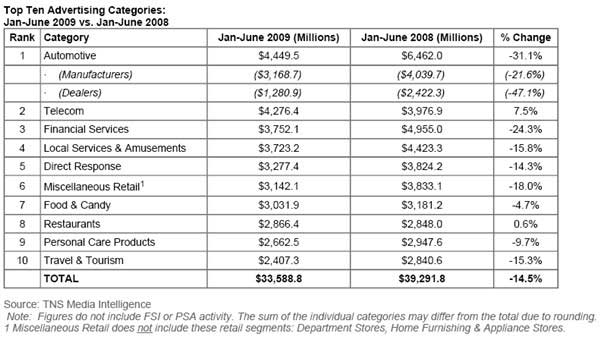

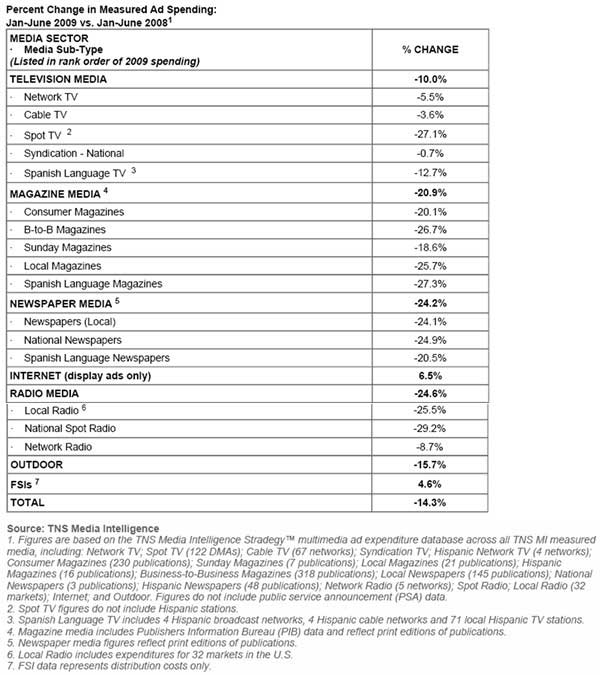

Total measured advertising expenditures in the first six months of 2009 fell 14.3% versus a year ago, to $60.87 billion, according to recently released data from TNS Media Intelligence. Ad spending during the second quarter of 2009 was off 13.9% compared with last year, the fifth consecutive quarter of year-over-year declines.

Internet display (+6.5%) and FSI’s (+4.6%) were the only media to achieve expenditure growth in the first half of 2009. Each benefited from larger budget allocations by CPG marketers. Online publishers also capitalized on a spending surge from wireless telecom operators:

Key findings:

- Print media continued to suffer large rollbacks in ad pages from key categories and this resulted in aggregate spending declines of 24.2% for newspaper media and 20.9% for magazine media.

- Total spending in radio media was down 24.6% because of ongoing weakness in automotive, retail, and local services.

- Among television media, ad spending on network TV declined 5.5% and cable TV slipped 3.6% in the first half of 2009. For both, Q2 results were slightly worse than Q1. Spot TV expenditures dropped 27.1%, buffeted by the slump in auto and retail activity.

Ad Spending by Advertiser

The top 10 advertisers in the first six months of 2009 spent a combined total of $7,866.4 million, a 3.5% decrease from last year. Across the top 100 companies, a more diversified group of marketers representing almost one-half of total ad expenditures, spending fell by 6.2%.

Verizon Communications edged out Procter & Gamble to claim the top spot in the rankings. The telecom behemoth spent $1,188.4 million, up 3.1% from last year. Its two leading competitors also landed in the top 10. AT&T was the third largest advertiser with total ad expenditures of $976.8 million, up 6.3% versus a year ago. Sprint Nextel, after slashing its ad budgets in 2008, reversed course and spent $631.1 million, a gain of 55.3%:

Key findings:

- Procter & Gamble slipped to second position in the rankings after reducing its half-year spending by 20%, to $1,178.4 million. The company pared its TV budgets by 30% while leaving magazine spending untouched.

- The only other packaged goods marketer in the top 10 was Johnson & Johnson, which spent $805.9 million, up 18.0%.

- General Motors had the largest budget reduction among the Top 10, with spending down 25.9% to $773.1 million; it was the only auto maker to make the list.

- Media companies rounded out the Top 10, with General Electric posting a spending increase of 5.1% while News Corp., Time Warner and Walt Disney each finished the period with decreases. At each of these advertisers, results were primarily shaped by their movie studio divisions.