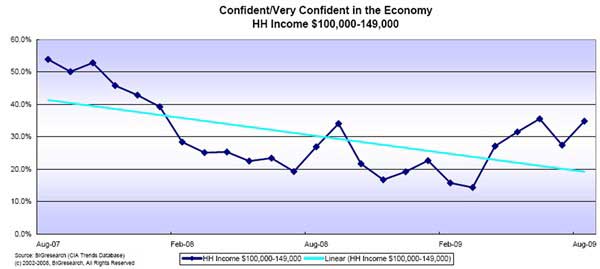

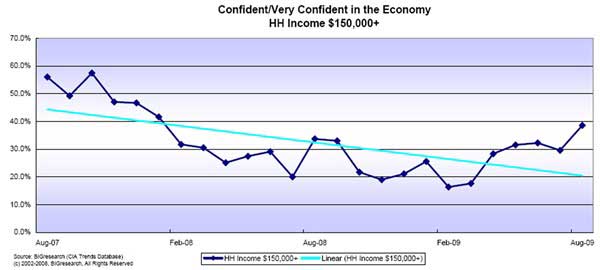

US consumers with a household income of $100K+ are feeling the recession's pinch, and it's changing what and how they spend, according to recently released data from BIGresearch. Their confidence in the nation's economy has decreased as the recession has deepened:

One bright spot in this data is that even though consumer confidence for these two groups has trended down over the past two years, it has bounced up four of the last five months (although it's still off from August 2007).

Perceptions of Their Own Wealth

Over the same two-year period (August 2007 to August 2009), upper-income individuals' perceptions of their own wealth declined. Some 54.8% of consumers with household incomes of $100K-$149K reported feeling less wealthy than they did two years ago, in August 2007. Only 11.6% said they felt wealthier. Of individuals with household incomes of $150K+, almost half (49.3%) reported feeling less wealthy than they did in August 2007, versus 22% who said they felt wealthier.

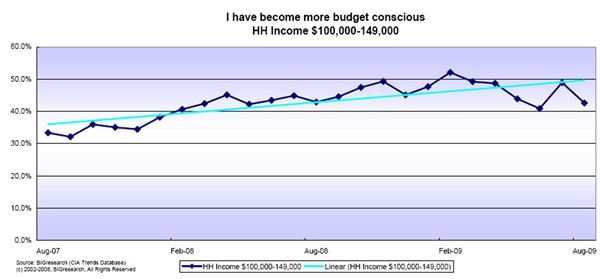

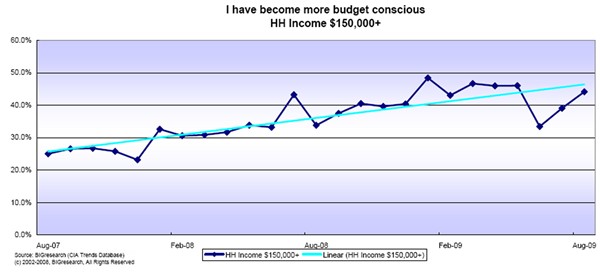

Changes in Shopping Behavior

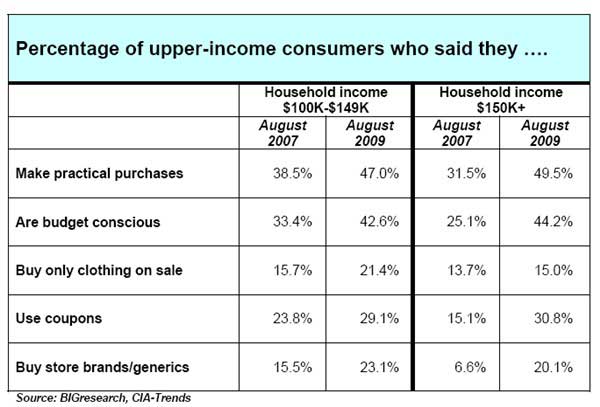

In response to the country's plunge into recession and to fluctuations in gasoline prices, many upper-income individuals became more budget-conscious between August 2007 and August 2009:

The research found that many upper-income consumers had altered their shopping behaviors, for instance purchasing only sale-priced clothing, using coupons, and buying generic products more than they did two years ago:

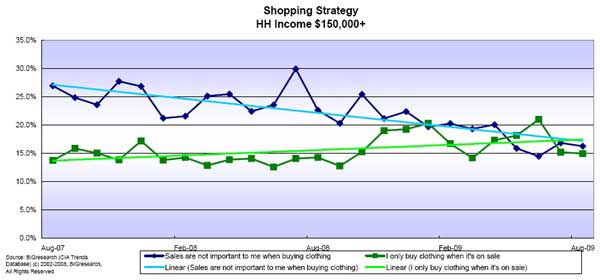

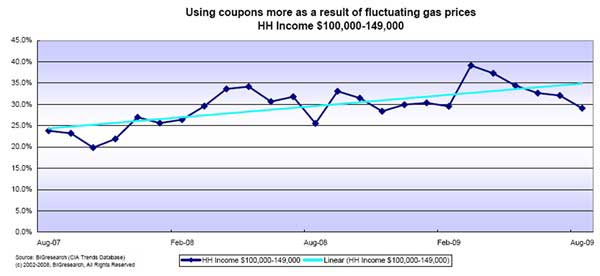

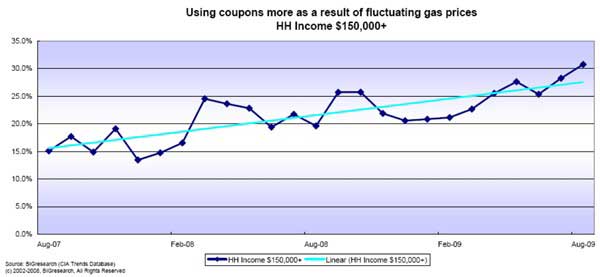

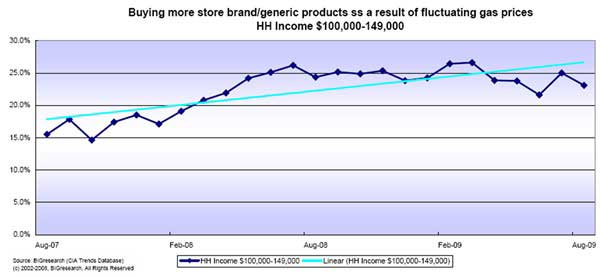

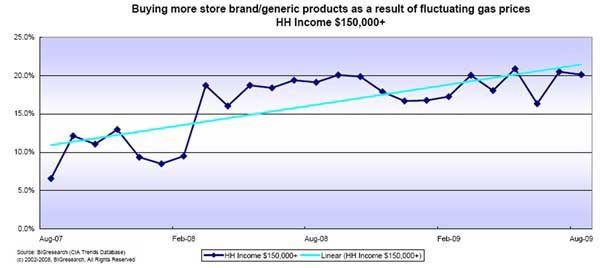

The following series of charts drill down into the changes in upper-income consumers' shopping behaviors from August 2007 to August 2009:

- Shopping Strategy

- Use of Coupons

- Increased Purchase of Generic/Store Brands

Anticipated Shopping Patterns for December 2009

Some 34% of US consumers surveyed with incomes between $100,000 and $149,000 plan to spend less on gifts during the December 2009 holiday shopping season than they did in December 2008. Of those with incomes of $150,000 and above, 27.6% plan to spend less on gifts than they did in 2008's holiday season.

Only 2.1% of those with incomes between $100,000 and $149,000 and only 4.8% with incomes $150,000 and higher plan to spend more—bad news for struggling retailers.

Other Findings:

- 74.9% of consumers with incomes $100K-$149K and 66.2% of those with incomes $150K+ said that they think voters have lost their voice in Washington. An overwhelming majority of each consumer group said Congress is not spending tax dollars wisely and characterized this governing body's performance with words like "disappointed," "bad," and "incompetent."

- They also said that Congress and the President should fix the economy rather than reform healthcare: 83.4% of those with incomes $100K-$149K said this, and 82.8% of those with incomes $150K+ said this.

- Regarding the healthcare legislation currently under development, 61.1% of respondents with incomes between $100,000 and $149,000 and 56.6% of respondents with incomes of $150,000 and over said it is too personal to be developed by Congress and the President and should reflect the will of the people.

- Some 36.1% of consumers with incomes $100K-$149K said the cap and trade policy will eliminate jobs, and 36.3% said it will hurt the economy. 28.3% of those with incomes $150K+ said it will eliminate jobs and 30.2% said it will hurt the economy.

About the data: BIGresearch conducts the monthly Consumer Intentions and Actions Survey (CIA) of 8,000+ respondents and the semi-annual Simultaneous Media Survey (SIMM) of 15,000+ respondents. It also conducts the monthly American Pulse Townhall Survey of more than 4,000 Americans. Sources include BIGresearch, CIA-Trends, CIA-Jul09, CIA-Aug09, American Pulse Townhall Survey-Aug09.