ZenithOptimedia revised downward its forecast for global ad expenditure growth in 2009 to -8.5%, from its April prediction of -6.9%, after Q1 came in below its predictions, the firm announced (pdf) this week.

The second quarter of 2009, however, was not quite as tough as Q1, and expectations for the rest of the year remain unchanged as signs emerge that the downturn is approaching its nadir, ZenithOptimedia said.

It anticipates a mild global recovery in ad expenditures in 2010, followed by a return to growth for all global regions in 2011.

The following is a summary of company's ad spend analysis and 2009-2011 forecast for various geographies and media.

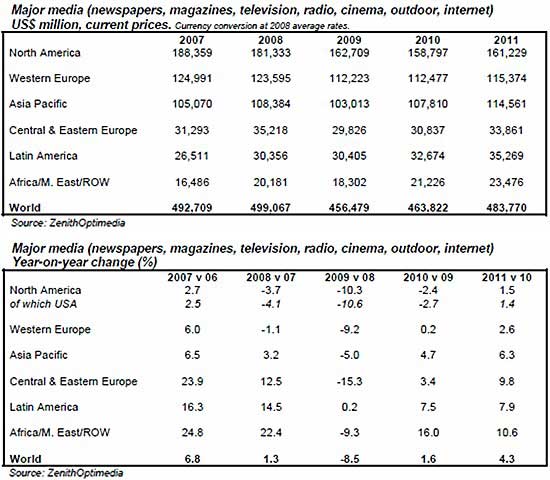

Advertising Expenditure by Region

- Not every market is in decline: Of the 79 markets covered, 25 are still growing. Many of them are small, young markets, but they also include heavyweights like China and India:

- China ad spend is forecast to grow 5.4% this year, overtaking the UK to become the world's fourth-largest ad market.

- India is expected to grow 7.7% this year and overtake Norway, Mexico and the Netherlands to become the 14th largest.

- In 2010 a mild global recovery of +1.6% is anticipated, as 62 of the 79 markets experience growth.

- Regions that went into the ad downturn first are expected to suffer the most and come out of it last:

- North America will shrink a further 2.4% in 2010, after shrinking 3.7% in 2008 and 10.3% in 2009.

- A stagnant 0.2% growth rate is anticipated for Western Europe in 2010, following 1.1% decline in 2008 and 9.2% decline in 2009.

- However, 2009 will be the only year of decline for Asia Pacific, Central & Eastern Europe, and Africa/Middle East/Rest of World, while Latin America will come to a halt rather than go into reverse.

- Those regions will return to growth in 2010, followed by North America and Western Europe in 2011.

- In 2011 all but five markets (Finland, Greece, the Netherlands, Norway, and Taiwan) are predicted to grow, while global ad recovery builds to +4.3%.

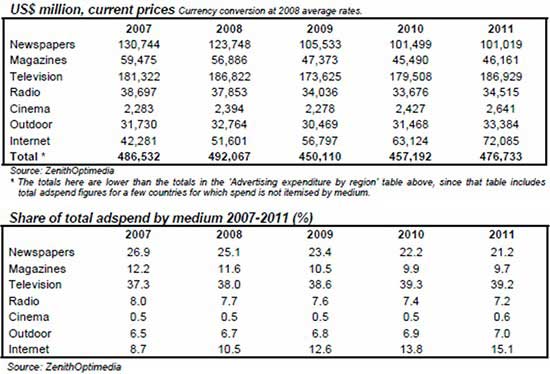

Global Advertising Expenditure by Medium

Internet advertising has held up even better than predicted in the previous quarter by ZenithOptimedia, its familiar virtues of transparency, accountability, and flexibility proving even more attractive in a recession:

- Internet ad expenditure is expected to grow 10.1% globally in 2009, ahead of the 8.6% prediction made in April. It is the only medium expected to grow in 2009.

- By 2011, Internet advertising is expected to account for 15.1% of all ad expenditure, up from 10.5% in 2008. Most of Internet ad-spend growth will come from paid search.

- In the US, search advertising is predicted to grow 20.0% in 2009, while traditional display grows 3.0% and classified grows just 1.8%.

Among the other media, television, cinema, and outdoor are forecast to decline less than the market as a whole, shrinking 7.1%, 4.8%, and 7.0% respectively.

Some advertisers, particularly in the fast-moving consumer goods sector, are taking advantage of cheap television and increasing their volumes, targeting higher market share. Cinema often does relatively well in a recession, providing consumers with escapist entertainment. Digital billboards and other non-traditional forms of outdoor are attracting budgets from other media by offering new types of eye-catching display.

Newspaper advertising peaked at $131 billion in 2007 and has fallen ever since. Newspaper ad expenditure is expected to shrink 14.7% in 2009 and to continue shrinking for the rest of our forecast period. In 2011, newspaper ad expenditure is forecast to total $101 billion, 22.7% below its 2007 peak.

Magazines face an even tougher time this year as luxury advertisers cut back severely: a 16.7% decline is forecast for 2009. But long-term prospects for magazines are brighter than those of newspapers, since the experience of reading a magazine is less easy to replicate on the Internet: Ad spend is expected to return to 1.5% growth in 2011, reaching $46 billion, 22.4% below its own 2007 peak.

* * *

The return to growth in 2010 and 2011 will bring no end to the pain of many big media owners, because competition for consumers' attention, and the ad revenue that comes with it, will only get more intense as the world economy recovers, ZenithOptimedia concludes.

New technologies are reducing entry costs, providing a lot of new competition for the established players: Television networks are losing viewers to digital channels and video websites; newspaper websites are losing readers to bloggers; radio stations are losing listeners to podcasts; and so on.