

Work experience will be emphasized: Only 27.1% of hires are expected to come from universities.

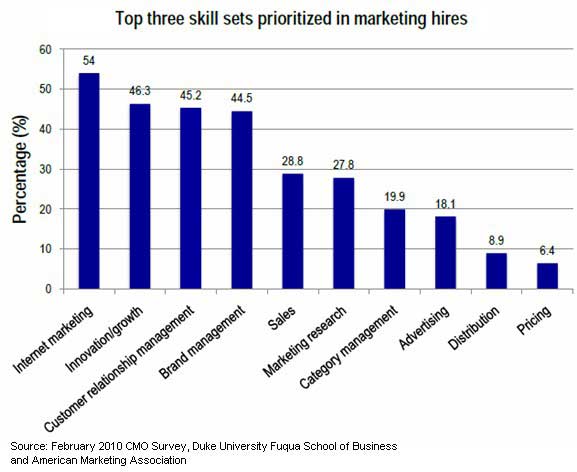

Among skill sets, Internet marketing, innovation and growth, CRM, and brand management will be the most sought after by senior marketers.

B2B product companies are planning the largest hiring increases overall, while B2B services companies are planning the smallest hiring growth. Consistent with that finding, B2B services marketers report the highest expected increase in outsourced marketing activities.

Nearly three-quarters (72%) of all companies now outsource some aspect of their marketing programs, and 4% plan to increase outsourcing over the next year.

Brand Leaders

Asked to identify marketing leaders that set the standard for excellence across all industries, marketers selected Apple, Procter & Gamble, and The Coca-Cola Co as the top 3 companies. Google, General Electric, Nike, and McDonald's were given honorable mention.

About the data: The February 2010 CMO Survey is a nationwide poll of chief marketing officers conducted twice each year by Duke University's Fuqua School of Business in conjunction with the American Marketing Association. The survey collected responses from 612 marketing executives during the last two weeks of January.