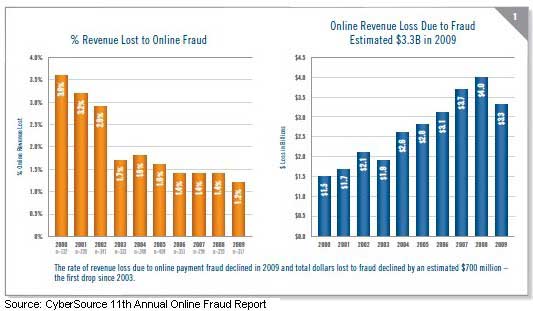

Even in the current economic climate, investments in fraud management are paying off as total estimated online revenues lost to fraud fell 18% in 2009, down to $3.3 billion from $4 billion in 2008, according to a survey from CyberSource.

The average rate of online revenue lost to payment fraud dropped to 1.2%, the lowest level recorded in the 11-year history of the survey.

Below, other findings from the CyberSource 11th Annual Online Fraud Report.

Merchants Accepting More Online Orders

The rate of accepted US and Canadian orders later determined to be fraudulent fell to 0.9% in 2009, down from 1.1% in 2008. Across industry sectors, consumer electronics reported the highest fraudulent order rate, averaging 1.5% for the year, but still down a half percentage point from 2.0% in 2008.

The percentage of orders rejected due to suspicion of fraud fell to 2.4% in 2009, from 4.2% in 2007––a 40% drop in order rejection over the two-year period and a 1.8% increase in total orders accepted.

Fighting Chargebacks

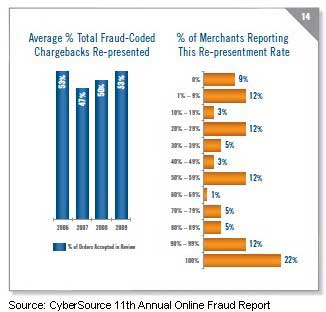

Merchants reported that chargebacks accounted for less than half (49%) of fraud losses in 2009. The remainder (51%) occurred when merchants issued credits to reverse charges in response to consumers' claims of fraudulent account use.

The share of fraud-coded chargebacks that merchants contested rose to an average 53% during the year, up 3 percentage points from the 50% reported in 2008, while medium and large merchants reported contesting chargebacks at slightly lower rates, 48% and 49%, respectively.

International Fraud Down Dramatically

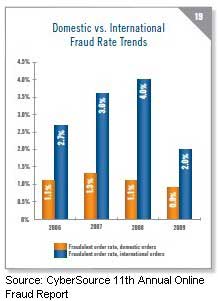

In general, the rate of fraud associated with international orders is over two times as high as domestic orders. However, in 2009 merchants reported dramatic improvements in managing international fraud; such fraud rates fell to an average 2.0%, down from 4.0% in 2008.

On average, merchants continued to reject international orders at a rate three times higher than domestic orders.

Merchants also made some progress in reducing their reliance on manual review processes during 2009: 20% of orders transacted online were manually reviewed, a slight improvement from the 22% reported last year.

Looking for great digital marketing data? MarketingProfs reviewed more than 200 research sources and selected 64 of the best to create the Digital Marketing Factbook a 144-page compilation of data and 110 charts, covering email marketing, search engine marketing, and social media. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Merchant Fraud Budgets

In 2009, 37% of merchants spent 0.5% of their online revenue managing online payment fraud, while 63% spent less than 0.5%. The median ratio of fraud management expense to sales was 0.3%, up from 0.2% in 2008, although some merchants in high-risk categories reported spending significantly more.

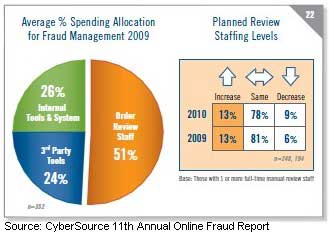

Over the past four years, merchants have consistently spent just over half of their fraud management budgets on review staff: In 2009 merchants spent 51% on review staff, with the balance allocated to internal tools and systems (26%) and third-party tools (24%).

Only 13% of online merchants expect to increase manual review staff (the dominant budget factor) in the coming year, and 9% anticipate decreasing staff levels. Those are the lowest levels of planned staff increases reported in the 11-year history of the survey.

Among strategic priorities for 2010:

- 60% of merchants plan to improve the automated detection and sorting capabilities of their systems.

- 20% plan to focus on process analytics.

- 16% plan to streamline manual review.

About the data: The survey was conducted from Sep. 10 to Oct. 7, 2009 by Mindwave Research on behalf of CyberSource and contains the opinions of 352 US and Canadian online merchants—small, medium-sized, and large organizations—together accounting for more than $60 billion in total 2009 online sales.