US advertising spending fell 15.4% in the first half of 2009 compared with the same period in 2008, according to Nielsen.

US ad expenditures declined more than $10.3 billion to a total spend of $56.9 billion in the first two quarters of this year, according to the preliminary figures.

Cable television was the only medium for which ad spending grew through the first six months of the year (+1.5%). The increase is especially significant because Nielsen reported cable TV ad spending was down 2.7% through the first quarter of this year.

- Spanish-language cable TV ad spend grew a modest 0.6%.

- The rest of Nielsen’s measured media declined year over year, ranging from Internet (-1.0%) to local Sunday supplements (-45.7%).

- African-American television (a subset of network, cable, syndicated, and local) continued to grow, increasing 14.3% through the first six months of 2009.

Below, additional data issued by Nielsen.

Product-Category Ad Spending

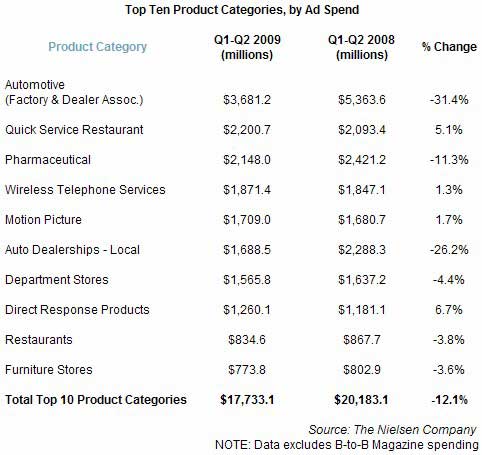

Automotive once again emerged as the top product category in ad spending, despite cutting back 31%, or $1.68 billion, in 1H09. Local auto dealerships also cut back spending significantly: 26.2%.

Quick service restaurants continued thriving through the economic downturn. Many companies, including McDonalds, Sonic, Domino’s Pizza, and Papa John’s, increased spending. The industry placed second with an ad spend of $2.2 billion.

Direct response products grew the most (6.7%) among the top 10 industries, due mostly to increased advertising for products marketed by Idea Village, AllStar Products, and Dish Direct, Nielsen said.

Category Growth

Outside the top 10, there was significant growth among many major product categories. Multifunction mobile phones (e.g., smartphones, PDAs) enjoyed the highest growth among all categories that spent a minimum of $200 million in the first half of 2009. Promotion of Apple’s updated iPhone models and TMobile’s Sidekick led the category’s 104% surge in spending, Nielsen said.

Nielsen also said cable TV services ad spending increased 62%, to almost $500 million—a direct result of ad buys this year leading up to June’s DTV transition.

“What’s interesting is that we’re not just seeing a rise in spending for recession-friendly products like fast food restaurants," said Annie Touliatos, VP for Nielsen’s advertising information services. "We’re seeing a lot more promotion of technological innovations like smartphones, computer software, and consumer-driven websites. These advertisers see potential for their products despite our stressed economy and are leveraging advertising to drive their success.”