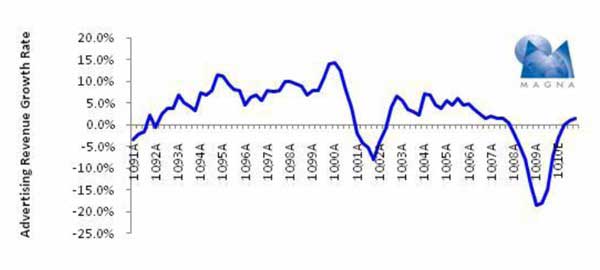

In view of improved expectations of economic recovery, the US advertising market is forecast to fall just 0.1% this year, according to a revised forecast from MAGNA. The reassessment is a slight improvement from MAGNA's forecast issued in December 2009, which projected a 1.3% decline in ad spending.

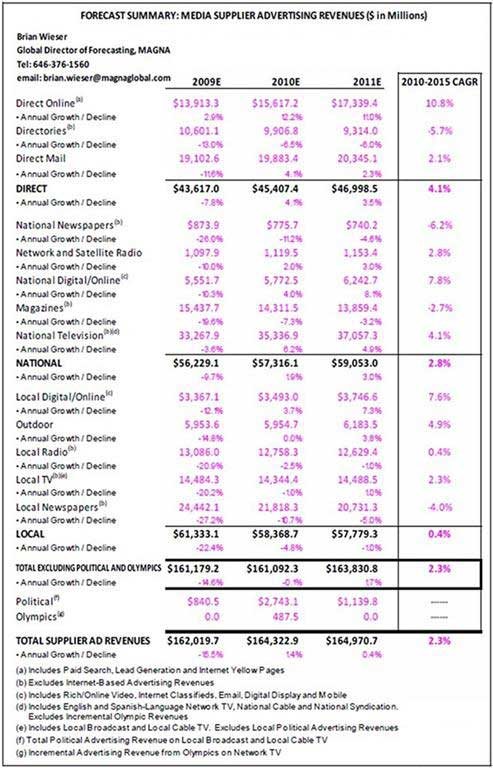

US advertising revenue is forecast to reach $161 billion in 2010. When incremental revenues from local political and Winter Olympics ads are factored in, spending is projected to reach a total $164.3 billion during the year; political ads will account for $2.74 billion and Winter Olympics ads for $487.5 million.

Below, additional projections issued by Magna.

First Quarter Ad Forecast: Down 3%

The first quarter of 2010 is forecast to be the last quarter of decline for the US ad market during this recession: US media suppliers will collectively generate 3% less advertising revenue on a normalized basis than they did a year ago, even accounting for the very weak economy experienced in early 2009. Industry revenues will drop to $36.8 billion during the quarter, from $38.0 billion in the first quarter of 2009.

These figures reflect a moderating pace of decline compared with the estimated revenue reductions of 7% during the fourth quarter of 2009, and a 15% decline during the third quarter.

Looking for great digital marketing data? MarketingProfs reviewed more than 200 research sources and selected 64 of the best to create the Digital Marketing Factbook?a 144-page compilation of data and 110 charts, covering email marketing, search engine marketing, and social media. Also check out The State of Social Media Marketing, a 240-page original research report from MarketingProfs.

Ad Categories: Online Still Strong

Despite flat or negative growth in some categories, digital advertising and TV are forecast to grow in 2010 from 2009 levels:

- Direct online ad spending, which includes paid search, lead generation and Internet yellow pages, is forecast to reach $15.6 billion, up 12.2%.

- National online ad spending, which includes rich/online video, Internet classifieds, email, digital display, and mobile ads, will reach $5.8 billion, up 4%.

- Local online spending will reach $3.5 billion, 3.7%.

- National TV will reach $35.3 billion, up 6.2% from $33.3 billion last year.

Meanwhile, most traditional advertising categories are forecast to fall in 2010:

- Local Newspaper spending, which excludes Internet-based ad revenue, will fall 10.7% to $21.8 billion.

- Magazine spending will drop 7.3% to $14.3 billion.

- National Newspaper spending will drop 11.2% to $775.7 million.

Longer-term forecasts have also been modestly increased to reflect the higher confidence in economic recovery: Total normalized media supplier advertising revenues are forecast to rise at a compound annual growth rate (CAGR) of 2.3% between 2010 and 2015.

About the data: Revised forecasts are provided by MAGNA, a division of IPG's Mediabrands.