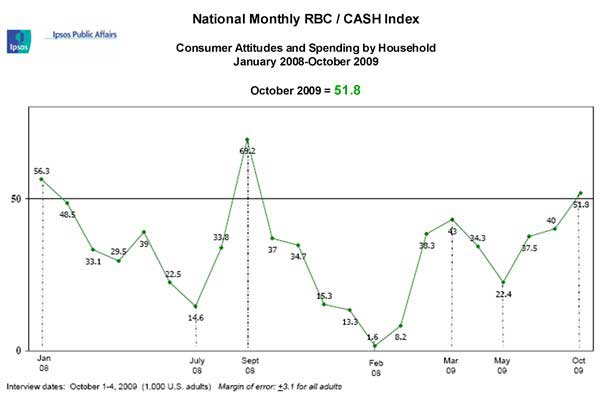

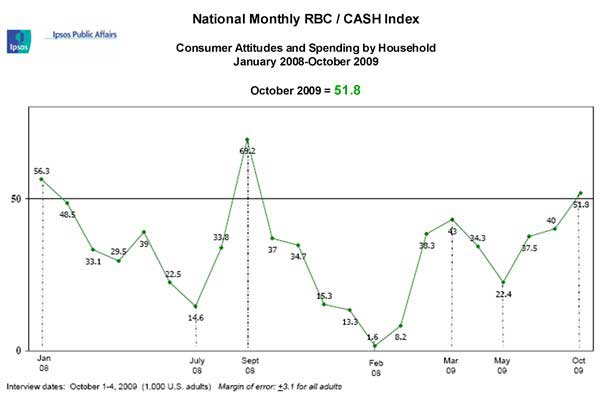

Propelled by diminishing concerns about current personal finances and job security, US consumer sentiment reached a 12-month high in October, according to the most recent results of the RBC CASH (Consumer Attitudes and Spending by Household) Index.

Gains were made in every facet of consumer sentiment, with overall consumer confidence climbing 11.8 points. As a result, the RBC Index stands at 51.8 this month, compared with 40.0 in September. This marks a 50-point improvement over the all-time low of 1.6 observed in February 2009:

"Federal Reserve Chairman Ben Bernanke's assertion three weeks ago that the recession is over, together with a lack of negative financial news since then, have had a galvanizing effect on consumer sentiment," said RBC Capital Markets US economist Tom Porcelli. "Although the trends are moving in the right direction, consumer confidence remains fragile, and unexpected bad news about the economy or markets could once again send sentiment spiraling downward."

Highlights of the Survey's Results

The RBC Investment Index increased sharply this month, climbing 21.1 points to 58.0, the highest mark for the Investment Index this year.

- Pessimism has declined significantly since mid-summer, with the number of Americans who report they feel less confident in their ability to make investments for the future dropping to 54%, down from 64% in July.

- Consumers who feel confident about investing for the future continued to improve, increasing to 33% in October, from 31% last month.

- Consumer comfort levels for making major purchases, such as a car or new home, also edged up, with 22% of consumers reporting they are more confident this month, compared with 19% in September.

Fueled by a drop in consumer pessimism, The RBC Current Conditions Index also reached a 12-month high in October as it climbed to 50.3, up 17.1 points from the September reading of 33.2.

- The percentage of consumers saying their personal financial situation is weak has dropped to 27% in October from 37% last month.

- Americans' assessment of current local economic conditions held steady this month, with 41% of consumers saying their local economy is currently weak, essentially the same rate as the 42% observed in September.

Consumers' near-term economic outlook brightened for the third consecutive month, sending The RBC Expectations Index to 54.2, up 12.7 points from September's level of 41.5. Although consumers' expectations for both their local economies and their personal finances are essentially unchanged since last month, there is now much less concern with impending job losses, resulting in the overall Expectations Index improving.

- Currently, 36% of consumers believe the economy in their community will be stronger in the next month, while only 16% believe it will continue to weaken, roughly the same split as in September.

Americans remain guarded about the job market, as evidenced by the slight increase in The RBC Jobs Index by 5.8 points in October to 59.3, well below the 78.8 level observed at this time one year ago.

- The most significant influence on confidence in job security continues to be real experiences in job loss. This month, 67% of Americans say they or someone in their close circle has lost a job in the past six months, up from 63% in September.

- Despite ongoing job losses, relative confidence in personal job security also continues to show signs of improvement. Nearly one-third (31%) of American consumers say that they feel more confident in their job security now than they did six months ago, up from 28% in September.

- Correspondingly, the proportion of consumers who are less confident in their personal job security is down to 58% in October after reaching a high of 71% in March.

About the data: The RBC Index is a monthly national survey of consumer attitudes on the current and future state of local economies, personal finance situations, savings, and confidence to make large investments. The Index is composed of four subindices: RBC Current Conditions Index, RBC Expectations Index, RBC Investment Index, and RBC Jobs Index. The index is benchmarked to a baseline of 100 assigned at its introduction in January 2002. This month's findings are based on a representative nationwide sample of 1,000 US adults polled from October 1-4, 2009, by survey-based research company Ipsos Public Affairs. View the entire RBC CASH Index report here.

.