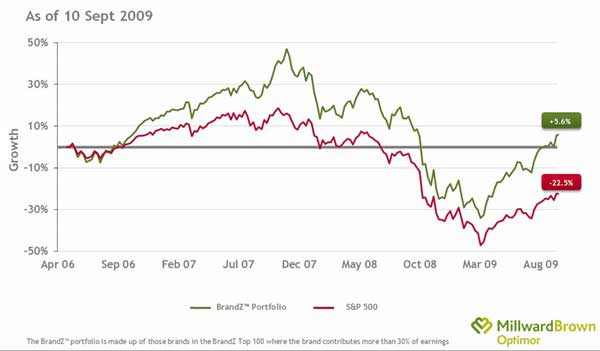

The world's most valued brands are recovering from the recession faster than the Standard & Poor's 500 as a whole: the BrandZ* Top 100 brands have returned a 28% higher yield than the S&P 500, and are becoming profitable ahead of the market, according to Millward Brown.

"Our new analysis reveals that as the stock market recovers, the share prices of companies who [sic] have invested in developing strong brands are recovering fastest," said Joanna Seddon, CEO of Millward Brown Optimor. "Companies that continue to invest in their brands in a recession emerge with a sustainable competitive advantage."

Post-Recession Consumer Behavior: The Cheaper the Better

Companies waiting for a return to normality following the recession may be disappointed to find that their customers have tried cheaper products––and actually like them, according to separate research from McKinsey & Company.

An average of 18% of consumers of consumer packaged goods bought lower-priced brands in the past two years. Among those consumers:

- 46% said the cheaper brands performed better than expected.

- A large majority said the performance of such products was much better than expected.

- 34% said they no longer preferred higher-priced products.

-

41% said although they preferred the premium brand, it "was not worth the money."

Looking for great digital marketing data? MarketingProfs reviewed more than 200 research sources and selected 64 of the best to create the Digital Marketing Factbook a 144-page compilation of data and 110 charts, covering email marketing, search engine marketing, and social media. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Growing Numbers of Consumers in Play

As a result, many consumers are up for grabs, with levels varying depending on how many consumers switched from higher-priced brands, their experiences with cheaper brands, and the way they revised their buying intentions.

For example, only 12% of beer buyers switched to cheaper brands. Of those, 31% said their experience was more positive than they had expected, indicating that just about 4% of customers (beer buyers) are in play.

However, among buyers of cold and allergy medicines, more than 20% tried a lower-priced option, and 48% of those consumers said the experience was better than expected, leaving nearly 10% of cold and allergy medicine consumers now in play.

*The BrandZ Top 100 ranking, based on financial data and research among 1.5 million consumer and B2B customers in 30 countries, is derived using a methodology called, "Economic Use," in which value is calculated by looking at the role that brand plays in the purchase decision and identifying what proportion of the business value can be attributed purely to the brand. The ranking uses financial data from Bloomberg and market data from Datamonitor.

About the data: The BrandZ study, conducted annually by Millward Brown on behalf of the WPP, measures the brand equity of thousands of global "consumer facing" and business-to-business brands, and has interviewed over 1 million consumers globally.

McKinsey & Company is a global management consulting firm.