Companies tend not to understand what people want from online branded communities––or the role that the brand plays in fulfilling those needs, according to a study by ComBlu.

In addition, most brands lack a cohesive strategy for integrating their online communities with each other and other social media initiatives, and they offer only a limited number of ways for members to engage––overlooking the variety of participant types that interact online.

Below, additional findings from ComBlu.

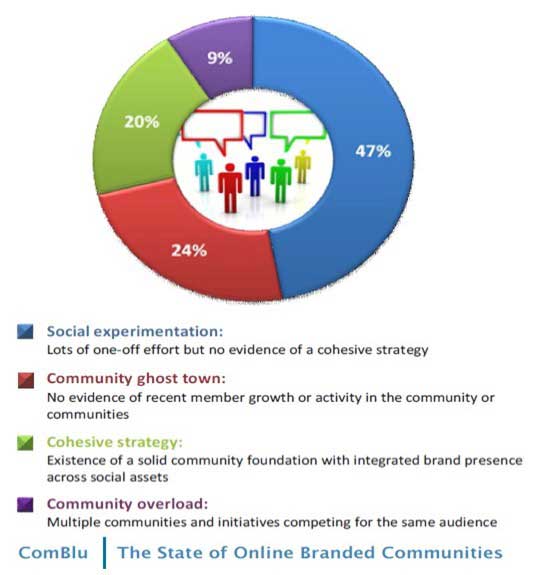

Overall, most companies are in the early stages of implementing online branded communities:

- 47% are in the social-marketing experimentation stage; the elements of their social media activity have with little connection or integration with each other.

- 24% of companies have community ghost towns, void of members, engagement, or recent visitors.

- 20% have a cohesive, integrated approach to their community and social media programs.

- 9% show evidence of community overload, which most often occurs with brands that have multiple products targeted to the same or similar market segments.

Nine out of ten brands have an official presence on popular social media platforms and 56% integrate that presence with their branded communities. However, only 32% of branded communities are integrated with social media.

Summary of Best-Practices Audit

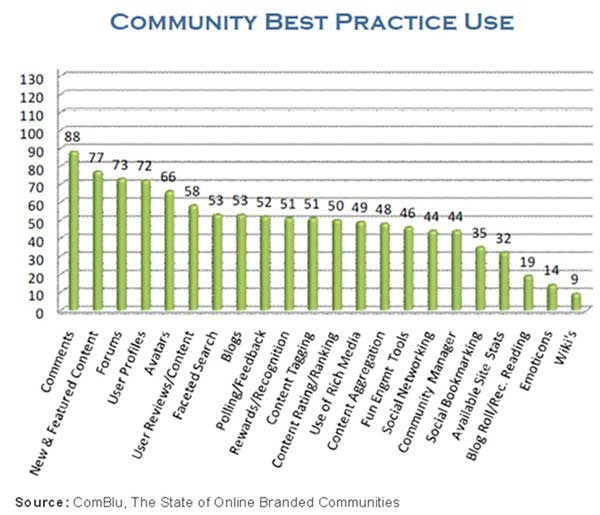

Online communities were analyzed across 23 best-practices defined by ComBlu. On average, only 36% of communities were found to leverage a majority of best-practices, and only 36% have high levels of activity.

In addition, some brands that have more than one community program are inconsistent in their use and application of best-practices, bringing mixed results across their social marketing programs.

Among the 135 online communities studied:

- 65% allow comments (88 out of 135).

- 57% have new and featured content.

- 54% have forums.

- 54% allow users to create their own profiles.

Many of the least-used best-practices among communities are those that potentially can offer the greatest lift in terms of engagement, recruitment, and growth:

- 74% lack social bookmarking, which offers members a tool to personalize and aggregate their online experience.

- 67% lack social networking, which offers tools to find others inside the community who share interests or needs.

- 67% lack a community manager, the face of the community who provides coordination among members and the brand.

- 61% lack faceted search, which allows users to continuously customize their community experience.

Top Performers

Five high-performing companies were identified based on scoring criteria developed by ComBlu: AT&T, Sony, YouTube, Sears, and Best-Buy.

Of the five high performers, only Best-Buy was categorized in the experimentation stage. Although Best-Buy does not exhibit an overall cohesive strategy, it has incorporated a significant number of best-practices into its community model and has integrated its community with social media.

Retail Ahead of the Curve

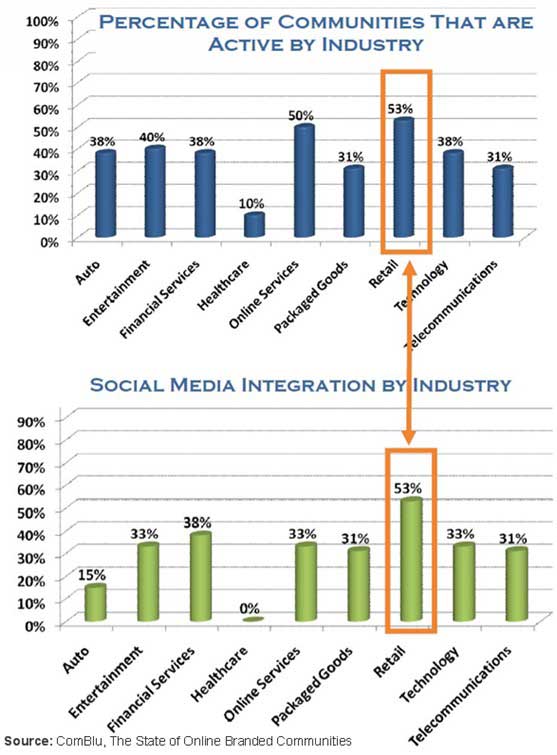

An analysis of activity by industry shows that retail has the largest proportions of communities online that are active(53%), followed by online services (50%), and entertainment (40%).*

Retail, the pioneer of e-commerce, also has the highest evidence of community/social media integration (53%), achieved through content syndication and aggregation, links, and marketing themes. Financial services follows with 38%.

* The industry analysis is based on total sample size of 45 companies across nine industries: auto (5), entertainment (5), financial services (5), healthcare (4), telecommunications (5), online services (3), packaged goods (6), retail (7), and technology (5).

Looking for real data that can help you match social media tools and tactics to your marketing goals? The State of Social Media Marketing, an original research report from MarketingProfs, gives you the inside scoop on how more than 5,000 marketing pros are using social media to create winning campaigns, measure ROI, and reach audiences in new and exciting ways.

About the data: The audit of 135 online branded communities among 45 US companies was conducted by ComBlu and published in December 2009. None of the companies were aware that their sites were being analyzed, and ComBlu did not contact these companies prior to the analysis of the data it collected.