Even as business travel shows small signs of improving, leisure travel is expected to remain weak through early 2010 as concerns over household budgets dampen consumer spending, according to the travelhorizons survey, cosponsored by Ypartnership and the US Travel Association.

Leisure Travel to Stay Weak

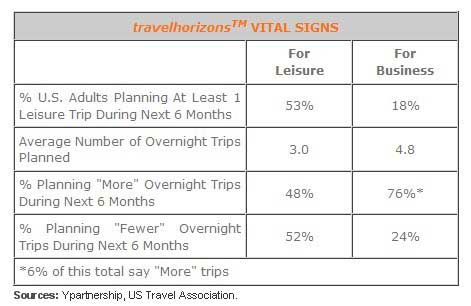

Just over one-half (53%) of US households were planning at least one leisure trip between October 2009 and April 2010, compared with 56% who said so in 2008 for the equivalent six-month period.

Financial concerns are the primary deterrent to future leisure travel: 39% of those not planning a trip say "the household budget" is their top concern, yet the incidence of this concern is now at the lowest level observed since the question was added to the survey, reported Ypartnership.

Meanwhile, among consumers planning to travel, the average number of leisure trips expected to be taken during the six months ending April 2010 is up to 3.0 trips, compared with 2.8 in October 2008.

Other leisure-travel findings

- The most significant decline in expected travel is among the younger population (Gen-X and Gen-Y).

- The number of trips taken by Baby Boomers is expected to increase.

Business Travel Outlook Mixed

Only 18% of adults expected to take at least one business trip (including trips to attend business meetings) between Oct. 2009 and April 2010, compared with 17% recorded last year.

More encouraging are consumers' expectations with respect to the average number of business trips planned during those six months; they have increased throughout this year and rose again in October 2009 to 4.8 trips, compared with 3.3 in April.

That increase in the average is being driven up by a relatively small percentage of the overall business traveler population, however, with only 6% of travelers planning to take more business trips during the next six months and 24% planning to take fewer trips.

Traveler Sentiment Index Flat

The overall Traveler Sentiment Index, a derivative of six variables measured in the survey, suggests that the demand for travel services is likely to be flat during the Oct.-April period.

Among the six variables from which the index is derived, only one, "personal finances available for travel," is moving in a positive direction. The other five have declined from levels recorded in July 2009, with "expected quality of travel services," "affordability of travel," and "time available for travel" declining the most.

About the data: The travelhorizons quarterly study surveyed 2,244 US adults and was conducted October 6-13, 2009 by Ypartnership and the US Travel Association. For more information on the survey, visit the Ypartnership blog.