Smartphone units sold worldwide in 2009 will grow 14.5% from 2008 levels, according to a forecast by Infonetics, which also anticipates a 21% compound annual growth rate (CAGR) in smartphone units from 2008 to 2013—significantly better than projections for other mobile markets.

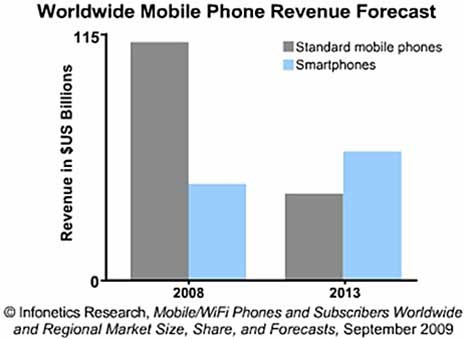

Despite an expected revenue decline in 2009 due mainly to revenue erosion and lower-ARPU (average revenue per user) units coming to market, smartphone revenue will pick up in 2010 and continue growing, easily outstripping the combined revenue of standard mobile phones by 2012, Infonetics said.

Other findings from the Infonetics biannual Mobile/WiFi Phones and Subscribers market size, market share, and forecast report:

- Despite an estimated 10% increase in number of worldwide mobile and Wi-Fi phones sold in the second half of 2009, downward price pressure will cause a 9% revenue decline.

- Some 1 billion mobile phones will be sold in 2009 worldwide.

- Smartphones account for an increasing percentage of total mobile revenue, driven in part by HSPA (High-Speed Downlink Packet Access) deployments in North America, Western Europe, and developed Asia/Pacific countries.

- Nokia maintained its mobile market leadership in the first half of 2009.

- Apple's smartphone share rose to 9% in the second quarter of 2009 on the strength of the iPhone 3GS.

China Helps Drive Smartphone Growth

China's smartphone market grew in 2008 with a 30% increase in shipments over the previous year, according to separate research, from In-Stat. Smartphones accounted for 15% of total mobile phone shipments in China in 2008, up from 12% in 2007, In-Stat said.

Key drivers of the growth include mobile internet applications, GPS, and multimedia functionality, according to In-Stat, which said Symbian retained its leadership in the OS marketplace, with a small share increase in 2008, due to steady smartphone sales growth from Nokia and sales decline from Linux.

Mobile Continues to Replace Landline

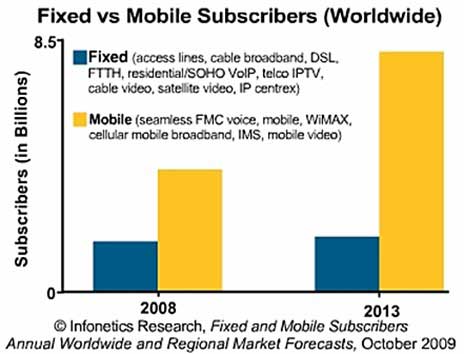

Mobile phone adoption has accelerated during the recession, with wireline-to-mobile substitution gaining strength, according to the Fixed and Mobile Subscribers market forecast report from Infonetics.

Access lines are disappearing fastest in North America and China, due to the move to fixed-to-mobile substitutions, the switch from copper to fiber lines, and the recession, during which many people ditch their landlines and keep only their mobile or smartphone, Infonetics said.

Some other findings from the Infonetics report:

- There were nearly 4 times more mobile subscribers than access line subscribers worldwide in 2008 (3.9 billion vs. 1 billion).

- The number of mobile subscribers grew 17.4% in 2008 over 2007, while access line subscribers declined 5.5%.

- The number of worldwide mobile subscribers will reach 5.9 billion by 2013.

China, which had half a billion mobile subscribers in 2008, and India together make Asia/Pacific the world's largest mobile subscriber region, and that's expected to remain so into the forseeable future, Infonetics said. The next largest is the EMEA region, with strong growth driven by Africa.